Tags

blockchain, city discipline, cryptocurrencies, dot-com bubble, Ethereum, flipping, George McDonaugh, ICOs, KR1, Kryptonite, Kryptonite 1 plc, multi-bagger, token sales, venture capital

As some of you suspected, my last post (& related comments) were intended as an essential intro here, so it’s worth revisiting:

Cryptocurrencies & Blockchain – Longs, Shorts, or Trading Sardines…

[And since I ducked providing some kind of primer, let me highlight the best introductory books I’ve read in the past year: ‘Digital Gold’, ‘The Age of Cryptocurrency’, ‘Blockchain Revolution’, ‘The End of Money’…nor would I under-estimate the ‘For Dummies’ books. And this is new: Hash Power. And finally, here’s an interesting news/research resource.]

After highlighting some of the risks & challenges investors face if they’re considering direct investment in cryptocurrencies & blockchain (via mining, buy & hold investment, initial coin offerings, and/or blockchain VC investment), I concluded the safest & most practical approach for the vast majority of investors was inevitably via:

Listed Investment Companies

But while I detailed metrics for 16 core listed sector plays (& highlighted another 23 potential plays), I offered no recommendations. In fact, in terms of such nascent technology/innovation & the listed sector’s $2.6 billion market cap (just 2% of the $144 billion cryptocurrency market…which is another rounding error globally), I question if valuation’s even a relevant filter at this point. Same for management – many of which don’t necessarily match the typical CEO profile investors expect, or boast a prior/public track record.

[Not suggesting you abandon all (valuation) rationale. Or ignore management: Companies/projects will ultimately live or die by their management & they still need to be evaluated in their current role (at the very least). Focus particularly on what they actually do & achieve, not just what they say…]

In reality, the main challenge (& best framework) now for investors is to develop a real view on the entire sector – long, or short – one strong & personal enough to hopefully steer you towards the best investment opportunities, and help you sleep through the inevitable volatility & reversals to come. Thinking about cryptocurrencies & the blockchain separately is a great place to start, as people still confuse/conflate them*. Ultimately, they’re very different beasts…a negative view of one shouldn’t preclude a positive view of the other.

[*Even crypto-warriors have decided (or at least conceded) they’re trading Ethereum…but they’re actually trading Ether!]

Personally, I’ve no idea what Bitcoin, Ether, Ripple, Litecoin, Dash, or any other cryptocurrency’s actually worth, esp. in the wake of such astonishing gains. [Not to mention, their prospects for success/survival – look at Bitcoin, its crypto market share (& see here) has halved since early-2016!?] But that’s not an indictment, I still have the same problem with gold – God knows what it’s really worth, despite being around for millennia. So for now, cryptos are just trading sardines for me…at least in terms of price. But I do believe in the blockchain – particularly, the Ethereum blockchain – as a foundational technology, with huge potential to disrupt/exploit the massive revenue & profits exchanges, brokers, intermediaries, middlemen, custodians, record-keepers, etc. now hoard & enjoy for themselves globally.

Therefore, I believe investing in blockchain companies & projects is now far more compelling. But it’s early days yet, we see the original blockchain already losing ground to Ethereum’s smart contracts blockchain, and we should presume continued evolution & radical new developments to come (as with any new technology). And while Fortune 500 CEOs now boast about their blockchain experiments…what happens when real-world applications pose a serious threat? Do they try to kill the blockchain, persuade the world to accept limited/private blockchains, co-opt blockchain benefits & savings for themselves, or will they be forced to reinvent themselves to try defend (or even expand) their turf? Just remember, the latter’s far less common than you might think…it’s nigh on impossible for conventional CEOs/large listed companies to pull the trigger & cannibalise their existing business. Inevitably, they freeze in the headlights, ’til they finally launch a huge/extortionate acquisition binge to try acquire & control the competitive/existential threat they face.

Now try putting all that together – then start mapping out the possible scenarios, risks & opportunities which may lie ahead for the sector!? God knows how the winners & losers will shake out here…a diversified approach is essential. But barely a handful of listed companies are now developing their own blockchain applications & technologies. [And they’re akin to venture capital investments anyway]. Which points me towards listed investment companies which are now building venture capital portfolios of blockchain companies (via traditional equity/convertible/preferred stock investments). Plus companies focused – albeit, more cautiously & gradually – on making similar blockchain investments in companies & projects, via initial coin offerings (ICOs).

The latter may surprise you, considering some of the more alarming ICO headlines you’ve probably seen in recent months… But fools & fraudsters are always pervasive in new asset classes & investment themes – it’s silly to presume they’re somehow unique to ICOs. And simple due diligence invariably weeds out the obvious frauds & failures. While recent/looming regulatory threats may just be noise – this is a radically new approach to seed/venture capital funding, and it won’t suddenly disappear in the face of regulation. ICOs may choose to take advantage of regulatory work-arounds, to simply ignore Chinese & US regulators, to reject US funds & citizens (as we already see with banks, brokers & investment bankers globally), to embrace further regulation & seek out accredited investors, etc…on balance, more regulation may deter some existing crypto-enthusiasts, but it’s also likely to open up the sector to a far larger pool of global investors.

