Tags

Alpha FX Group plc, alternative asset manager, Brexit, currency manager, forward rate bias, FX hedging, FX market, James Wood-Collins, Neil Record, owner-operators, REC:LN, Record plc, volatility

Record plc (REC:LN) is the world’s largest independent currency manager. Based in Windsor, it was founded in 1983 by Neil Record, winning the world’s first stand-alone currency overlay mandate two years later. Record is still majority-owned by its directors/employees, with no proprietary business of its own – it focuses solely on being a ‘trusted advisor’ to an institutional client base (pension funds & foundations), providing (bespoke) passive & dynamic currency hedging and currency for return strategies, with AUME now at $58.2 billion (£46.6 billion). [Record only manages currency risk, so AUM is notional – i.e. it doesn’t manage underlying client assets – therefore, it uses the term Assets Under Management Equivalents]. This (old) video is still worth your time watching:

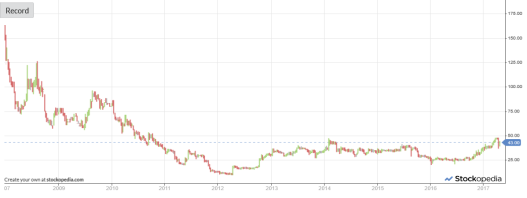

But unfortunately, after listing at 160p a share (a £354 million market cap) in Nov-2007, its long-term chart is none too pretty:

Ouch…

By early 2012, investors were so convinced Record’s AUME & business were heading to zero, its shares had collapsed 94% & were trading for net cash. [Which was pretty irrational, as Record’s operating margin was bottoming out at 32% at the same time!] Any investor brave enough to buy it sub-10p has a tasty four-bagger at today’s 43p share price (a £93 million market cap). [As did Jeroen Bos, see the final chapter of his book]. Even buyers six months ago have a near-60% return. But noting an average share price of 31p over the last 5 years, gains have been limited for most investors, while long-term shareholders continue to nurse big losses.

Maybe the financials look better?

Ulp, no… Since the IPO, AUME’s taken almost a decade to recover, after nearly halving in the post-crisis years. While aggregate management fee rates continue to fall, performance fees have evaporated, and revenue & earnings have collapsed. As for valuation, the shares now trade on a (last twelve months) LTM 17.1 P/E!?

OK, hands up – who’s ready to spin this Record?! Anyone, anyone..?

Is it any wonder it’s a misunderstood share? Just last week, Record boasted a new record high in AUME…yet the shares dropped 13%!? Seems like many investors are still shell-shocked enough to ignore good news & its positive impact on revenue/earnings – instead, only focusing on the negative highlights (no performance fees & the loss of a mandate)!

But I can assure you, Record’s actually an incredible growth story!

Seriously…

Now, granted: Over the last 5 years, AUME growth been impressive, but the continued decline in fee rates & the virtual absence of performance fees means revenue/earnings were stable at best (averaging £20 million & 2.4p per share, respectively). Nor did the last interims tell us anything new. And since last year’s rally, an impressive 6%+ dividend yield’s now a far more pedestrian 3.8% – of course, the current valuation doesn’t look too cheap either, in light of historic financials.

But again, I repeat, Record’s actually an incredible growth story!

We just need to dig deeper:

[NB: Cash & Futures is a residual/no-fee AUME category. FY-2017 introduces a new Multi-Product category to reclassify existing/future mandates which have both dynamic hedging & currency for return objectives.]

[NB: Seed fund investments are fully consolidated (since they’re majority-owned). Underlying revenue/operating profit excludes fund gains/losses (of +/-£0.5 million, or less) attributable to non-controlling interests. NCI in seed funds should also be excluded when calculating net cash & investments.]

In the early 2000s, Record championed currency as a separate asset class for its clients to invest in…nothing like the barrow boy approach to FX trading, rather a systematic medium/long-term approach to mining excess returns from currency markets, via the Forward Rate Bias (the tendency of higher interest rate currencies to outperform lower rate currencies – i.e. the carry trade), and other strategies (like value & momentum). Based on results, and their clients’ appetite to ‘leverage’ up currency exposure, Record had huge success with currency for return – growing it from almost nothing in 2003 to $29 billion AUME five years later. Not that dynamic & passive hedging AUME were far behind, at over $23 billion – but overall, currency for return’s higher management fees (at 28 bps) & substantial performance fees accounted for over 90% of Record’s FY-2008 revenue!

