Tags

Alan Walsh, hazardous waste, IAWS, metals recycling, NTR plc, One Fifty One plc, One51, Pageant Holdings, Philip Lynch, plastics, Straight plc, Sum-of-the-Parts Analysis

A One Fifty One plc investment write-up has long been outstanding from me now, as certain readers have reminded me! It’s high time now I rectify this – especially since I’ve already highlighted One51 & its CEO, Alan Walsh, play an integral role in the unfolding NTR plc story. Of course, One51’s also another classic example of Celtic Tiger hubris & near-collapse – but its future definitely looks far more promising…

Let’s rewind: In 2005, members of the Irish Agricultural Wholesale Society Ltd. approved the creation of One51. In bygone years, it would probably have remained just a sub. of the Society, conservatively managing its investment properties & portfolio. But the Celtic Tiger demanded something more ambitious, so it became a stand-alone company: a) When Society members became direct shareholders in One51, via a Feb-2007 share exchange, and b) grey market trading commenced in One51’s shares at the end of Oct-2007.

[NB: Irish grey market shares are unlisted – akin to unlisted UK shares (which trade via matched bargain), or US OTC/Pink Sheet stocks (but without the benefit necessarily of market-makers). One51 now has a quarter billion dollar market cap, and its standards of reporting, corporate governance & investor relations equal any of its listed peers, but it’s still a grey market share…so be aware of the usual investor health warnings. But if you’re still interested, you can discuss and/or trade One51 with these brokers.]

This independence was something of an illusion though, as One51’s board and management was populated mostly with continuing (& former) directors and management of the Society & IAWS Group plc. [IAWS Group was a listed sub. of the Society, which has now become Aryzta (YZA:ID) & Origin Enterprises (OGN:ID)]. The company’s shareholder base also overlapped with those of the private & public IAWS entities. But those were heady times – brokers & punters weren’t too worried about potential grey market illiquidity, or governance issues. All they really cared for was the mesmerising strategic vision painted by Philip Lynch, One51’s CEO. [Who was still CEO of the Society, and a former CEO & Chairman of IAWS Group]. Unlike everybody else at the time, Lynch wasn’t actually focused on property investment & development…instead, his real ambition was to become a genuine mover & shaker in the Irish (& even the UK) corporate world.

Unfortunately, looking back, his vision doesn’t look so compelling (or even that strategic). During 2006-08, operating & financial acquisitions were occurring at the frantic pace of almost one a month – and well over EUR 500 million (gross) was actually spent during this period. As a result, the balance sheet almost quadrupled within a two year period (peaking at EUR 900 million+ by end-2007), funded by an easy combo. of bank debt & fresh equity. [Plus EUR 168 million of Convertible Loan Note (CLN) issuance, most of which was quickly converted to equity also.]

Buoyant business & investment confidence, optimistic growth expectations, and the intoxicating availability of cheap funding, all conspired to jack up prices paid (& goodwill recorded) at the time. And management’s lack of financial discipline was clearly evident in the minimal (low single-digit) net profits & return on equity recorded in 2006-07. But judging by One51’s opening share price, investors didn’t much care – they were too focused on their prospective gains, and the touted ‘integration and synergies’ to be extracted from the company’s sprawling portfolio.

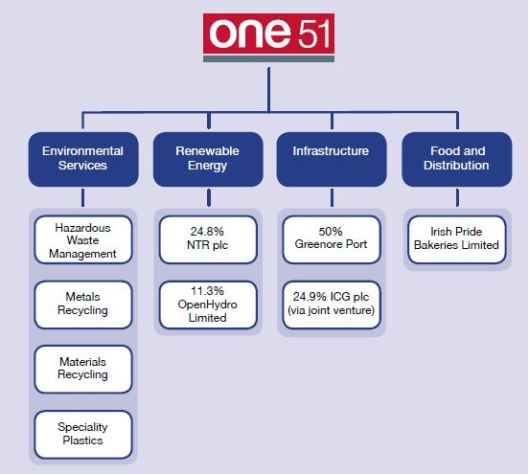

As 2008 came to an end, portfolio highlights included:

Not to mention One51’s other balance sheet holdings – investment property, private equity fund investments, 4%+ stakes in ThirdForce & IFG Group (IFP:ID), and a 26.9% stake in Augean (AUG:LN). [With further renewable energy investments still to come in Island Renewable Energy (80% stake), and Pioneer Green Energy (13.7% stake)]. And don’t even get me started on the potential friendly/hostile public takeover bids that were being considered by One51 at the time…most famously, the active role it played (via Moonduster, a JV with the Doyle Group) in the long-drawn out (& ultimately unsuccessful) bidding war for Irish Continental Group (IR5B:ID).

