Tags

activist investors, Alan Walsh, grey market share, National Toll Roads, Nick Furlong, NTR plc, One Fifty One plc, Pageant Holdings, Rosheen McGuckian, Tom Roche, Wind Capital Group, wind energy, Yieldcos

NTR is a strange beast, neither fish nor fowl. Of course, regular readers will recognise that tends to intrigue me – the best opportunities often arise from misunderstanding & neglect. And NTR’s balance sheet intrigues me even more… But whoa Nellie, we’re getting ahead of ourselves here! Let’s back up:

We should begin with the Roche family dynasty – here’s a good potted history. Tom Roche Senior founded National Toll Roads – its first venture, the East-Link toll bridge, opened in 1984. The company slowly expanded, completing the West-Link bridge in 1990 & adding a second span in 2003. With the advent of the Celtic Tiger in the late ’90s & the completion of the M50, traffic volumes & revenues exploded, and the company became a goldmine. The government, in its wisdom, then decided to buy the West-Link in mid-2007 – just ahead of the credit crisis! NTR subsequently monetised the NRA’s index-linked payments of EUR 50 million pa (from Aug-2008 to Mar-2020) for an up-front consideration of EUR 0.5 billion. This was a great deal (followed shortly thereafter by an even larger sale of its Airtricity stake), but unfortunately the company was also in full Celtic Tiger mode at this point. With Tom Roche Junior taking the helm after his father passed away in 1999, NTR had ambitiously transformed itself into a developer & operator in renewable energy (solar, wind & corn-based ethanol) and sustainable waste management – in Ireland, the UK & across the US.

By Mar-2007, in just 3 years, the balance sheet more than quintupled to EUR 2.0 billion (funded by 1.5 billion of total liabilities)! Accompanied by a share price which managed much the same feat – I specifically recall the brokers hailing NTR as a new Irish blue chip to every last punter with a pulse & a wallet. [When I mention the company’s listing ‘status’, you’ll realise this pitch was even more dangerous than it sounds…] But investors eventually started getting cold feet – the shares peaked at EUR 7.00 in Jan-2007, well ahead of the crisis. Because of the West-Link & Airtricity sales, the company was sitting on a large cash pile as it entered 2008 – but it was also burning close to EUR 0.7 billion pa of free cash flow at the time. And despite the financial crisis, the spending never stopped… In Apr-2008, management actually embarked on a brand new investment folly (solar energy) with an initial USD 100 million deal to purchase a controlling interest in Stirling Energy Systems. Well, you know what came next…

I’ll spare you most of the blood & guts, let me just highlight total equity (exc. NCI) bottomed this year at EUR 117 million, down nearly 90% from a Mar-2008 peak of EUR 1.1 billion. [NTR’s real annus horribilis came in FY-2011, with a loss of EUR 381 million – one of the largest non-banking losses in Irish corporate history]. And the share price suffered even more horribly – reaching a EUR 0.25 low in Aug-2012, down 96% from its peak:

Clearly, investors believed the company was on its death bed at that point…but hey, it survived! Why don’t we celebrate by taking a closer look & seeing what NTR might be worth today? Now, first, did I mention: i) NTR’s an Irish grey market share? And ii) it’s rallied over 500% since its 2012 low?!

[NB: Grey market shares are unlisted, but can be traded via a company’s brokers. For overseas readers, they’re akin to unlisted UK shares which trade via a matched bargain service (such as JP Jenkins). Or US OTC/Pink Sheet stocks, but without the benefit necessarily of market-makers. I don’t know of a reason why overseas investors can’t trade/hold grey market shares, though presumably a full-service broker would be required for submitting bids (& offers) into Davy Stockbrokers, Goodbody Stockbrokers, or Investec.]

Dear reader, I really do try my best to test you, eh..!?