Then the crisis hit & institutions fled anything remotely novel/esoteric/risky, or (God forbid) leveraged. During the initial post-crisis FY-2009/2011 period, dynamic hedging & currency for return AUME dropped 55%, but the resulting revenue collapse was partly mitigated: i) as clients regrouped from currency for return into dynamic hedging & then passive hedging (down just 14%), and ii) management fee rates held up well (clients were otherwise distracted). So while performance fees were annihilated, management fee revenue fell in more controlled fashion (down 36%). Still challenging, but it afforded Record the opportunity to re-focus on its passive hedging business – previously an after-thought, in revenue terms – and to also succeed in re-pricing (i.e. consistently raising) passive fee rates to reflect a new business reality.

But ever since, we’ve seen no tangible recovery in FX risk appetite & returns. While an unprecedented $12 trillion expansion in central bank balance sheets was a global sugar-rush in most asset classes, it negatively impacted currency markets. The resulting collapse/convergence in global interest rates & spreads, the implacable compression & decline in volatility/momentum, the restriction/regulation of banks’ proprietary risk, numerous FX scandals, the replacement of human traders by algo-trading, the near extinction of FX & macro funds, all served to disrupt and suppress currency for return & dynamic hedging strategies. Which has meant continued decline in related AUME…and falling fee rates as currency managers struggle to retain mandates. Since Record’s IPO, dynamic hedging & currency for return AUME plunged 71%, while management fee rates declined over 40%, on average. Which translates to a 64% collapse in its aggregate management fee rate from 16.3 bps to 5.8 bps.

But fortunately, this negative trajectory’s actually been offset in the last five years by impressive passive hedging AUME growth & fee rate increases.

And more recently, we have good news: I now include a pretty accurate pro-forma FY-2017 in the above tables. Since we have all the main drivers – average AUME/fee rates – it’s just basic math, based on the latest interims, subsequent end-Dec/end-Mar updates & an average FY 1.3067 GBP/USD. The new multi-product AUME category means it’s all a bit apples & oranges, but the end-result is clear: A real step-up in revenue, vs. a static five year average of £20 million. And now we start FY-2018, I include a current revenue run-rate, based on $57.0 billion AUME (per the March update, $58.2 billion AUME less a terminating $1.2 billion passive hedging mandate), today’s 1.2903 GBP/USD rate & a 5.4 bps aggregate fee rate. [Which keeps falling due a changing AUME mix]. This is also a pro-forma FY-2018 – but it remains subject to AUME/fee/FX rate changes, etc. – this estimate’s critical, as we see the full impact of the new AUME peak & sterling’s post-Brexit vote collapse flow through…not only in terms of revenue, but a radically higher incremental operating margin.

But first, how about we home in on that incredible growth story?!

And yes, there it is, in all its glory…

After a significant (but unsurprising) decline in FY-2009 AUME (though average AUME declined just 11% to $15.5 billion), ever since Record’s grown its passive hedging business on average by almost 20% pa – coming close to quadrupling AUME in FY-2017 (at $58.2 billion), with hopefully a new AUME peak to come as FY-2018 unfolds. This growth’s expanded passive hedging from 33% to 83% of total AUME in FY-2017 – while fee rates doubled in FY-2009/2010 & have continued to move higher ever since. Taken together, this consistent growth in passive hedging AUME/fee rates has actually delivered an astonishing 30% pa revenue growth since FY-2008!

