Tags

arbitrage, Berlin, commercial property, correlation, Debt/GDP Ratio, Deutsche Mark, Eurobonds, Europe, European sovereign debt crisis, Eurozone, GDP growth, German bunds, German property, Germany, Highway to Hell, Leverage, Manhattan, Margin of Safety, Net LTV, quantitative easing, rental yield, residential property, safe-havens, unemployment rate

Continued from here.

Economy:

Germany’s by far the largest & strongest (major) economy in Europe, with an average real GDP growth rate in excess of +3.3% in 2010 & 2011. Growth remains positive in 2012, while 2013 GDP growth’s forecast to be +1.7%. Far better than most EU growth rates in the same period…

It’s one of the few countries with a primary budget surplus. Actually bested by Italy, what a surprise! Germany’s Debt/GDP ratio at 81.6% isn’t much better (also surprising) than the EU average of 88.2%. But the majority of citizens (& investors) remain supremely confident in Germany’s ability to manage its own finances – and rightly so, I believe. [An important point to make: Now, really, an 88% Debt/GDP ratio? What crisis..!? I think not. I’d venture we can trace the current market hysteria squarely back to the bumbling & foot-dragging of Europe’s politicians. A clear message for US politicians as they merrily race down their own fiscal/debt Highway to Hell. An inability to learn from history’s unfortunate, but perhaps forgivable – an inability to learn from today’s headlines, however, just makes you a complete f**king idiot,sir!]

Inflation remains pretty Germanic, at a current +1.9%, the best in Europe (bar Greece, still bizarrely putting up a positive inflation rate in the depths of a recession!? What a broken bloody economy!). However, Germans (& investors) are v aware of the fiscal deterioration elsewhere in Europe, and the monetary actions of the ECB to date & to come. Generational memories of the effects (& consequences) of inflation remain strong in Germany, and fear may well prove a major factor in increasing demand for property.

Finally, Germany’s got one of the lowest unemployment rates in Europe, at 5.4%. Interestingly, its closest neighbours (Netherlands & Austria) have similar/lower rates. It’s also one of the few with an improved unemployment rate y-o-y. In my opinion, the relationship of housing prices to a country’s unemployment level’s often under-stated in property reviews. This chart provides a good illustration of that correlation:

All in all, Germany appears to present an attractive macro backdrop for housing prices. But you might argue there are significant risks to Germany’s (& Europe’s) 2013 growth forecast. Perhaps, but there’s nothing new in today’s headlines – one could reasonably argue doom & gloom‘s more than priced in. And there’s the other side of the see-saw: Consider the potential impact of the ECB’s actions to date, and its capacity to respond to further market/economic turmoil and/or deterioration…

In the final analysis, aside from the merits of its absolute attraction(s), it seems more than obvious Germany will retain its relative economic & investment advantage vs. the rest of Europe. Even in a worst case scenario, a major portion of capital invested in Europe obviously doesn’t just up & leave – it simply gets re-allocated towards safer/more attractive European investments & countries.

European Sovereign Debt Crisis:

Sigh, Germany’s really in the eye of the storm… On the one hand, it offers a safe-haven to investors, particularly those seeking safety of principal (bonds), or the potential for (lower risk) price appreciation (property). In fact:

Bunds are to Europe’s investors what US Treasuries are to US/global investors!

Yes, this flight to safety in Europe has been particularly advantageous for Germany. But remember, many institutions (like pension funds) can respond with glacial speed to events/trends of recent years, and to Europe’s shaky near/medium term prospects. I’m convinced this means we’ll see continued & increasing investor flows/allocations into German bonds, property & equities for years to come.

On the other hand, Germany’s inescapably a part of the EU & Eurozone, and the ECB’s policies will remain geared towards stimulus & liquidity. That likely promises low interest rates (both short & long term) for the foreseeable future. The US provides confirmation of this – it’s far ahead of Europe in the current cycle, and yet the Fed expects no increase in rates ’til 2014/15! Let’s think about what that might mean for German asset classes:

Bunds: Likely to remain an attractive safe-haven in the medium term, both for European & global investors. But Bunds (like most Western bonds) will eventually become increasingly risky with the likelihood of significantly higher (threatened, or actual) interest rates & inflation. In addition, there’s a real possibility of some type of European debt mutualization/guarantee scheme, which could also seriously compromise the safety of Bunds.

Equities: While low interest rates are generally supportive of stocks, German equities are v dependent on European & global growth prospects. Worst case, some form of Eurozone break-up (which I’m not predicting) would be a complete disaster for the German market. The growth shock to the rest of the Europe, and a surging hard-Euro (or even a new Deutsche Mark), would crucify German exporters. That all makes over-weighting German equities a difficult bet to call, or to make…

Property: Prolonged low interest rates, the ultimate threat of higher inflation, and the eventual rehabilitation of Europe’s banks offers up the perfect recipe for significant gains in property prices! Best case, Germany’s cheap property valuations offer great investment leverage. Neutral case, Germany’s sound/attractive domestic economic & property fundamentals offer the best defence. Worst case, property/asset investors could still benefit significantly from potential hard-Euro/new Deutsche Mark appreciation.

German property, esp. residential (obviously more domestically focused), clearly seems to offer the best medium/long term risk/reward for investors – particularly for European investors suffering through the current sovereign debt crisis.

Yields:

OK, of all the German residential property companies I track (which I’ll return to), take a guess at the yield on their property portfolios? No, not the average yield – the minimum yield?