But NTR’s slimmed down radically – now, its entire net worth is essentially invested in Wind Capital Group, which owns & operates two US wind farms (351 MW of total capacity, with 20 year investment grade PPAs in place). It has no holding company debt, and all project financing’s at a subsidiary level & on a non-recourse basis. Last November, the company returned EUR 100 million to shareholders via a (value-enhancing) share redemption. NTR also returned to profit (EUR 31 million) for the first time since 2008 & even turned free cash flow positive (in the latter half of FY-2014). There’s also some important events & catalyst(s) to focus on here… And arguably, the share price remains attractive – despite the rally, it’s still down almost 80% from its peak & trading near decade-old price levels:

But first, let’s focus on NTR’s intrinsic value per share. Its wind farms are just 2.7 years old (on average), and wind turbines generally have an estimated 25 year+ life. Couple this with wind project financing which depends on debt amortisation & back-ended returns for the ultimate equity owners, and it means we can’t rely on current return on equity (or P&L/cash flow run-rates) to accurately determine fair value. We shall focus on a Balance Sheet/SoTP analysis instead.

But every time I take a closer look at the balance sheet, it’s a bloody challenge… For example, the value of operating wind farm plant & equipment is recorded at EUR 415 million (USD 549 million), but deal multiples clearly indicate 351 MW of operating wind farm capacity’s worth significantly more!? Then again, so many companies have suffered seemingly endless write-downs since 2008, all too often they’ve ended up throwing the baby out with the bath-water when it comes to valuing assets…

However, it’s more unusual to see this conservatism also pervading balance sheet liabilities: We see a EUR 68 million deferred income liability (arising from a US Treasury grant for its Lost Creek wind farm), despite the fact: i) the cash was already received in 2010, ii) there’s only a remote chance the grant might ever become repayable, and iii) this repayment risk’s extinguished in 2015! And in the past 2 years, despite other continuing write-downs & losses, the P&L included an astounding EUR 65 million+ in gains from legal claims, asset sales, contingent consideration & the release of prior accruals/provisions!? [Plus an additional EUR 22 million gain from the de-recognition of Greenstar Ireland’s net liabilities, after it went into receivership]. I could go on…

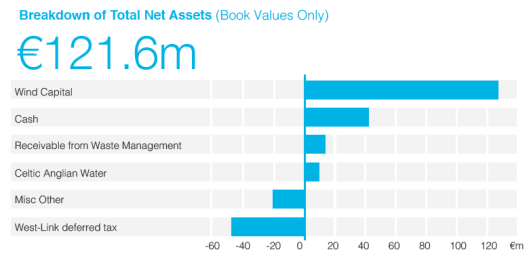

Obviously, I’m not suggesting NTR’s accounts are incorrect. Recorded asset values often don’t match market values at a given point in time, for a variety of reasons. And it’s quite normal to amortise up-front income/expense over the life of a (related) asset. But as Marty Whitman (& his books) always lecture us, financial statements can never really hope to consistently reflect economic reality anyway. Why don’t we just defer to NTR’s CFO, Marie Joyce – she provides a useful breakdown of the company’s total net assets:

But then she warns us: ‘The chart…provides a snapshot view of the components of our total net assets. It should be noted that it is based on book values only and does not represent the strategic value of the assets or what might be achieved were a market based valuation completed’.

However, this 2012 article also provides an interesting perspective: ‘Reading between the lines of the NTR annual report, it would appear that the aggressive Greenstar [NTR’s Irish waste management business] writedowns were at least in part a game of high-stakes poker’ as NTR was ‘attempting to buy the loans from the banks at a discount’. Pre-crisis, this strategy was basically unheard of in Ireland, but now the media’s full of stories about developers cutting such deals. And in 2013, we learned Woodford Capital had outstanding loans with IBRC. [Woodford’s a family vehicle of the Chairman, Tom Roche – it owns, via Dreamport, a 37.8% stake in NTR. Tom & Conor Roche (his son, who joined the board in Dec-2013) also personally own another 1.9% of the company]. Should we assume the same game was being played out here, before and/or after Lone Star acquired the loans from IBRC? As any good poker player knows, it’s often best to underplay a strong hand if you want to extract maximum value…

And perhaps it throws a different light on the EUR 100 million share redemption last November. Obviously, all shareholders benefited equally – but we can be sure the EUR 40 million received by Roche & family must have been a welcome bonus at the time! But in the end, reports of these debt dramas mean little in relation to my valuation approach – I’d prefer to construct my own balance sheet valuations anyway. But they obviously provide useful context and perspective for current & potential investors to consider, when evaluating NTR’s management & business.