Attention should focus ultimately on what ICOs offer in terms of an economic stake & upside potential. Again, the headlines can be misleading: Many promising/heavyweight projects don’t offer an explicit securities interest – so should be outside the SEC’s (perceived) remit – as they may not even be companies, and are often open-sourced anyway. [Making them unattractive to regular VC firms]. Instead, they offer participation via the upside potential of utility tokens, which are essential to/derive increasing value & demand from the successful functioning/scaling up of the underlying project. Hence, initial coin offerings are now being called token sales. Ideally, it’s all about investing in/exploiting/benefiting from global platform economics & network effects – something hard to imagine little more than a decade ago, but which globally the largest technology firms & unicorns are now built on. Picture Facebook with no shareholder, where its net revenue/profits belong to its most important stakeholders – i.e. its users: In such a scenario, Facebook Likes could well have become the most valuable utility token in the world!

But meanwhile, there’s far more compelling/immediate investment alpha & upside potential to be harvested here:

All I wanna do is have some fun…flipping ICOs!

Which inevitably leads me to Kryptonite 1 plc (KR1:PZ).

Formerly Guild Acquisitions plc – a tiny Bruce Rowan-backed vehicle that was dying a slow death. In July last year, the directors finally threw in the towel, announcing a small £0.1 million placing, a new blockchain investment strategy, and George McDonaugh as CEO. [A deal sponsored by Rupert Williams & Jeremy Woodgate, of Smaller Company Capital, who were also appointed as NEDs]. By year-end, the company changed its name, and announced two more small placings of approx. £0.3 million, its first venture capital investment (£30K in NOMAN Ventures Limited), and its first initial coin offering (£6K in SingularDTV).

These podcasts (here & here) are an excellent introduction to George McDonaugh, Kryptonite 1, and the ICO/token universe. Clearly he fell hard down the rabbit hole…not atypical in today’s cryptocurrency/blockchain community! Plus he was co-founder of The N.O.M.A.N Blockchain Network, with over 400 members & some of the most respected innovators in the space – which appears to be a key driver of Kryptonite’s success to date. Here’s a longer clip of him at a blockchain workshop last year:

And while we’re at it, here’s a brief/recent pitch from Keld van Schreven, a consultant to the company who was just appointed an executive director earlier this month:

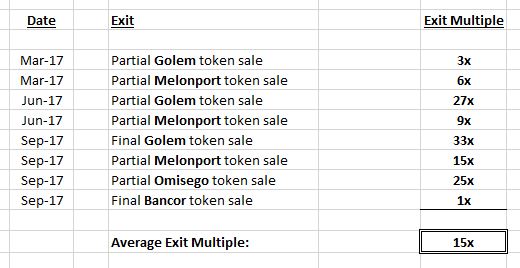

Unfortunately, Kryptonite’s equity still amounted to just £441K as of Dec-31st. [In my last post, I reported a £1.1 million book value due to a subsequent placing]. Which is barely a company…again, its expense ratio would inevitably kill it! Except I’ve actually witnessed something truly extraordinary with Kryptonite since…here, take a look at the ICO exits it’s announced YTD:

In the space of just 7 months, the company’s fully/partially exited 4 different ICOs at an average 15x exit multiple! And that’s just part of the story, Kryptonite’s also racked up some astounding revaluation gains.

‘Cos flipping ICOs is so flipping easy!

Apologies, I don’t mean to be flippant…flipping ICOs is how I would describe Kryptonite’s current/primary investment strategy. The board, not surprisingly, describes it in more measured terms:

‘We invest in cryptographic assets at an early stage (pre-ICO), or at ICO, and hold these assets until we reach our chosen valuation for the project. We bring city discipline to exiting our positions, and we put the proceeds back into further investments. We also look to seed fund early stage blockchain companies and hold private equity long term.’

Clearly, that’s appropriate…it would be silly to presume the Kryptonite team’s just throwing darts here blindfolded & hoping to strike it lucky. Let’s not forget, there’s 1,000+ cryptocurrencies already, with new ICOs arriving almost every single day! [As I said in my last post, even dabbling in ICOs would be a full-time career. Ya gotta outsource..!] Now take a look at the ICOs in which they’ve actually participated (see below) – it’s clear there’s a comprehensive due diligence process in place to evaluate them. The most critical hurdle is to first eliminate the obvious frauds & failures. Then, most important, you assess the calibre & reputation of the team/management leading the project/company…as with all start-ups, their ability to pivot could be critical. Next, focus on the underlying project/technology/application: How difficult is the implementation, how innovative the technology, what’s the potential timeline, scale & commercial opportunity, who else is targeting similar applications & space? Ideally you want a credible team, an exciting project, and an empty space to exploit. Finally, evaluate the crypto economics – both the short term supply/demand dynamics, plus longer term utility/demand/inflation/store of value potential of the token.