Of course, the strategic logic (or lack thereof) of the overall portfolio was academic at that point…as a cash-burning & over-indebted One51 was forced to face up to collapsing asset values, investor risk aversion, evaporating bank facilities & an accelerating economic recession. All exacerbated by the fact much of its own balance sheet was effectively trapped in minority investment stakes, over which One51 could exercise little or no control.

Looking back, we enjoy the benefit of hindsight…but let’s not under-estimate the existential threat to the company at the time: Operating free cash flow was minimal, there was little opportunity to realise assets (except at fire-sale prices) in 2009-11, almost EUR 400 million of net losses, investment write-downs & goodwill impairments were recorded in the five years ending in 2012 (which actually understates a near-85% collapse in net equity), as the banks kept shrinking their committed facilities & imposing harsher terms (and seriously considering pulling the plug). And investors weren’t shy about jumping ship…the One51 share price chart tells a painful story:

From a EUR 6.10 peak at the end of Oct-2007, the share price collapsed by an astonishing 98%, reaching a Dec-2012 low of just 15 cents per share! Considering the scale & timing of the decline, clearly it wasn’t just another post-crisis markdown. In fact, at its low, the company’s market cap amounted to just EUR 19 million – vs. 111 million of bank debt & CLNs – obviously attesting to the widespread investor belief at the time that One51 was locked into an inevitable death-spiral.

But salvation was actually on hand…

Enter Alan Walsh, one of the new breed of unsung heroes in a post-Celtic Tiger world, who was ready & willing to tackle the daunting task of picking up & salvaging the pieces. Walsh was appointed CFO in mid-2009, but an opportunity to take the wheel arose in Jul-2011, when Philip Lynch’s contract as CEO was ‘terminated with immediate effect’. Coming in the wake of a disgruntled shareholder campaign (led by Gerry Killen), this wasn’t much of a surprise – and it always seemed likely the architect of a (near) bankrupt business & investment strategy would end up being ousted anyway. Especially since Lynch made his fair share of enemies along the way… [His inability to go quietly was no great surprise either.]

The board first appointed Walsh as Interim CEO to replace Lynch – and after a comprehensive selection process, they confirmed him as CEO in Nov-2011. This was accompanied by his new 2 year Action Plan to remake the company into a more streamlined & focused entity – which included the following key components:

– Maximise free cash flow from One51’s operating activities

– Sell non-core assets & businesses within a realistic time-frame

– Use sale proceeds to pay down debt

– Identify & invest in those businesses which offer the best growth prospects

Walsh warned shareholders and employees of the painful restructuring, cost reduction & rationalisation still to come, and then began systematically ticking each action item off his list: i) After one last kitchen sink loss in 2012 of EUR 116 million (mostly goodwill impairment), One51 actually recorded a net profit in 2013 for the first time in 7 years, ii) free cash flow increased from just EUR 1.1 million in 2011 to 15.4 million in 2013, iii) almost EUR 100 million was raised in two years from the sale of the plastic extrusion business, the disposal of stakes in Island Renewable Energy, Thirdforce, IFG, and (most significantly) Irish Continental Group, in addition to a substantial 2013 capital redemption from NTR, and iv) net debt (exc. CLNs) fell from EUR 146 million to just 40 million. Here’s a nice summary:

A couple more disposals were still in the works at end-2013, with the sale of Irish Pride Bakeries & the company’s stake in Augean being completed in early-2014. This left a small mopping-up exercise for H2-2014 – the sale (& leaseback) of One51’s HQ (151 Thomas St, hence the name), plus the disposal of its 50% stake in Greenore Port. [And a clean sweep of the old IAWS/One51 regime was completed with Pat Dalton’s appointment as CFO in 2012 & the elimination of the Deputy CEO position, complemented by a new Chairman & a slimmed-down board. A 75% reduction in total board comp. from EUR 6.1 million (in 2007) to 1.5 million is also very welcome]. This leaves the stake in NTR as one of the few remaining non-core assets, but an activist campaign (standing shoulder-to-shoulder alongside Pageant Holdings, which owns both a 9.2% stake in NTR and an 8.0% stake in One51) to realise value for shareholders is now bearing fruit (since Aug-2014). And on the operating front, the company’s now focused on two restructured and profitable divisions – OnePlastics Group & ClearCircle Environmental:

And with a difficult first half out of the way, Walsh kicked off what should prove to be a far more exciting second half of the game with a renewed growth strategy for One51, executing its first acquisition in years – a EUR 13.4 million recommended cash offer for Straight plc in Aug-2014. This price equated to a cheap 0.5 Price/Sales multiple, but this looks more appropriate when you note Straight’s profitability was basically break-even at the time. But the strategic logic of the deal is obviously compelling – the company’s now being integrated with MGB Plastics (the king of wheelie-bins) to create one of the UK’s leading environmental waste & recycling container businesses. I suspect Straight’s margins can & will converge pretty quickly with One51’s underlying OnePlastics margin. Other potential acquisitions, in plastics or hazardous waste, are also now being actively considered. [Metals recycling remains in a holding pattern for the moment, awaiting a more sustained recovery. While management needs to bulk up the tiny & erratic materials recycling business, or just sell it off & be done with it.]

Maybe the only (apparent) misstep so far was a Sep-2014 placing of 25 million new shares at EUR 0.90 per share – which some viewed as dilutive, particularly in light of today’s share price. But this placing should be considered in its proper context – Walsh originally teed it up in Apr-2014 (see p. 13 of the 2013 Annual Report), specifically to pursue growth through acquisitions in a conservative manner (e.g. the Straight acquisition, which was already in progress). And we should recall the share price was significantly lower at the time (vs. today), and there was little real expectation in the market that substantial value/liquidity was going to be released from NTR in the near term. [Of course, as the placing was being completed, this market perception had changed decisively.]

The placing was obviously a trade-off: Funding a new growth strategy with an acquisition that could quickly add value, vs. dilution based on a potentially illiquid & uncertain NAV per share. With the benefit of hindsight (esp. if we see an NTR tender offer coming soon), the placing was an unnecessary luxury…but from an Apr-2014 perspective, a placing to fund Straight (& other potential acquisitions) was arguably an attractive proposition. In Nov-2014, an additional 5.3 million shares were issued at EUR 0.90 per share, but the logic here was obvious – it was used to fund/incentivise the retirement of a majority of One51’s remaining CLNs (& related interest coupon) at the bargain price of 50 cents on the euro. Big picture, we should also remember Walsh was CFO & then CEO since 2009 – even during One51’s darkest days, he gritted his teeth & avoided what was perhaps the easy way out: Launching a large & massively dilutive equity raise, to pay down/normalise bank debt. Shareholders, new & old, should continue to appreciate this close shave…

And based on 2014’s free cash flow, disposals & share placing, One51’s now in the best shape ever: Equity’s increased by 55%, while net debt (exc. CLNs, which are now minimal) has been reduced to a mere EUR 7.4 million, with 114 million+ of banking facilities (inc. a new commitment from HSBC) now extended ’til Jan-2019. All of which was accompanied by increasing revenue, EBITDA & adjusted earnings.

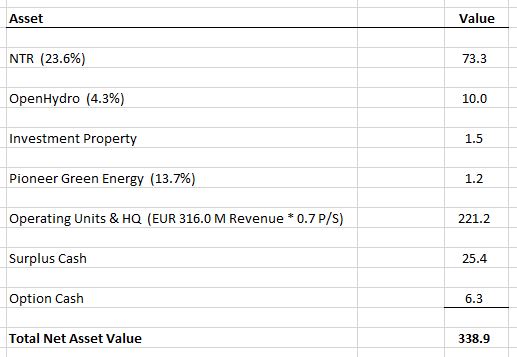

OK, it’s about time…a Sum-of-the-Parts analysis is the best approach to properly evaluating the key components underpinning One51’s intrinsic value:

[But before we do, here’s an in-depth interview with Walsh that presents an excellent summary of his strategy & progress to date.]