OK, let’s focus on the recently published annual report (FY ending Mar-2014). Not surprisingly, I can envisage a spectrum of adjusted valuations here, so we’ll define this range by lining up the current balance sheet against two separate adjusted balance sheet scenarios – let’s call them Scenario I (Conservative) & Scenario II (Aggressive). Apologies, there’s no easy way to do this – I’m going to work my way down through each line item & then include some useful tables below (you may want to print them out first):

[NB: Assume a 1.3769 EUR/USD rate for Mar-2014 balance sheet & a 1.3242 rate today. For NPV purposes, I’ve used a (fairly arbitrary) 6% discount rate. Note I’ll only comment on balance sheet items (& Scenarios) where my value adjustment(s) exceed EUR 5 million. Feel free to email me with questions.]

Property, Plant & Equipment

Scenario I: PP&E includes €14 million (M) of other assets. Wind farm capacity of 351 MW, at a total project cost of $715 M, is equiv. to $2.0 M per MW – which compares favourably with a capacity-weighted US average installed project cost of nearly $2.1 M per MW. Allowing for 3.33% pa straight-line depreciation & a 2.7 year average operating life to date, the current replacement cost is $651 M. €14 M + $651 M = €506 M

Scenario II: Relying on market value instead of replacement cost, US deal multiples have ranged between $2.0-2.6 M per MW in the past couple of years. [For example, note this recent NRG Yield (NYLD:US) $2.5 billion acquisition for 947 MW of operating capacity (the largest wind farm in North America)]. Using the upper end of this range, NTR’s 351 MW wind farm assets are now worth up to $915 M. €14 M + $915 M = €706 M

[NB: REIT/MLP/Yieldco EBITDA multiples generally trade in a 10-14 times range in the current environment. Based on NTR’s current wind EBITDA of €49 M, the implied multiple range of €494-691 M is closely correlated with the figures above.]

Goodwill

Scenarios I & II: Zero.

Joint Ventures

Scenario I: NTR’s stake in Celtic Anglian Water, where share of net profit has improved from a loss to €1.7 M to €2.2 M (and €4.1 M of dividends were received) in the past 3 years. A 12 P/E is conservative. €2.2 M * 12 = €27 M

Scenario II: Considering the current growth trajectory in net profits, a 20 P/E is not excessive. €2.2 M * 20 = €44 M

Trade & Other Receivables

Scenario II: €7 M of other receivables. $20 M of guaranteed deferred consideration in 2016 from sale of Greenstar Recycling to Waste Management & an assumed 75% of an additional $20 M deferred consideration in 2018 – apply NPV. Further $20 M receivable from US FERC re transmission upgrades – no clarity re NPV. €7 M + $20 M * 89% + $15 M * 79% + $20 M = €45 M

Deferred Tax Assets

Scenario II: Deferred tax assets (with expiration dates of up to 20 years) of $36 M have not been recognised in respect of US losses, due to uncertainty regarding their utilisation. With careful tax planning, there may be potential for utilisation or monetisation of an assumed 50% of these assets – no clarity re NPV. $36 M * 50% = €14 M

Assets Held For Sale

Scenarios I & II: Note the net €41 M of assets & liabilities held for sale appears broadly equivalent to the announced $60 M Osage deal price (on a PV basis).

Loans & Borrowings

Scenarios I & II: Change in FX rate. $380 M = €287 M

Deferred Income

Scenarios I & II: Risk this grant liability will ever be crystallised/repayable is remote, and legal liability will be extinguished in 2015 anyway. Zero.

Provisions

Scenario II: Noting the substantial release of prior accruals/provisions in the past couple of years, assume this remaining provision will be reversed, or offset elsewhere. Zero.

Derivatives

Scenarios I & II: Property companies will generally exclude net derivative assets/liabilities from their NNNAV calculations – there are sensible arguments for/against this approach & I think they apply here also. My normal practice is to include 50% of this net liability. $17 M * 50% = €7 M

Deferred Tax Liabilities

Scenario I: Unchanged €9 M offsetting deferred tax asset. $83 M US deferred tax liability re wind assets – no clarity re NPV. €6 M annual tax liability on €50 M annual West-Link payments from NRA (’til 2020), equates to €38 M liability – subject to an average 3 year NPV. $83 M + €38 M * 84% – €9 M = €85 M