[Here’s a visual summary of Kryptonite’s investments to date – for the ICOs, I’ll list project websites & token price graphs (if trading):

Cosmos: ATOM

FOAM: FOAM

Enigma: ENG

RChain: REV

Rocket Pool: RKT]

But while all that’s true…unfortunately fortunately, the longer term investment & technology potential of an ICO scarcely matters when: i) there’s a multitude of new (& possibly superior) ICOs/projects being announced every single day, and ii) crypto-enthusiasts are falling over themselves to hand you 15-baggers – or even 30-baggers!?! – in just a few weeks/months. Hence, the cited ‘city discipline’: Kryptonite’s board acknowledge a duty to shareholders to recover initial invested capital quickly, and subsequently (average out slowly?) to lock in truly astonishing gains – which might otherwise get obliterated by a fresh bout of volatility. And to keep on making hay while the sun shines…the fact Kryptonite’s an Isle of Man company is just sweet sweet icing on the cake:

All its gains are actually tax-free!

And arguably, their strategy’s less risky & ephemeral than you might assume. Ask a fund manager – they’ll confirm flipping IPOs is maybe the easiest/most rewarding/sustainable alpha you’ll ever encounter. [The problem, of course: a) getting access, and b) actually getting a decent allocation!] With most ICOs being built on top of the Ethereum blockchain, Kryptonite’s ICO gains obviously owe a debt to Ether’s own price-rally this year (up almost +3,650% YTD). But I think it would be wrong to presume those gains vanish in the absence of such a rally – because the initial supply/demand we’re seeing with so many ICOs is all too familiar…

Firstly, because I got my start (& my first serious returns) as an investor flipping IPOs. [Or stagging IPOs…as it was called back then, when it was actually an accessible & lucrative strategy for private investors. Maybe a future post, eh?!] I also had a ringside seat on the dot-com bubble – and skipped the collapse – so all I remember is how irrational a real bubble can truly get. Today, I see the same story playing out: A new & ultra-hot technology sector, investors playing free & easy with house money, blind faith in what seems like guaranteed returns, privileged friends & family allocations, lock-ups, severely limited free floats, etc.

And today, there’s a wall of cryptocurrency effectively trapped out there – investors fear missing out on gains, they don’t want to return to fiat currencies, plus they want to avoid the risk of a huge tax liability. But money’s always looking for another rally, which can become self-fulfilling… And with many new tokens held back – by lock-ups, by the founders, by the project/company itself – subsequent trading can see a huge initial pop, then a steady ratcheting higher. And despite the absence of the usual gatekeepers (i.e. investment bankers), it’s becoming far more difficult for small investors to now participate – they don’t have the access, or the speed. Which can mean a wall of money chasing through a very small door, and investors often feed this momentum because they’re perfectly happy buying tokens at 3/5/10 times the ICO price (as long as they’re convinced it will soon hit 20/30 times the price).

And this phase may last longer than you think…check your dot-com history: Even four years before the Mar-2000 peak, first day 100%+ IPO premiums were not unusual, while 400-600% premiums were a regular feature of the bubble for a full one/two years before it finally started deflating. So we may see plenty of mileage yet, with today’s supply/demand situation far more extreme – the listed sector’s still only worth $2.6 billion. It may have performed handsomely this year, tracking Bitcoin & Ether higher – but in reality, most crypto-guys have yet to consider buying shares, while most share-guys have yet to consider buying crypto. But this will change…a rising tide lifts all boats.

So what’s it all mean for Kryptonite 1?

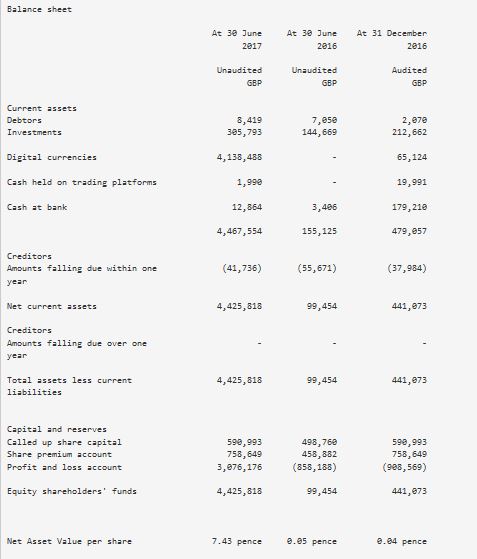

Well, the first half of the year was so astounding, I actually gave up on my post & waited for the Friday interim results release. My balance sheet projection would have seemed so ridiculous, readers probably would have blinked & moved on…so here it is from the horse’s mouth, this is the June-30th balance sheet:

[NB: Ignore prior NAVs – they haven’t been adjusted to reflect the 1-for-19 share consolidation completed in Apr-2017.]