And no…

I’m not just cherry-picking the best bits here. Markets change, business models adapt – sometimes planned, sometimes not – regardless, passive hedging evolved into Record’s primary business. And each year it’s a more dominant component of total AUME, revenue & earnings. [In FY-2017 it now accounts for a majority of revenue]. As for the rest of Record’s business, check the competition – in fact, it has no listed peers – so let’s see how currency hedge funds are doing. Except…when did you last hear about them, do they even exist anymore? Actually they’re mostly extinct now, due to poor returns & a lack of investor appetite. The granddaddy of them all – FX Concepts – even went bust! At the time, the BIS estimated currency fund AUM had collapsed by almost 85%. Judging by BarclayHedge & subsequent BIS market reports, there’s been no improvement since. And CTAs & global macro funds aren’t exactly setting the world on fire either. In relative terms, Record’s own performance can hardly be faulted…

And so, evaluating its current valuation/prospects, I’d put much less weight on its inability to overcome an implacable secular trend which continues to negatively impact currency strategies, and put far more weight on its ability to grow passive hedging revenue at consistent super-charged rates for almost a decade now. But first, we still need to consider the risks Record may face, vs. the advantages/opportunities it enjoys today.

Risks:

Sterling: AUME’s quoted in dollars, but only 9% of Record’s AUME is actually dollar-denominated. Europe’s the real exposure, with 70% of AUME denominated in Swiss francs & euros, vs. a mostly sterling cost base. Gradual sterling weakness has been a long-term tailwind, while the Brexit dump is clearly a key driver of the FY-2017/2018 revenue step-up. While Record’s cash & investments are in sterling, and it hedges short-term FX exposures, sustained sterling strength would hurt results.

Brexit & Other Regulations: Brexit’s potentially a source of elevated currency volatility – rather than FX risk itself, which already existed – so arguably, it’s as much a new business opportunity as a P&L risk. However it may present medium/long-term risk in terms of EU employees & dealing with EU clients – locating some staff in Dublin might be a relatively simple contingency plan. Possible margin requirements on clients’ FX hedging is another risk. But presuming consistent implementation, there’s no effective alternative, so it’s unlikely FX hedging/strategies would be abandoned simply due to underlying collateral requirements (standard futures practice anyway, for example). Plus, Record’s earmarked this as a potential collateral/cash management opportunity.

Concentration: Passive hedging tends to be an all-or-nothing decision. If it makes sense to a client, why would they hedge a mere portion of their exposure? Which tends to imply larger passive hedging mandates – vs. dynamic & (particularly) currency for return mandates – so Record’s client base is now more concentrated. Its five largest clients account for 58% of revenue (and a major change in Swiss pension regulations could impact 32% of revenue). If that gives you the willies, Record may never be the stock for you…but its exceptional AUME history, decades-long experience & reputation, freedom from conflicts of interest, owner-operators & employee retention, broad & deep long-term client relationships, and its exceptionally low fees (at 3.5 bps), have served & will serve to mitigate the risk of a major defection.

Advantages & Opportunities:

Passive vs. Active: The debate rages, but the odds seem to be shifting in favour of passive investment management. Unlike most asset managers, this is a sideshow for Record – whether underlying assets are actively/passively managed, currency hedging’s still a potentially compelling proposition. And in reality, Record’s relatively indifferent when it comes to pitching/winning mandates – since larger passive hedging mandates often mean any potential fee gap (vs. dynamic hedging/currency for return mandates) is much smaller in revenue terms.

Market Returns: Record’s clients are also suffering the after-effects of the crisis. Pre-crisis returns infected return/growth forecasts, as well as current/future spending commitments, but have proven wildly optimistic in a ZIRP/NIRP/low growth world. As they continue to struggle with lower returns, lower liability discounts, spending commitments & funding gaps, currency risk’s now a far more meaningful component of return, and one of the few levers they can control (i.e. hedging’s now a far more compelling proposition).

Asset Management: While Record only manages currency risk, it enjoys the same advantages as other alternative asset managers. It requires a relatively small staff/HQ, negligible capex, and has no working capital/inventory/bad debt issues. Revenues are predictable (presuming stable/growing AUME), performance fees are possible, and operating margins tend to be high. [Record’s 31-61% margin range is not unusual]. And the model’s geared to the markets (underlying asset growth’s a natural tailwind) & enjoys a network effect (good returns & more AUME tend to attract even more AUME). Most important, it enjoys impressive economies of scale – with a relatively fixed cost base & little incremental expense needed to manage higher AUME, incremental margins are extremely high.