Scenario II: With careful tax planning, there may be potential for a 50% reduction in $83 M US deferred tax liability re wind assets – no clarity re NPV. We’ll also assume a 50% reduction in €9 M offsetting deferred tax asset. In light of minimal cash tax payments/refunds in the last few years, and further tax planning, there may also be potential for a 50% reduction in €38 M liability re West-Link payments from NRA (’til 2020) – subject to an average 3 year NPV. $83 M * 50% + €38 M * 84% * 50% – €9 M * 50% = €43 M

Non-Controlling Interests

Scenario I: 3.5% of Wind Capital Group’s estimated adjusted net assets are owned by external investors. $287 M * 3.5% = €8 M

Scenario II: 3.5% of Wind Capital Group’s estimated adjusted net assets are owned by external investors. $593 M * 3.5% = €15 M

[NB: I’ve conservatively assumed 98.6 million shares outstanding, which inc. about 1 million employee shares which are currently restricted (for tax purposes). I haven’t included any estimate for FY-2015 profit, or any adjustments to the value of some of NTR’s other legacy assets – like its stakes in Highview Power Storage, the CRG toll road concessions, the Blackrock NTR renewable power investment platform, etc. Since book values for these legacy assets would appear to be negligible, they may offer some future optionality.]

And wow…just to remind you, the NTR share price last traded at EUR 1.57!?

Of course, we must acknowledge the gap between a company’s share price and its intrinsic value can sometimes be a long & difficult journey… But in terms of a key event/catalyst, this Sunday Times story (from March) is critical: ‘Tom Roche, the largest shareholder in NTR, has wrested back control of his 38% stake in the investment firm after a receiver was appointed to the company that holds the stock…It is understood Roche had been seeking a substantial discount on the borrowings guaranteed by shares in NTR...Roche, who is the chairman of NTR, won a last-minute reprieve by writing a cheque for the full amount of the loans last Monday’.

A bizarre story indeed, but it wraps up the last of NTR’s debt ‘issues’…and we’re already seeing better market sentiment, and a renewed investor relations effort & much-improved results from the company ever since. NTR delivered its first net profit since 2008, it also indicated continued profitability for the current year, the share price is trading near a 4 year high, the construction-phase 150 MW Osage wind project was sold for USD 60 million post year-end, the annual report was accompanied by a new Shareholders Communications Policy & a useful Explanatory Guide, while Rosheen McGuckian (the CEO) has been out courting the press & talking about NTR’s new expansion plans.

More importantly, my favourite catalyst is also present: Activist investors!

Pageant Holdings should be familiar to readers – in May, I highlighted some of their disclosed holdings, which clearly demonstrate ‘a keen eye for value’. But their 29% stake & involvement with Zamano (ZMNO:ID) also highlights they’re prepared to be far more than a passive value investor, if necessary. As of last month, their stake in NTR has steadily increased to 9.1% (from 7.0% a year ago), and it’s now their largest publicly disclosed holding with a value of EUR 14 million. Pageant ‘recently indicated it was in favour of NTR selling its valuable wind asset in America, Wind Capital Group, effectively meaning a break up of the group’. And back in March, Nick Furlong confirmed he was an ‘avid’ buyer & also ‘said the NTR stock was worth more than EUR 3.00’. Knowing Furlong’s only quoted in the press once or twice a year at most, I certainly wouldn’t treat this as merely some off-the-cuff remark… Of course, it’s also nice confirmation of my own fair value estimate(s)!

But we’re spoiled for choice here…

One Fifty One plc (One51 – incidentally, another Irish grey market share) is a much larger shareholder. This is an investment Alan Walsh inherited when he became One51 CEO in 2011, and he’s been an NTR board member since Jun-2012. CNBC may focus on Ackman & Icahn, but corporate CEOs are the unsung heroes of activist investing. Activism isn’t a portfolio decision for them, it’s a key one-time event to maximise & extract value. And inevitably, they’re on the board – so they know the players & the history, they know where the bodies are buried, and they know the right levers to pull. Most of all, they have a burning desire to extract cash & re-invest in their own business. So forget Icahn – a corporate CEO seeking to realise a substantial stake in another company is far more relentless..!