Yep, that’s right: The Kryptonite team delivered a (clean) 10-bagger in just 6 months! [And yes, the figures make sense & correlate nicely with my own projection (based on the year-end balance sheet, YTD announcements & my own independent verification of token prices)]. That’s just extraordinary…as an investor, I’ve never seen a company generate anything remotely close to an (unleveraged) 900%+ return on equity! And that’s not even annualised…

Even if we see less eligible ICOs going forward, and premiums start to compress & rallies evaporate, initial supply/demand & classic venture capital economics may still work in Kryptonite’s favour. Picture it buying ten new ICOs in the next year (they actually announced 4 new ICO investments recently) – even if nine are duds (say, a net wash), a single 5/10-bagger could still deliver a 65% RoE (gross)! And all else being equal, Kryptonite’s busy tilting the odds in its favour…ICO due diligence process is still paramount, but its network of crypto-contacts, support/sponsorship of the crypto-community, balance sheet, growing credibility are granting it preferential and/or guaranteed access to ICO seed funding rounds, private/pre-sales, price discounts, bonus tokens, etc. The interim results commentary highlights this nicely.

But somebody always wants to kill the golden goose… To alleviate this risk, Kryptonite should also gradually recycle profits into longer term venture capital (& ICO) investments…they may not offer high returns up-front, but could prove compelling in the future. They also have a longer lead-time & may offer a single chance to invest – so even though current ICO returns are incredible, building a VC pipeline is prudent. Kryptonite announced two such investments YTD – both of which look promising – a €59K investment in Jan-2017 for a 1% stake in SatoshiPay, and another £200K investment just a week ago for a 5% stake in Vo1t Ltd (Kryptonite’s their first beta client).

Despite this accelerated RoE, Kryptonite’s mostly remained below the radar. Sure, it rallied sharply YTD, like the rest of the sector – but who else can boast a 900%+ RoE in the first half of the year?! And that means KR1’s far cheaper than in my last post – which didn’t include realised/unrealised crypto gains – in reality, at 4.125p per share, it trades on a mere 0.56 Price/Book multiple (vs. a Jun-30th NAV of 7.43p per share). Even with a less attractive future in store, that multiple’s ridiculously cheap. On the other hand, if you think flipping ICOs is a sustainable source of alpha/high returns for some time to come, how on earth do you put an appropriate valuation on a 900%+ RoE, or even some small fraction of that return?!

Who knows…

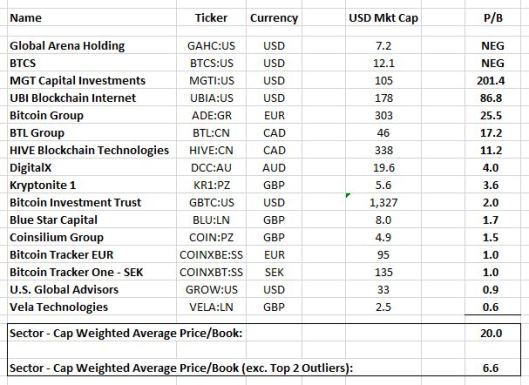

But when I see investors prepared to pay a staggering 84% NAV premium for a passively managed $1.3 billion Bitcoin investment vehicle – i.e. Bitcoin Investment Trust (GBTC:US) – I consider that a bare minimum fair value multiple for Kryptonite 1:

7.43p NAV per share * 1.84 Price/Book = 13.66p FV per Share

Which implies a 231% Upside Potential, vs. a current 4.125p share price.

Except…I just can’t forget this table from last week’s post:

The entire sector literally trades on a cap weighted average of 20.0 times book. Even removing some ludicrous outliers, we still get a 6.6 Price/Book…which is pretty daunting, because the sector hasn’t delivered anything remotely like Kryptonite’s RoE. Plus, I’m aware some of those P/Bs may be overstated – possibly significantly, like KR1 above – as I didn’t attempt to incorporate potential realised/unrealised crypto gains.