Investments:

– One51’s 23.6% stake in NTR plc is an obvious crown jewel – there’s no need to rehash the story here, as I documented it in detail last year & just recently (I recommend you read here & here). Alan Walsh is a director of NTR, so he’s well positioned & highly motivated to accelerate the timing & maximise the pricing of the proposed tender offer. And NTR’s latest announcement confirms receipt of a net USD 195 million from its recent wind farms sale – unfortunately, management has also (finally) confirmed this figure is gross of fees & minority interest (with 10% to remain in escrow ’til Nov-2016).

But logically, this presents no real issue, as NTR’s resulting cash on hand should still amount to at least EUR 198 million (inc. 47 million of existing balance sheet cash) – which is more than sufficient to fund the proposed tender offer in full. [That’s based on the assumption Tom Roche & management do not sell any shares in the tender].

Plugging a current 1.1006 EUR/USD rate into my most recent NTR model, and specifically tweaking for the highlighted deal fees & minority interest, I now arrive at a EUR 3.18 NAV per share for NTR (all else being equal). For One51’s 23.0 million NTR shares, a tender offer at that level would correspond to a potential (tax-free) payout in the near future of EUR 73 million.

[When added to the company’s existing cash, plus its undrawn banking facilities, this represents a substantial war chest. And management’s clearly been busy evaluating & lining up one or more acquisition targets, so we can be pretty sure they’re now planning to pull the trigger (esp. on the back of an NTR tender offer). This acquisition strategy may trump it, but there’s still also potential for a post-NTR distribution to One51’s shareholders. A tender offer would be logical, but might be considered problematic (vs. last year’s EUR 0.90 share issuance), so a return of capital is possibly a more viable option].

– A 4.3% stake in OpenHydro is carried on the books at EUR 2.1 million. This compares to the EUR 8.5 million received from DCNS (in 2013) for its acquisition of 46% of One51’s original stake. Based on OpenHydro’s subsequent newsflow & performance, and noting the lack of reason(s) cited for its subsequent write-down, I see little reason to depart from the prior valuation benchmark – which pegs the remaining stake’s value at EUR 10 million.

And if this valuation proves a little aggressive, it hopefully reflects (in aggregate) additional gains to be potentially harvested from the company’s Pioneer Green Energy stake, its residual interest in Island Renewable Energy, and/or other possible gains to come from further asset revaluations/sales. [Though it’s worth highlighting here: We’ve seen One51 record exceptional gains in the past 2 years (in the single-digit millions), but I see no evidence of any kind of systematic or pervasive manipulation of its current book values.]

– A 13.7% stake in Pioneer Green Energy is now held on the books for EUR 1.2 million. Noting Alan Walsh remains a director, and that One51 received EUR 3.8 million in distributions from Pioneer in the last year alone (p. 14 of the 2014 final results presentation), further gains wouldn’t be surprising. But with no further info. to reference, my increased OpenHydro valuation will serve as a catch-all for potential Pioneer gains.

– A residual book value of EUR 1.5 million for investment property looks pretty reasonable.

Operating Divisions (& HQ):

Let’s not fool ourselves – for obvious reasons, our valuation won’t rely on some pleasing and consistent revenue & earnings growth history. [And the divisional P&L history we can actually reference is pretty sparse anyway]. We therefore need to rely on more recent results, and a revenue & margin approach to valuation is appropriate. Consequently, One51’s 2014 Annual Report should be a close read, as it’s crucial to our analysis (esp. Note. 3, p. 57-59). Continuing ops. revenue growth was +10.2% at EUR 276.5 million, which delivered a pre-exceptional EBIT of 12.9 million – that’s a 4.7% EBIT margin (well ahead of the prior year’s 4.0% margin, after we exclude receipt of a 2.0 million business interruption claim). However, we need to allow for quite a few adjustments, if we hope to arrive at a set of figures more representative of the company’s underlying intrinsic value:

– We should exclude certain components of EBIT: i) a EUR 0.4 million JV profit (from Greenore Port, sold in 2014), ii) a 0.3 million discontinued ops. profit (from Irish Pride, also sold), and iii) 0.4 million of property rental income (see Note. 4). And noting the recent EUR 5.1 million HQ sale & leaseback, we’ll also deduct a EUR 0.3 million annual lease cost (assuming a 5% cap. rate). This actually pegs adjusted EBIT at EUR 11.7 million, a 4.2% margin.