One51 has a 23.3% stake in NTR, which is currently worth EUR 36 million (30% of its own EUR 119 million market cap). [At the mid-point of my adjusted NAV range (above), the stake could be worth almost 80% of One51’s current market cap!] The language in its latest annual report is suitably bland: ‘One51 will focus its future development on its Plastics and Environmental Services businesses while continuing to manage its investments [inc. NTR] for maximum value’. Fortunately, we can find a better scoop. Walsh recently told the Irish Times: ‘Ultimately we have no control over NTR, and it’s a big chunk of the value. We need to get to two divisions first. Then we could certainly go there [a flotation]’. And he was more blunt with the Indo:

‘We want to get out. It’s not core for us…’

Meanwhile, One51 just completed the acquisition of Straight plc (STT:LN), and is now proposing a new private fund-raising, which certainly confirms they see plenty of expansion potential in their existing core businesses. Oh, and I shouldn’t forget, Pageant also has a 7.9% stake in One51 (this article suggests they’ve now reached 12%)! Which means I’m quite happy making a colossal mental leap here & presuming they’re both pretty closely aligned regarding NTR…in spirit, if not in deed.

But first, NTR has to arrive at a decision to sell its US wind assets. The annual report’s no help – management’s clearly unenthusiastic about new US wind projects, but remains strangely silent about potentially realising value from its existing Lost Creek & Post Rock wind farms. Ultimately, I think it’s going to be an unavoidable decision to consider. Because once a wind farm’s up & running, there’s precious little you can do to enhance its value. All you need is a redneck, his tools & a pick-up truck, plus a very long ladder…so he can check everything’s running smoothly. He can mow the grass, plant some flowers, paint the Stars & Stripes on every turbine, it makes no difference. You can buy a tanker of WD-40 & tell him to go hog wild, you can even try persuade him to spend all that spare time doing an MBA, it still makes no difference..!

But this is a good thing – that kind of dependability is an obvious reason why wind farms are so attractive to income investors. They produce predictable long-term revenues (from 20 year PPAs), with minimal capex & operating expense – after debt interest & amortisation (and the debt can be re-financed in due course), investors can enjoy increasing cash flows & dividends for decades to come. And these days, US investors are totally ravenous for yield, which explains the huge boom in US REITs, MLPs & now Yieldcos, and the escalating prices/multiples they’ve been willing to pay for long-term assets & infrastructure.

And really, what’s the alternative here?! Ask shareholders to hang on for the next 20-30 years, while value is harvested in small annual increments? And hope an unlisted Irish company, which owns US wind farm assets – a strange beast, indeed – will suddenly revalue & achieve the kind of valuation we might expect up-front from an open-market auction? When we’re surely near the end of a decades-long bond bull market (2.38% on 10 year USTs & 0.98% on Bunds)!? NTR now has a golden opportunity to realise a premium valuation from a successful investment…and considering its fiduciary duty to shareholders, I suspect the board will ultimately arrive at the same conclusion.

But then there’s another decision for the board to make – to distribute or re-invest the proceeds? But that presents the same issues… To explain: Essentially, these wind assets now represent NTR’s net worth – so if they were realised, I’d hope to see NTR’s market cap gravitate to the value of its resulting cash pile. But if cash ends up being re-deployed into a new long-term European wind strategy, as management’s now proposing, could we expect asset values to be correctly reflected in an unlisted Irish company’s market cap? Or would shareholders just end up trapped in a neglected & under-valued company? [And look at deficits, debt & future entitlements across Europe (or the US) – is management so confident governments will be in a position to continue providing the necessary subsidisation of wind farm projects? I’m not so sure I’d make that bet…] In the current environment, a UK/Irish market listing might achieve an incremental uplift in valuation, but it still wouldn’t solve the basic problem – the natural home, and the highest valuation, for NTR’s wind assets is in a (US-listed) income-oriented fund (or a private equity/pension fund).

[And logically, the company’s Celtic Anglian Water stake should be sold too – it’s a nice asset, but it’s unlikely to ever reach its full potential within NTR. Combine the net proceeds with NTR’s significant cash & receivables (to be collected), and that’s another substantial distribution for shareholders. That would leave a mere rump of a company – unfortunately, NTR’s central costs would then represent an excessive burden. Obviously much of the cost is management compensation (FY-2014 directors’ emoluments amounted to a whopping EUR 4.1 million!), so it would probably make more sense at that point for management to step up & buy out external shareholders. Which would offer them a perfect opportunity to finally get the structure right…for example, to be the sponsor & manager of a listed wind/renewable energy fund. Of course, the previously announced strategic relationship with Blackrock (where Jim Barry, ex-CEO of NTR, heads up the renewable power group) might also offer interesting opportunities.]