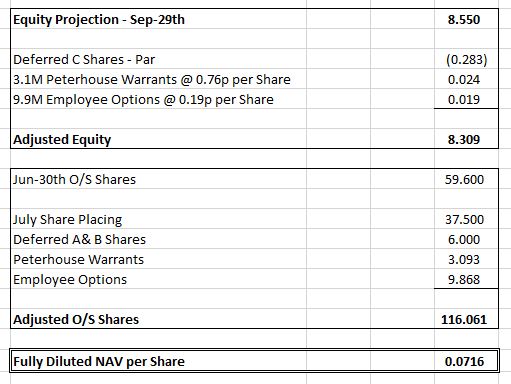

Therefore, somewhat arbitrarily, I’ll haircut that P/B multiple by 50%. Noting Kryptonite’s performance to date, its tiny market cap, and the sector’s relatively tiny $2.6 billion market cap, I believe a 3.3 Price/Book as a secondary fair value multiple is entirely fair & possible (again) if investors seriously target Kryptonite. But using that kind of multiple, it’s only prudent we reference a current balance sheet projection (as of Sep-29th):

[NB: Adjusted for 3 months admin expenses, my 60% deemed writedown on a legacy Romanian property loan, and Ether/ICO token sales & revaluations. Investments/ICOs still at cost are omitted. Any unreported sales would obviously impact this projection.]

As you’ll note, most items are a wash. But exc. the July £750K share placing, the Kryptonite team came up trumps again, generating an astonishing 77% return on equity in just 3 months, with equity now an estimated £8.6 million. Unfortunately, we also need to adjust for substantial dilution:

Management provides an undiluted/going concern NAV per share – but this doesn’t capture the deferred C shares par value or the Peterhouse warrants granted in Feb-2016, plus I’ll assume the deferred A&B shares will soon effectively convert to ordinary shares. [See p. 17/18]. The deferred D shares have zero economic value (see p. 7). Main dilution arises from:

- Recent grant of 9.9 million options. The options were worth £277K, in terms of intrinsic value – which looks acceptable, as Kryptonite’s expenses haven’t increased much since the new management team arrived, so these options are clearly in lieu of compensation. [In fact, with the surge in equity, the expense ratio’s now an impressive 2.1% pa]. But management should have warned shareholders in advance, and should indicate how compensation will be handled in the future.

- The July £750K share placing was at 2p per share, a 33% discount to the share price at the time (not extraordinary for a nano-cap). Unfortunately, we now realise it was extremely dilutive vs. a Jun-30th 7.43p NAV per share (since reported). Alas, we need to chalk this one up to management’s learning curve – presumably the placing was in the pipeline for quite some time, a substantial portion of the subsequent ICO gains weren’t evident at the outset, no Jun-30th balance sheet was in circulation, and the placing price made sense vs. the share price at the time.

So overall, despite a near-doubling in total equity, we end up with a marginally lower fully diluted NAV of 7.16p per share (though clearly, we’re not comparing apples to apples here). Which is fair warning for management…and shareholders: Personally, I’d be extremely wary of further dilutive placings – it would indicate management is dead-set on scaling-up the balance sheet, regardless of any implied cost/dilution. But why should they?! Management’s execution has otherwise been pretty flawless, they have an incredible story to tell, and underlying RoE bodes well for Kryptonite’s prospects & valuation – now they should hit the road & really start getting the story out there.

Of course, once Kryptonite’s trading at a consistent NAV premium – and I’m positive it will – then a new placing’s entirely possible. Not to mention the chance, in due course, to move the listing up from NEX to a bigger exchange (as van Schreven highlighted in his recent pitch). In fact, noting my last post, some kind of North American merger/listing would be ideal – that’s a long-shot, but it could potentially exploit a gigantic valuation arbitrage. [N American stocks often trade at a multiple of UK valuations, particularly when it comes to hot new sectors – witness the astounding step-change in HIVE Blockchain Technologies’ share price & valuation.]

And so, as I detailed above, I’m still happy to assign a 3.3 Price/Book ratio as a secondary fair value multiple here:

7.16p NAV per share * 3.3 Price/Book = 23.62p Secondary FV per Share

Which implies a 473% Secondary Upside Potential, vs. a current 4.125p share price.

At this point, an obligatory nano-cap warning: I haven’t given one of these in quite some time, as I’ve focused on larger-cap stocks (even Alphabet!), but Kryptonite’s underlying performance to date & the upside it potentially offers as a unique cryptocurrency/blockchain play is extraordinary. It currently trades on the more lightly-regulated NEX exchange, it still sports a mere £4.0 million market cap, and it usually trades on a ridiculously wide spread (though you can work/close the spread, as I did, if you have the patience). [Plus you need to be able to trade it – here’s one recommendation from the company itself. But a decent full-service broker should be able to help – yes, they’re still useful occasionally – even if they don’t usually trade NEX, ideally they can source stock via a London market-maker]. Clearly, if this go pear-shaped, the resulting spread & illiquidity could be a real killer…it’s no stock for widows & orphans. [What do they know about cryptocurrencies anyway..?!] Of course, it would be remiss of me not to highlight those very same attributes could also deliver an utterly ridiculous price rally/valuation…if a bunch of investors & the message boards really got excited about Kryptonite’s prospects!?