‘Stickiness’ of AUM: While Record doesn’t enjoy fixed life investment vehicles like other alternative asset managers, we should still distinguish its AUME from regular asset managers who regularly struggle with unpredictable fund subscriptions/redemptions. As I highlighted, passive currency mandates tend to be larger – arguably, they’re also far more valuable, as AUME can prove incredibly sticky, with little reason for clients to terminate an overlay once it’s implemented. Unless (perhaps) for cause…again, judging by Record’s exemplary record/attributes, such a risk appears to be fully addressed.

[NB: Record does flag mandate terminations, but new investors can take advantage of an undisclosed mandate pipeline – it’s worth remembering, new business wins may easily take 12-24 months to originate/complete (as I know personally, from sitting on both sides of the table). Of course, some mandates are lost (or never get approved), but on balance I believe Record’s IR would be improved by making some kind of periodic contract pipeline disclosure to investors (as we see in certain other sectors).]

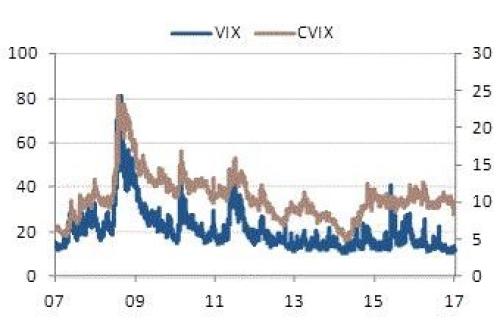

Macro/Political Volatility: Deutsche Bank’s Currency Volatility Index (vs. the VIX) tells its own story…

The longer central banks suppress volatility, the more painful & savage its return will be… And in the last couple of years, the seeds have been sown for increasing volatility & a more normal/functioning FX market: The SNB abruptly abandoned its euro cap, the Fed began raising rates, the UK voted for Brexit, America voted for Trump, the UK now has a June general election, and Le Pen won 21%+ of the first round French vote. While increasing potential for significant global macro/monetary divergence, the meteoric ascent of political populists & populism, the ongoing debate for renewed fiscal stimulus (vs. austerity), latent inflation potential, etc. all suggest a (far) more conducive environment for Record’s products & services, both in terms of winning mandates and better returns. [Not to mention the implications of a potential splintering/demise of the euro – personally, I think such predictions are absurd]. But regardless, I suspect Record now has better prospects & a greater opportunity set ahead of it for the next few years, and also offers a potentially compelling long-term bet on (or hedge against) volatility (with none of the horrific negative roll yield, or time/margin constraints, associated with most volatility bets…take a peek at VXX).

Capital Allocation: OK, I cheated a bit, I should have revealed Record is a cash-rich/zero debt company (with no pension/contingent liabilities) – with free cash flow that consistently matches/exceeds earnings – so arguably, it’s much cheaper than it shows up on the screens. But despite a generous dividend (66% payout ratio over last 5 years), management’s made no other cash payouts – gross cash & investments, at £36 million, is a huge multiple of regulatory requirements. Nor is there any evidence they’ve ever contemplated an acquisition. No bad thing, perhaps – acquisitions of ‘people’ businesses are fraught with risk, so buying a business you know (i.e. Record, via share buybacks) may be the better bet. But two targets grab my attention: i) Adrian Lee & Partners, a well-established Dublin currency manager which manages $9 billion plus – the ‘Brexit hedge’ angle is intriguing & it could inject a new dose of entrepreneurial blood, or ii) Alpha FX Group (a new IPO, see Peer Valuation below). Meanwhile, management’s finally acknowledged the surplus capital position & will return (as special dividends?) at least part of the annual excess in EPS vs. the regular dividend. Noting this possible/cautious first step towards shareholder value, it would be foolish to discount Record’s cash now – and as owner-operators, we can be confident they won’t spend it foolishly & will ensure it’s fully recognised in a possible takeover situation.