One51 is clearly seeking this type of outcome – for them, realising the value of NTR’s assets is a stepping stone to extracting the cash. This cash also represents the most obvious & best exit ultimately for Pageant Holdings from its NTR investment. But their current shareholdings, in aggregate, are still pipped by Tom Roche’s overall stake – so we have to ask whether he’d support, or oppose, a realisation strategy? [Again, this article would appear to suggest things will come to a head, one way or the other]. Quite honestly, a more relevant question would be to ask whether shareholders really have the stomach for taking this roller-coaster ride all over again? Especially all those who are still nursing substantial losses…

Because ever since the original success of National Toll Roads, management’s investment record has been decidedly mixed. [The company’s solar adventure only lasted 3 years, but managed to clock up a scorching USD 0.5 billion of total losses & impairments!? While over the last 5 years, the waste management businesses wasted something like EUR 0.2-0.3 billion, if you’d like to go blind attempting to reconcile all the impairments & disposal/operating losses. Not forgetting the biodiesel business, which belched out another EUR 80 million write-down]. While Rosheen McGuckian & Marie Joyce are new to their positions (both were appointed in 2013 – that’s like 3 CEOs & 3 CFOs in less than 3 years!?), we should note McGuckian (the ‘not wannabe CEO’) was formerly chief executive of solar development & Greenstar Ireland, while Joyce was formerly CFO of solar. Given a choice between cold hard cash, or a brand new long-term bet on management, what do you reckon the majority of other/smaller shareholders would vote for?! Of course, NTR’s previous share redemptions also set an obvious precedent…

Ultimately, I try to buy the business, not the stock – my last post covers this exact ground. NTR has no debt (at the holding company level), there’s plenty of publicly reported transactions to quickly & independently benchmark the value of its wind farm assets, and I believe we’re in an exceptional environment to achieve a quick sale of those assets. Best of all, shareholders can leave all the heavy lifting to Pageant Holdings, and particularly to One51 – in terms of their activism & its potential results. All of which offers a free option & a good night’s sleep!

[And knowing the One51 CEO’s sitting in NTR’s boardroom offers reassurance the best deal(s) get done & value’s maximised. It’s worth highlighting NTR sold substantially all of its Green Plains Inc. (GPRE:US) stake for USD 100 million in 2011 & early 2012, to fund an increased stake in Wind Capital Group…those shares would have been worth almost USD 500 million today! This lawsuit regarding the sale of Greenstar Recycling is also worth noting.]

In my opinion, Scenarios I & II (above) mark out a realistic range of underlying intrinsic values for NTR. [If you prefer to focus/rely on book value, the shares are now trading at a 33% premium – not excessive for a profitable company, presuming you agree the balance sheet’s conservative]. Assuming a potential revaluation and/or realisation anywhere within this range would obviously offer very decent upside. Personally, I’m happy to rely on the average of my Scenarios as a good indicator of NTR’s underlying intrinsic value – that’s a EUR 4.08 Fair Value per share, which offers an Upside Potential of 160%.

[This is a good place to remind readers again of the risks of investing in unlisted companies. If you’re uncomfortable with small/illiquid stocks, and have never dreamed of buying an unlisted stock, this is probably not the place to start… On the other hand, if you buy small stocks & can still sleep soundly, it’s worth highlighting NTR isn’t so small – in dollar terms, the balance sheet’s over USD 800 million & the market cap exceeds USD 200 million!]

I currently have a 6.8% portfolio allocation to NTR plc. The forthcoming AGM is being held at the Conrad (in Dublin), on September 4th – it will be interesting to see if there’s any fireworks at the meeting. If you’re already a shareholder, why not come along & create some fireworks of your own..?!