But in the end, the company’s actual price/book multiple – either mine, or what the market sets – may not matter all that much. Whether management can keep executing & steadily compounding Kryptonite’s balance sheet (even at a small fraction of its YTD return on equity) going forward, that’s obviously what really matters & what might potentially deliver out-sized future returns. But clearly they’re incentivised – management’s purchased 8.0 million shares to date & now controls a 15%+ fully diluted stake (inc. options) in Kryptonite (worth over £0.7 million). Personally, my investment’s constrained by Kryptonite’s current market cap (& the usual reporting threshold requirements), so I’ll just confirm I currently own between 1% and 3% of Kryptonite 1 plc (KR1:PZ).

- Kryptonite 1 plc: 4.125p per Share

- Market Cap: GBP 4.0 Million

- P/B Ratio: 0.58 (vs. estimated fully diluted NAV per share)

- Target P/B Ratio: 1.84

- Target Fair Value: 13.66p per Share

- Target Mkt Cap: GBP 13.3 Million

- Upside Potential: 231%

- Secondary P/B Ratio: 3.3

- Secondary Fair Value: 23.62p per Share

- Secondary Mkt Cap: GBP 22.9 Million

- Secondary Upside Potential: 473%

Pingback: FY-2017 Wexboy Portfolio Performance…Crackin’ The Code | Wexboy

Any thoughts about Blockchain Intelligence Group? https://blockchaingroup.io/

Publicly traded in Canada.

Hi wexboy I think targets around 25 p for book X 1.84 what do you reckon?

01-Dec-2017:

KR1:PZ I’ve increased my Kryptonite 1 shareholding by another 5%…my FVs of 13.7p & 23.6p per share (vs. a 7.75p share price today) still stand: https://wexboy.wordpress.com/2017/09/30/kryptonite-even-superman-could-love/ … … I continue to own between 1% and 3% of the company…

[NB: Again, per my Oct-2nd comment below, my portfolio deemed weighting now will therefore increase from 4.7% to 5.9%, implying an average 5.3% Kryptonite 1 portfolio holding for performance purposes.]

Hi WB Good Morning , Question ! If Ethereum has increased at such a vast rate from March 17 when KR1 were beginning to invest within the eth platform eg- $17.55 on 01/03/17 to $700 on 13 /12 /17 = 4000%, during that period KR1,s SP has only increased from 2.55 to 8 = 350%, Would that not indicate we are due a Massive rerate ? Another issue that seems to throw up a bone of contention is the amount of shares dumped last few weeks , OK taking into account these are the majority of the 10/11/17 12.5 million placement shares, Its still heavy offloading on a continuous daily basis so why would that many shares come on the market if KR1,s NAV ( just say 20p ) is way ahead of the sp , so we are trading @ a 150% discount to nav

Am I missing something ? , especially the non correlation of current sp to current Ethereum price ,,

My reply below was a DM on 16-Dec-2017:

But in reality, Kryptonite 1 is NOT a Bitcoin/Ether price tracker. While a BTC/ETH rally is obviously positive for sentiment, KR1 short-term gains have actually been derived from huge multi-bagger gains on new ICOs, which arguably are relatively price independent – i.e. they can potentially harvest a 1,000% new ICO premium whether BTC is at $5,000 or $15,000.

Longer-term gains should come from successful ICO project & Blockchain VC investments, but that will take time…

So while the huge crypto rally this year has been a marvelous backdrop, I don’t see it necessarily as the prime driver or highly correlated with Kryptonite’s NAV gains this year…which of course are also truly impressive too (e.g. a 900%+ RoE in H1)

So the big problem is the lack of an actual valuation re-rating – i.e. the KR1 share price approximates its NAV/book value, whereas other crypto/Blockchain stocks (particularly in N America) trade at 3/5/10/20/200 times book value! I’m hounding management about that – they are doing a marvelous job, but need to spend a lot more time on investor relations & getting the story out there

The aim is to get off NEX…to AIM wd be the default, but frankly I’d prefer N America

As regards the selling, it’s an unfortunate fact of life with placings like that, as the bulk of the shares go to larger/existing shareholders…so in reality most of them flip the shares, as they are comfortable with their pre-existing stake…which is why I highlighting I hadn’t sold any placing shares!

something seems strange here they have 75M ffair coins which is around 40 cents a piece which is a value of 30 million alone and yet its priced at 30% of this

Hi markc,

Kryptonite 1 actually bought 73.3 million FunFair tokens at 0.5p each (a total of GBP 384K). They have reporting selling less than 5% of their holding since (a 4-bagger). Today, the rest of their holding would now be worth GBP 2.9 million (at 4.1p per token, an 8-bagger).

Regards,

Wexboy

Well thats what happens when u dont pay attention to detail and miss a decimal place!

my error!