7.0%

Yes, that’s the bloody minimum..! On an asset class that experienced no price wobble, let alone price crash, in the past 5-7 years!? In a world that seems more & more obsessed with income, that kind of safety & yield really grabs the attention. Of course, it’s a rental yield, so there’s also scope for improvement from annual rental increases. So what have Germany’s (urban) rental trends looked like? Well, in the past 5-6 years, rents rose pretty steadily at about +2% per annum. More recently, we’re seeing a significant acceleration:

(From a great WSJ article – check it out). That’s about +6.2% pa nationally, and +9.3% pa in Berlin! Wow, and that’s in the face of a debt crisis that’s 2 (even 3) years old now! Certainly seems like compelling proof of our overall thesis…

But with property, other yields are just as relevant & important. We can think about this in three (related) ways:

a) The P&L Impact: German companies are relatively conservative – they tend to hedge a major portion of their risk (i.e. they lock into fixed rate swaps). This means much debt is still being carried at avg. 4.5%-5%+ effective rates. With rates remaining low, companies will enjoy a major tail wind as debt rolls off for years to come & is replaced at cheaper rates. A 150-200 bp improvement (to the low 3%s all-in) is indicated from recent newsflow. The P&L impact will be magnified with further rental increases & improving economies of scale.

b) The B/S Impact: A host of other factors determine property valuations, but long (& short) term interest rates exert an enormous influence also. Current 3 mth EUR LIBOR’s 0.13%, the 5 yr Bund’s at 0.59%, and even the 10 yr’s only 1.58%! This collapse in yields will feed through into higher property valuations, and leverage will then provide a disproportionately positive impact on Net Asset Values. Revaluations will also lower Net LTVs, freeing up borrowing capacity – leading to continuing/increased demand for more portfolio acquisitions (& economies of scale).

c) The Investor Impact: Another version of the B/S impact – investors face a prolonged period of these ultra low rates for their cash/bond investments. As we all know, this will inevitably force investors into other asset classes… A property yield of 7%+ will prove incredibly tempting, esp. if investors perceive German property’s safer than (regular) equity exposure. This preference will ultimately manifest itself in higher property valuations, premium price/book multiples for listed property companies, or both.

Valuations:

Saving the best for last..! It needs little explanation really – the following two charts sell a great story:

Yes, German residential property never actually participated in the mid-2000s property boom. There’s no over-valuation to be wrung out of the market, no market bottom to be guessed at, no blight of negative equity to scar a generation, no foreclosure/second home inventory overhang, no multi-billion mortgage scandals & litigation – it’s just business as usual. That is, a slow & steady price appreciation – the normal default for housing – which now looks set to accelerate…

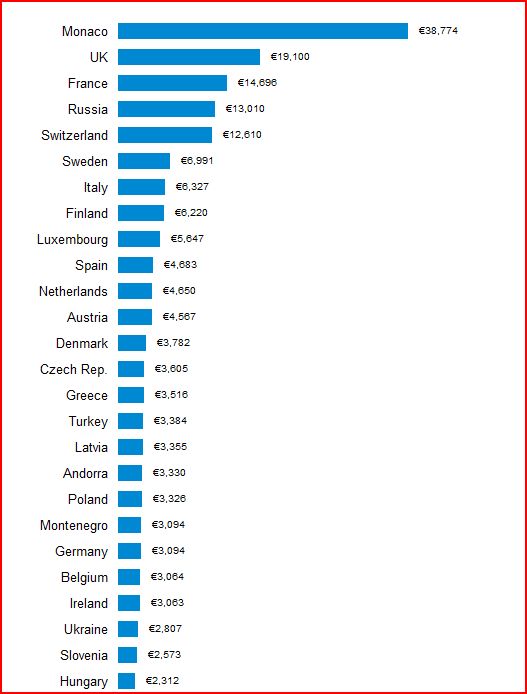

(Source: European premier city centre apartment prices per sqm, from Global Property Guide).

But what if the first valuation chart started from a massively over-inflated base level? Oohhh, Betty – you are funny! Nothing’s further from the truth. Look at this chart of relative European property valuations – what, is Germany located somewhere in Eastern Europe!? An average German price of just over EUR 3,000 per sqm looks wildly anomalous vs. the rest of W Europe.

And that ain’t the ‘alf of it, guvnor! A major portion of listed German portfolios were sourced via wholesale purchases from municipal/housing authorities, so their average asset values are far lower than the value charted above.

In fact, they’re less than EUR 1,000 per sqm..!

Think about that in a bloody global context – how many cities average ’round that kind of price? Actually…I mean per square foot?! Manhattan, for example, is around $1,000 per sqf – and there’s plenty of similar pricing ’round the globe! Is Manhattan real estate really worth 10 times the price of real estate in Berlin, for example? Sure, we can argue location, location, location all day long, but that’s mostly just a gigantic scam invented by real estate agents simply to persuade you to pay up…

I’m not sure it’s even a question worth debating. Often, major long term success comes from recognizing markets tend to abhor an arbitrage, in the broadest sense of the word. Whether you’re a business, or an investor, there’s always a migration towards cheap labour, cheap assets, higher profits, higher yields etc. The process may be slow, but it’s relentless… The perfect long term/low-maintenance portfolio is ideally stuffed with investments that exploit those long term arbitrages. Investing in emerging/frontier markets is one v obvious play, and I believe German property (particularly residential) is another different, but equally compelling, opportunity.

Next, we’ll take a closer look at some of the listed German residential property companies on offer. To be continued…