- Tgt Price/Book: 3.4 (based on Mar-2014 Total Equity)

- Tgt Market Cap: EUR 403 M

- Tgt Fair Value: EUR 4.08

- Upside Potential: 160%

Pingback: Wexboy Portfolio – FY-2014 Performance | Wexboy

Pingback: The Great Irish Share Valuation Project – 2014 Portfolio Performance (Part II) | Wexboy

Pingback: The Great Irish Share Valuation Project – 2014 Portfolio Performance | Wexboy

Pingback: The Obligatory Top Tips For 2015! | Wexboy

31-Dec-2014:

NTR plc share price jumped 43% (frm EUR 1.57 to 2.25) after my Aug write-up: https://wexboy.wordpress.com/2014/08/24/ntr-plc-wind-of-change/ …

NTR peaked at EUR 2.60 in Sep & has subsequently retraced 19% to EUR 2.10 today…

Amazing hw impatient investors are…avg investment time horizon nw seems to be abt 3-4 mths!?

Since my Aug write-up, NTR board has confirmed i) US wind farms will be sold, ii) sale proceeds will fund a tender offer, +

+ iii) sale process was launched (w/ Marathon Capital), and iv) a decent set of interim results…yet NTR shrs hv retraced 19% since Sep!?

I have increased my NTR plc stake frm 9.3% to 9.9% – my second largest portfolio holding: https://wexboy.wordpress.com/2014/08/24/ntr-plc-wind-of-change/ …

Usually dn’t add shrs whn a single co holding exceeds 7.5%, bt I nw consider NTR an event-driven/activist investment w/ imminent asset sales

btw The valuation range frm my NTR write-up was EUR 2.68-5.49, fr an avg price target of EUR 4.08: https://wexboy.wordpress.com/2014/08/24/ntr-plc-wind-of-change/ …

At today’s EUR/$ FX rate (& all other things being equal) tht valuation range wd nw be EUR 2.93-5.97, fr an avg NTR price target of EUR 4.45

NTR: Tht’s an upside potential of anything frm 40% to 112% to 184%…which 2 activist shrhldrs, who own abt 33%, wnt to see realised in 2015

Pingback: TGISVP – One Last Yr-End Snapshot | Wexboy

Pingback: TGISVP – An Updated Snapshot | Wexboy

NTR plc: Stronger dollar’s a nice tail-wind – nw increases my valuation range to EUR 2.79-EUR 5.70, and my Fair Value to EUR 4.25 per share

NTRplc: http://www.ntrplc.com/News/Press-Article/ntr-plc-statement-regarding-shareholder-agreement/ Agreement finalised between Woodford, One51 & Pageant re proposed sale of US windfarms & subsequent tender offer

03-Sep-14:

Packed NTR AGM on Thurs, I hear!? Shrhldrs wd be smart 2 bring attendance card, plus ID & ideally proof of shrs owned http://www.ntrplc.com/uploads/documents/shareholder_services/Form_of_Proxy_2014.pdf …

Follow-up articles on NTR from the IT/Indo: http://www.irishtimes.com/business/sectors/energy-and-resources/ntr-board-aware-of-shareholder-restructure-plan-1.1912279 http://www.independent.ie/business/irish/roche-proposes-30m-share-payout-after-ntr-wind-sale-30548131.html

While the ST carries a more pointed attack on NTR’s corp governance http://www.thesundaytimes.co.uk/sto/news/ireland/Business/article1452995.ece And SBP has an in-depth article if you hv access

And we all love those Indo ‘who’s on the share register’ articles, so…Who Got Hosed at NTR: http://www.independent.ie/business/irish/nick-webb-irelands-great-and-good-get-hosed-at-ntr-30548141.html

01-Sep-14:

Noting previous press quotes/articles I highlighted, new Indo & Irish Times articles last week abt NTR didn’t come as a huge surprise…

Bt word of a draft agreement to sell US wind farms, followed by a tender offer, was definite news …forcing an NTR confirmation to shrhldrs

Here are those NTR plc articles frm the IT/Indo: http://www.irishtimes.com/business/sectors/energy-and-resources/tom-roche-needs-to-be-upfront-on-plan-for-ntr-s-future-1.1908899 … … http://www.independent.ie/business/irish/shareholder-talks-raise-a-lot-of-questions-for-ntr-30542405.html … … http://www.irishtimes.com/business/sectors/energy-and-resources/ntr-shareholders-agreed-draft-plan-to-sell-wind-assets-1.1911223 … …

You need to get a better understanding of the PTC accounting treatment and the flip structures in the US before assuming valuations, the only way to value is on a DCF. You should also note that YeildCo’s use the ITC tax structure to enable distribution of the free cash flow.