10-Nov-2017:

KR1:PZ And yes, I’ve now increased my Kryptonite 1 shareholding by 20%…my FVs of 13.7p & 23.6p per share still stand: wexboy.wordpress.com/2017/09/30/kry… I continue to own between 1% and 3% of the company…

[NB: Per my Oct-2nd comment below, my portfolio deemed weighting now will therefore increase from 4.7% to 5.6%, implying an average 5.2% Kryptonite 1 portfolio holding for performance purposes.]

What’s your view on their latest (and by far, largest) investment – Web3’s Polkadot Project?

Hi Mark,

With Kryptonite’s balance sheet/NAV a huge multi-bagger in the last year, they’ve naturally been scaling up their investments, so the size of this investment is no real surprise.

As for Polkadot itself, the team/backing is impressive, and it appears to be an obvious foundational infrastructure project for a rapidly proliferating crypto/blockchain universe – which, of course, is endorsed by the fact there’s also other teams/projects out there with similar/related objectives (inc. Cosmos, in which Kryptonite also invested).

While I think there’s easy multi-bagger profits to be harvested here now from new ICO launches, handicapping the odds of success for longer term ICO/blockchain investments is obviously challenging. But as any good VC would recommend, betting on the right people/teams almost inevitably proves to be the most important criterion – while a diversified portfolio’s also essential, where hopefully one big winner (/unicorn) can hopefully yield huge returns despite other losers in the portfolio.

Regards,

Wexboy

Hi Wexboy , Good Morning

KR1 Unicorn ?

Difficult for a small investment company to hit unicorn status, but I like the cut of your jib there! But yes, there’s definitely a chance Kryptonite 1 may now be investing in a future unicorn or two…

Thanks for the reply – I’m going to look into Polkadot further and get some more technical guys than me go over it – so I understand better the inherent value and also the route to monetization. Cheers 🙂

Cheers – any subsequent/further feedback on Polkadot, feel free to share it here, or email me. Thanks.

Coin pushing on today, KR playing slow catch up, As we are aware , The potential in the sector is still to become clear figures wise , GMc will have his targets and if it’s anywhere near last 8 months , Anything is possible even unicorn status.

Wexboy: Yes, COIN:PZ up another +25% today!? What can I say, Eddy is always pounding the pavement & getting the Coinsilium story out there: https://www.youtube.com/results?search_query=eddy+travia+coinsilium

Wexboy, Reference your 30th Sept current summary in KR1, From my point of view I am in awe of your 2% holding in KR1, The figures are very compelling and staggering in forward potential, I might have this projection all wrong but here goes, As of today 22/10/17 we have an sp of 7p, quoting your average roi on holdings within the table we have x 15 within the last 7 months giving us a current book to value of x 3.5 = sp 24.5p, Should we assume another x 15 ( I appreciate the x 15 was on the back of Ethereum,s metaphoric rise and other crypto,s tracking ) over the next 12 months and and sp follows suit to say 100p, THEN we factor in a us listing and as you state the us markets award much higher book value with the average p/b in the blockchain cc sector of x 20, Then we are looking at (without dilution) in 12 months -= MC of £2 BILLION = £20 SP

AS you state in your summary the figures are staggering so is the ablove a realistic projected mc based on the last 7 months growth and returns on investments made in CC ICO,s ?

Appreciate your wisdom and response

Davec M

Hi Dave,

If only it were so simple… 😉

The crypto/blockchain space is moving so fast who knows where we’ll be in a year, and I’ve no idea where Bitcoin will end up (in terms of its value vs. the dollar), but I definitely like Kryptonite 1’s investment strategy, particularly the specific & pretty unique exposure it offers to the sector.

If the company can continue to clock up even a fraction of its YTD return on equity, it more than deserves to trade on at least 2/3 times book – which would still offer a cheap ground-floor entry price to a sector that trades at much higher multiples on average – hence my 13.7p & 23.6p price targets (vs. 6.875p per share today).

On the other hand, if Kryptonite managed to continue racking up 100/500%+ RoEs for some time, NAV & the share price could potentially compound to price levels that are a multiple of my FV targets (but please note, I’m not suggesting anything remotely like 20 pounds per share). If that happens, then yes, all my Christmases come at once – but I’d definitely caution you (& me) not to start counting those chickens just yet!

One step at a time…

Good luck,

Wexboy

Many Thanks for the reply and the wisdom there in

Of course my figure were extremely bullish in rapid mode but it was in the realms of reality based on the x 15 ROI achieved to September and the US x 20 average book value

The more you post the more I learn, Your knowledge and cautious approach are extremely Welcome

And many thanks to you too, Dave!

more food for cryptoinvestors coming soon:

https://www.bloomberg.com/news/articles/2017-10-04/from-biotech-to-bitcoin-bioptix-shifts-focus-to-blockchain

Thanks, mmi – I’m wondering now if I really should follow through on my promise to highlight/list any new crypto/blockchain companies – they all seem to be ‘change the name/feed the ducks’- type companies, and I’m sure we’ll see more of the same soon!