– Straight plc was only acquired in Aug-2014. From Note. 17, we know only EUR 10.3 million of Straight’s annual revenue (of 26.1 million) was included in the 2014 P&L. Therefore, we can expect One51’s annual revenue run-rate to be higher at EUR 292 million, accompanied by a (0.6) million reduction in EBIT, which drags down our adjusted EBIT margin to 3.8% – here’s a summary table:

– Sterling’s actually appreciated 12% against the Euro in the past year, if we compare the current 0.7106 EUR/GBP rate to an average 0.8061 rate in 2014. That’s a huge tailwind for One51 in 2015, which reports its UK share of revenue at 60% (when you include Straight’s FY revenue). [And UK share of EBIT is even higher]. Adjusting accordingly, we now arrive at an expected EUR 316 million annual revenue run-rate – here’s another table:

– For simplicity, let’s assume One51 will continue to earn the same adjusted 3.8% EBIT margin – which may prove conservative, when you consider EBIT & the geographical mix of expense vs. revenue. [While we’re at it: a) I suspect the strength of the dollar & yuan will add (smaller) pluses and minuses to the P&L, while b) the lower oil price may add a second tailwind for OnePlastics in 2015, but larger customers & competitors will probably ensure much of this benefit gets passed along eventually]. But a 3.8% EBIT margin isn’t necessarily representative of One51’s underlying value, in terms of:

i) The cost savings & synergies we can expect from the integration of Straight. The current underlying OnePlastics margin (exc. Straight) is actually 10.0%, which looks pretty representative. While it may take 12-24 months to fully realise, I don’t believe I’m being overly aggressive in my valuation by assuming Straight’s profitability can & will steadily converge to the same 10% margin (from near-zero today). [And hopefully like-for-like/organic revenue growth of 11.6% pa for OnePlastics since 2012 will also provide some continued 2015 momentum.]

ii) The current average operating margin for ClearCircle Environmental is only 4.1% (obviously driven by its dominant unit, metals recycling). Since 2008, ClearCircle’s been hit by a reduction in waste volumes, volatile & declining benchmark metal prices (even iron ore pricing is relevant, as a raw material input for steel), and a decline in margins as market competition’s intensified. [NB: Falling metal prices aren’t necessarily a direct risk for metals recycling, as the business is structured to hedge/pass along market-based pricing. But falling & volatile prices can obviously discourage scrappage volumes & reduce overall revenues, which consequently hits margins.]

But clearly this margin isn’t very representative of what the division/units would hope to earn on average (or on a peak basis) across the economic cycle. We also know the units have been comprehensively restructured over the past few years & now appear to be well capable of withstanding further challenges, if necessary – conversely, we also know they’re potentially far more leveraged now to economic growth and recovery (in the UK & Ireland). [Metals recycling is notably correlated to the level of construction activity, but there’s typically a time lag from construction commencing ’til waste enters the recycling chain]. All of which suggests more normalised margins (for each unit) are appropriate for valuation purposes.

Let’s revisit the 2008 Annual Report (p. 19) – we see Environmental Services (which included both ClearCircle & OnePlastics at the time) actually earned an 11.2% EBIT margin on EUR 365 million of revenue. Not surprisingly, it did even better in 2007, earning 13.4% on EUR 161 million of revenue…in fact, the margin may have been as high as 17.6% (pre vs. post-exceptional?). Let’s just average ’em out, to arrive at a 15.5% peak margin.

