OK, Top Tips done – now, it’s performance time!

And already I’m fully aware the designated performance benchmark here is very different for me than everybody else…which is, of course, entirely my own fault! Because I chose to include the ISEQ as 25% of my benchmark, and it’s performed quite spectacularly every single year. Which, you’ll have to admit, is terribly unfair… 😉

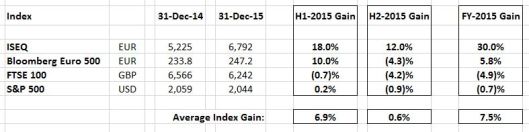

Unfair, because it jacks up my benchmark return every year. And because it’s such a painful & galling reminder that if I’d been just a little bit dumber, and simply overdosed on the Irish market, doubtless I’d now be reporting a totally amazing performance. Except…who bets their entire portfolio on a single market? Esp. the Irish market, which is a mere rounding error globally (in terms of market cap)? Intellectually, prudent diversification makes all the sense in the world, but emotionally it’s a lose-lose proposition: ‘Cos markets surge & you loathe being diversified, you just want to concentrated on the winners…then markets collapse, and being diversified is great, except you’re still inescapably miserable because you’re actually losing money! But at this point, the ISEQ’s clearly my personal cross to bear – so let’s just stick with it – here’s my 2015 benchmark:

Obviously, it’s been a game of two halves – with most markets suffering in the second half – so I’ve also added a H1 vs. H2 breakout. But wouldya ever take a gander at that ISEQ performance! Who’d have expected an additional +12.0% rally, after an +18.0% surge in H1? And that’s nothing…if I described a market which had clocked 15%+ annual returns in 2012-2014, would you ever have guessed a +30.0% return for 2015?! Methinks not… But then again, I’ve actually been consistently bullish on the Irish market for the past 4 years now – which I’m v pleased by, except when I agonise over the fact I capitalised far too little on such prescience. Sad, sad, sad…

Continue reading →