Wexboy Keep up the good work Any chance of getting Zamano to do a reverse takeover of Kryptonite

As it is Zamano seems to be going nowhere or worse still stuck in reverse. K could do the takeover (at a nav premium), and utilise the cash funds for their ICO investments or even do a limited buy back of Zamano shares.

Or they could simply offer say Eur 0.045 per share coupled with the option of taking shares in K as an alternative to the cash offer, keeping their existing listing rather than zamanos

If nothing else this would crystallise CGT losses but retain an upside

Best regards Paul

Sent from my iPhone

>

Thanks Paul,

Yes, there’s def some merit to that idea, and I certainly think about such things! But reverse-merger candidates are mainly unquoted companies seeking a listing, rather than companies trading on a smaller exchange & looking to step up – though granted, a Zamano deal is in theory pretty clean & easy at this point.

I think the main issue now at Zamano – presuming a motivated & likely candidate did show up in time (& that may be a tough proposition) – are the three main shareholders. If it turned out they weren’t keen on the new business, or preferred/intended to exit the resulting company, then a deal wouldn’t make a lot of sense in the first place. [Not to suggest they’ll actually be a road-block here – equally, their sponsorship could make a good deal happen, to everyone’s benefit.]

Regards,

Wexboy

What do you make of the director links with V22 ?

http://colouringinculture.org/blog/v22transnationalartwashing

Ah yes, that little rant – when somebody keeps posting repeatedly about some tiny £0.5 million company, I think it’s sensible to presume they’re pursuing some crazy personal vendetta…

V22 plc was simply another legacy investment of Guild Acquisitions…it has nothing to do with the new directors appointed (since July-2016), or Kryptonite 1 plc. Not to mention, in line with its new investment strategy, that V22 shareholding (which was worth just £17K) was already disposed of last year.

Cheers for that sounds quite reasonable. Im presuming Stephen Corran is a typical nominee director thanks for that. I believe i shall stick a few pounds onto supermans enemy!

Yes, I think it’s fair to say Stephen Corran is there simply in his capacity as ‘a typical nominee director’ & Corp. Secretary. Good luck!

Hi Wexboy, I like this idea – you look at it differently to me – I went through their RNS’s, worked out the current value of what they held less sales / capital raising etc… Then worked out what it was worth. http://www.coinmarketcap.com has good list of crypto current prices if you are interested in monitoring it like this…

Worrying thing is that when crypto takes a dive this discount can evaporate. Still I think you are right here could be lots more opportunity.

Mentioned you in a post here:

Hi Rob,

Nice trigger finger there..!

Yes, coinmarketcap.com is def one of the better sites – check out the ICO tickers above, they’re actually coinmarketcap quotes/graphs.

Frankly, I have no real idea whether Bitcoin’s ‘worth’ $50 or $500,000 (the latest & most ambitious prediction from John McAfee!), so right now I’m focused on investing in the blockchain & flipping ICOs – which is a pretty unique proposition, in terms of the available listed companies out there (globally, in fact), hence Kryptonite 1.

As I highlighted, I think the current supply/demand dynamics for new ICOs suggest compelling profits to be made participating in their sale/pre-sale, regardless of the absolute Bitcoin level, or even whether it’s making further/fresh gains. Of course, if the Bitcoin price did collapse, it does seem likely the new ICO market would dry up…so Kryptonite’s policy of recycling capital & working on its longer-term pipeline of potential blockchain-related investments is prudent.

Good luck,

Wexboy

Pingback: KR1 – Kryptonite 1 Good results re-entering | Deep Value Investments Blog

‘Personally, my investment’s constrained by Kryptonite’s current market cap (& the usual reporting threshold requirements), so I’ll just confirm I currently own between 1% and 3% of Kryptonite 1 plc (KR1:PZ).’

For readers, I certainly hope & presume this line was useful confirmation of my conviction in the Kryptonite 1 Investment thesis & my current skin in the game…

But for portfolio performance, I’ve just remembered I’ll still need a % of portfolio for my calculations – an arbitrary but fair way of doing that is simply to use an average holding size from my Aug portfolio post:

Therefore, please note I’m assigning a 4.7% of portfolio deemed weighting to my Kryptonite 1 holding for performance purposes.

Some Kryptonite 1-related Twitter a/cs:

@KRYPTONITE1plc

@georgemcdonaugh

@keldster

@SCC1td

@rew8081

@NEX_Exchange

@Crypto_Vo1T

@SatoshiPay

@weareNOMAN

And a new* advfn KR1 message board for Kryptonite 1:

http://uk.advfn.com/cmn/fbb/threads.php3?symbol=LSE%3AKR1

*There was an old one (KR1.), but I’m guessing nobody could find it.

it’s a doughnut

Mmmm, tasty…