More relevant metric for you analysis may be the development premium in the US is circa $100-150k/Mw, in Ireland you looking at €300k/Mw+!

Hello John,

NTR opted for PTC on one farm & the ITC on the other. Obviously any potential buyers will value & bid based on a DCF analysis. I’d love to do the same here, but of course we don’t have the necessary detail from management – that’s why I highlighted above: ‘we can’t rely on current return on equity (or P&L/cash flow run-rates) to accurately determine fair value’.

Every project’s a little different, of course, but based on the history of the projects & the info. provided at the time/to date by the company, I’ve seen no suggestion at all here that project structures & financing are somehow out of the ordinary (or adverse to NTR’s shareholders). In terms of original project costs, as well as sector costs & reported deal values, I believe $2.0 million per MW (as above) represents a very reasonable floor for potential bids in a competitive auction situation.

Regards,

Wexboy

Hi John,

I don’t think DCF is the only way you can value these assets and it is certainly not the only metric that investors/buyers use to value these assets! There are many ways to value assets like Wind Capital Group.

DCF is particularly good for valuing wind farms that have already paid off the tax equity investor and bank debt. A combination of DCF analysis, EV/EBITDA multiples, EV/MW and of course ‘replacement cost’ should give a good indication of fair value. I believe that NTR will sell WCG for a number larger than $800mm.

KR

01-Sep-14:

And finally, we see a couple of new NTR trades…at 225 cts, that’s up +43%… http://www.ntrplc.com/Investor-Relations/Share-Information/m:3/ … https://wexboy.wordpress.com/2014/08/24/ntr-plc-wind-of-change/ …

And these 225ct trades were frm Thurs, ahd of this late Fri NTR release http://www.ntrplc.com/News/Press-Article/statement-from-the-board-of-ntr-plc/ … Nxt trades will also be interesting to see…

ntrplc.com/uploads/documents/shareholder_services/Notice_of_AGM_2014.pdf … NTR’s AGM this Thursday may prove to hv more fireworks thn I originally expected..!

As a fellow shareholder, what are your thoughts on the NTR AGM resolutions? Thanks

Hi JoeC,

Unless you have a specific objection to a particular director, most of these resolutions are pretty bog-standard…so as they say, just vote with your conscience. But I’d object on principle to the two Special Business resolutions. These days, management teams everywhere tell shareholders resolutions like this are simply housekeeping. I disagree…

It seems entirely reasonable shareholders should have an actual opportunity to consider & approve a specific use of proceeds for a proposed (substantial) share issue, rather than giving management carte blanche in advance to raise & spend money as they see fit. This is even more critical when a company’s already cash/asset rich – which begs the question, why would a fund-raising be needed? [Not to mention where a company’s shares are trading at a substantial discount – a new issue of shares would dilute fair value per share].

The last resolution is just as objectionable – why should shareholders vote to dis-enfranchise themselves?! The right to participate in a company’s rights issue is clearly valuable to all shareholders! And the desire of companies to deny/exclude small shareholders (for reasons of convenience & economy) seems counter-productive to me anyway – they’re often the most loyal of shareholders, and should be accommodated/rewarded accordingly.

Regards,

Wexboy

How do you track activists’ stakes in Irish/English/European companies?

Marc,

In the UK & Ireland (and most/all European countries), shareholders have to notify their shareholding above a certain % threshold (3% in Ireland/UK) – similar to the US. Investegate is probably the best place to reference for UK & most Irish companies – look for Holding(s) in Company RNSs. For example: http://www.investegate.co.uk/Index.aspx?searchtype=3&words=zmno Other listed Irish companies will be found here: http://ise.ie/News_and_Media/Market_Announcements/

And a company’s IR section of their website is also a good place to consult – ideally, they’ll have an up-to-date listing of major shareholders. For European companies, this might be your best bet – otherwise, you may have to track down a company’s filings on the relevant stock exchange website(s), and they may not be in English.

Since NTR’s unlisted, the annual report (see the director’s report – e.g Page 19 here: http://www.ntrplc.com/uploads/documents/shareholder_services/NTR_plc_Annual_Report_2014.pdf) provides the latest snap-shot of the major shareholders. [Unless NTR, or a shareholder, chooses to subsequently notify a substantial change in shareholding(s)].

Regards,

Wexboy