Now, we’ve obviously no real idea when such a margin might be reached again, if ever…

But it seems perfectly reasonable to expect some intermediate margin can & will be attained in due course. [Or a larger competitor (or private equity fund) might just recognise & pay up for that inherent value potential…you can be sure they’d quickly eliminate HQ costs, and capture significant employee & purchasing savings]. Therefore, for each ClearCircle unit, a sensible approach is to go ahead & split the difference between its current unit margin & this 15.5% divisional peak margin – with OnePlastics at 10.0%, and allowing for HQ costs & adjustments, that would imply an overall & much-improved 7.9% adjusted EBIT margin. Here’s a table:

I believe this margin’s far more representative of actual operating capacity & value, when it comes to assessing One51’s underlying intrinsic value. And just in case you think I’m simply cherry-picking numbers out of thin air here, it’s important to note the company actually generated operating free cash flow (i.e. operating cash flow, less net capex) of EUR 42 million in the past two years – that’s an average 8.0% Op FCF margin! Now, you might argue this margin’s somewhat flattered by PP&E sales & improved working capital management, but so what – as they say, cash is cash & cash is king – it’s clearly a resounding endorsement of my adjusted 7.9% EBIT margin. And per my usual valuation metric, that margin’s definitely worth a 0.7 Price/Sales multiple for the operating divisions (inc. HQ):

EUR 316.0 million Revenue * 0.7 P/S = EUR 221.2 million

As usual, this valuation incorporates all related balance sheet assets/liabilities (except investments & surplus cash), and it specifically includes a sustainable level of debt. [It’s also worth highlighting here: One51 doesn’t have any other material pension, deferred consideration, provisions, or other legacy liabilities.]

[NB: One51 did announce the post year-end sale of Thormac Engineering, one of its Irish plastics units – though judging by the EUR 0.2 million of net assets held for sale, I think we can presume a fairly immaterial impact in terms of revenue/value.]

Surplus Cash:

Despite single-digit year-end net debt, 2014 finance cost was actually EUR 3.9 million due to One51’s gross cash & debt positions. [Oddly, cash flow finance cost was EUR 7.2 million…though a yoy change in the language employed in the notes suggests amortisation vs. (once-off?) payment of specific finance costs might be an explanation (maybe related to One51’s re-financing last year?). 2013 cash vs. P&L finance cost also suggest some potential timing differences]. But noting an average 3.57% debt cost at year-end (which makes sense), deriving a new run-rate from the 2014 P&L finance cost certainly seems reasonable. Noting year-end bank debt of EUR 65 million & elimination of most outstanding CLNs/interest, I’d estimate what I think is a pretty conservative EUR 3.3 million finance cost for 2015 – and I’m ignoring any prospect of 2015 free cash flow & debt pay-down, so there’s plenty of wiggle room here.

Working with a EUR 316 million revenue run-rate & an actual (current) operating margin of 3.8%, we get to a 12.0 million EBIT. That pegs estimated finance cost at 27% of EBIT – which I wouldn’t necessarily consider sustainable. But One51 has plenty of cash on hand now: So if we choose to allocate just over half this cash (EUR 34 million) to debt reduction, One 51’s debt burden & finance costs would reach a sustainable 15% of EBIT. Which would also leave EUR 25 million of surplus cash to be included in my SOTP analysis.

Option Exercise Cash:

Below, I conservatively assume all outstanding options will be vested/exercised – accordingly, One51 can expect to receive EUR 6.3 million of cash as holders exercise these options.

Outstanding Shares:

Currently, there are 157.0 million One51 shares outstanding, offset by 0.4 million of treasury shares. In addition, there are 10.3 million options outstanding (see Note. 31). Judging by the volume of options & the low strike prices (EUR 0.20 & EUR 0.90), it’s prudent to assume all options will be ultimately exercised (accordingly, we’ll also include the benefit of option exercise cash received). That puts total net (diluted) shares outstanding at 166.9 million.

[Outstanding options may seem generous here (in terms of amounts & strikes), but I’m delighted to see this incentive in place – after years of hunkering down & fighting from the trenches, a generous option package may be the best & only way to reset management’s mindset to a more offensive strategy. And the strikes simply reflect the prior collapse in the share price. Nonetheless, future option awards bear monitoring, and it would be encouraging to see senior management step up & increase the value of their direct/indirect shareholdings (in relation to their annual compensation).]

OK, let’s now piece this all together in a single SOTP analysis:

A EUR 2.03 Fair Value per share now offers investors Upside Potential of 45%. Maybe that seems a little tame compared to some of my other investment write-ups, but it’s important to remember intrinsic value upside (at a particular point in time) may ultimately prove to be only a relatively small component of one’s overall medium/long term investment return. By which I mean: A company/stock’s ability to compound is almost inevitably more important than how cheap it might be temporarily. Of course, that’s not intended to be an invitation to pay for growth at any price…but here we have a share price vs. an intrinsic value that offers 45% upside potential, and also a decent margin of safety.

One51 has essentially eliminated its (net) debt burden, it has a OnePlastics division that’s marching along nicely, and its ClearCircle division is pro-cyclical & perfectly placed to now benefit from continued growth in the UK & an accelerating Irish recovery. Its stake in NTR is poised to deliver a substantial value/liquidity event. It’s also actively assessing other possible acquisition opportunities, and now has significant fire-power in terms of cash & undrawn debt facilities. And it has a 38 year old CEO who’s already made his bones as a turnaround guy, and wants & needs to prove he can now deliver a compelling organic & acquisition growth story…while also reassuring shareholders he’ll avoid the potential horrors of a debt-fueled spendthrift acquisition strategy.

One51’s also overhauled its structure, pushing operating functions down to its business divisions, and reducing central headcount & costs – promoting a more performance-based culture throughout the company, and a more dispassionate perspective towards potential future divisional investments & divestments.

Management has also committed to a significant liquidity/value event for shareholders by 2016 – ideally, this will be an IPO. [One51 may first need to exit its stake in NTR, but otherwise it looks ready to me – the balance sheet’s clean, it’s transitioned to IFRS & KPMG’s been the auditor for years now, share capital’s been re-organised to permit dividends (& even share buy-backs), and Hugh McCutcheon (ex-Davy Head of Corp. Finance) is a useful director to have on board. Since liquidity’s perhaps the first priority here, a reverse takeover of an existing listed company might also be a possibility]. Finally, we can be reassured by some of the names we see on the share register – a number of Irish co-ops & food companies (14.4%+), Pageant Holdings (8.0%), Larry Goodman (Vevan, who appears to have increased his stake to 4.4%), and maybe even Dermot Desmond (rumoured to have bought a 4.7% stake from Co-Operative Group last November…except there’s no sign of him on the register in the 2014 annual report), will obviously be actively pushing for a liquidity/value event to occur as soon as possible.

And looking ahead, judging by their respective (prior) growth histories & the current inflection point we’ve now reached in the UK/Irish economies, both of One51’s divisions could enjoy a steady progression in terms of increasing revenues & expanding margins over the next few years – while a measured acquisition strategy would obviously add another powerful growth tailwind. Based on these potential drivers, it isn’t difficult to foresee an easy/medium term double for One51 shareholders…who can otherwise remain comfortable owning what’s now a financially stable company with a decent margin of safety & upside potential, coupled with some likely near term positive sentiment drivers (an NTR tender offer & a possible IPO).

I currently have a 6.7% portfolio allocation to One Fifty One plc.

- Share Price: EUR 1.40

- Market Cap: EUR 220 M

- Price/Sales: 0.4 (exc. est. value of investments & surplus cash)

- Tgt P/S: 0.7 (exc. est. value of investments & surplus/option cash)

- Tgt Mkt Cap: EUR 339 M

- Tgt Fair Value: EUR 2.03 per share

- Upside Potential: 45%

23-Aug-2015:

Have also now eliminated my entire One51 plc stake, which had become an 8.0% portfolio holding at this point…

Here’s my original One51 plc investment write-up from May, at €1.40 per share: https://wexboy.wordpress.com/2015/05/25/one-fifty-one-no-its-worth-far-more/ …

At today’s €1.85 price per share, One51 is steadily closing in on my recent Fair Value estimate per share

That was a €2.03 Fair Value per One51 share: https://wexboy.wordpress.com/2015/05/25/one-fifty-one-no-its-worth-far-more/ … Which still looks about right to me, at this point in time…

So this sale of my One51 stake is a nice opportunity to realise a 32% gain on my holding in just three months…

And this sale of my One51 holding will also increase my dry powder substantially – nt a bad result at all in the current market environment…

One51’s now leaving value territory & moving into growth territory…bt I’ve no reason to doubt new One51 growth story I recently painted

Bt One51 shr price near my recent FV est., I cn realise attractive gains & dry powder may be v useful for other opps in this mkt environment

Pingback: Smokin’ the S&P…H1-2015 Wexboy Portfolio Performance! | Wexboy

Pingback: Weekly market round-up: 25 May 2015 | Dustin's Blog