New Business: Just look at Record’s passive hedging AUME/revenue trajectory, how do you argue with success?! But on the other hand, its geographical reach – with over 90% of clients still in the UK/Europe – does suggest a huge & relatively untapped global opportunity. [Perhaps Record can strengthen & broaden its existing network of relationships with local/global investment consultants]. As for North America, the new WisdomTree Investments (WETF:US) collaboration (announced in early-2016 & recently expanded) may be small in terms of revenue, but it’s a great calling card for Record]. Alpha FX Group’s successful IPO & revenue trajectory also suggests huge corporate opportunity. And consider the FX scandals: State Street & BNY Mellon coughed up a billion plus for ripping off clients, while the major FX banks paid $10 billion for rigging trading & fixings. Ironically, some of Record’s competitors today are units of those same banks (or other large financial institutions)!? As a reputable listed company with decades of experience (& no conflicts of interest), FX execution/auditing/benchmarking could be another significant opportunity. In fact, its passive fee rates are so low, they’re a bargain simply in terms of best execution! But considering Record’s record of success & a $5 trillion a day FX market, diversity just for the sake of it isn’t necessary either – in terms of FX volume/exposure, pension funds & foundations offer a much larger opportunity than corporates, so selling them new & add-on products/services is a compelling strategy. Clearly, a more aggressive new business approach could really pay off here – though upfront P&L costs would need to be flagged for shareholders – ideally, this step-up in Record’s revenue run-rate (& its proven ability to earn higher margins) could fund such investment in a relatively painless manner.

Owner-Operators: Neil Record continues to lead the company as Chairman – he still owns a 33% stake (and notably, his total compensation package is just £88K), other current directors own 11%, and over two thirds of the company’s employees are also shareholders. Staff retention’s high (its most senior executives are now with Record for almost 17 years, on average), head-count hasn’t changed much since (shortly after) the IPO, and Record tends to hire interns, graduates & early-career employees, with a focus on internal development & retention – all of which is critical to its reputation & long-term client relationships. [NB: Record takes a systematic approach to currency, it has no star traders!] And yes, owner-operator/family businesses are often more prudent in their capital structure & growth strategies, but plenty of studies attest to their long-term out-performance (& survivability) – bet on them, not against them!

Peer Valuation: Record had no listed peers, but Alpha FX Group plc (AFX:LN) was a new IPO earlier this month – it focuses on managing FX execution/hedging risk for UK corporates, earning its revenue/profits by taking a spread. Only founded in 2010 – oddly enough, also in Windsor – it currently has about half the employees of Record & about 40% of its revenue (at £8.5 million). But its revenue growth has been exceptional in the last two years (a 69% CAGR) & it boasts a 50%+ operating profit margin. [Begging the question: Are Record’s historic 50-60%+ margins potentially achievable at current revenue run-rates?] It IPOed at 196p per share, and is up 60%+ since – for a market valuation of £104 million, a little higher now than Record’s own £93 million market cap! Which puts Alpha FX on an estimated EV/Sales multiple of 9.9 vs. Record on a EV/Sales multiple of 2.8!? While Alpha boasts higher margins & growth right now, Record’s a larger/more well-established company with similar/higher margins historically, and a highly impressive 30% pa revenue trajectory in its passive hedging business for almost a decade now. You decide which multiple is right, or wrong…or when they might converge. But if Alpha turned into a busted IPO at some point, it could be an acquisition to consider.

Technicals & Sentiment: Record employees own a majority, Schroders is the only institution (at 16%), and presumably there’s a fair contingent of dividend investors & grim long-term shareholders, so the available free float’s surprisingly small for a near-£100 million market cap – please note the average 100 K daily share volume may limit larger trades/investors, while the price can be volatile (a daily 5-10% move isn’t that unusual). [All things considered, the spread’s generally reasonable]. The shares still appear a bit neglected & misunderstood – averaging just two/three comments monthly on the main message boards, with most investors focused on value & dividends, and no real sign of growth/momentum investors homing in on Record’s underlying growth trajectory… Key technical levels here are 40-41p & 47-47.5p – a breach of the latter would signal a potentially major break-out from what’s been a six & a half year old trading range.

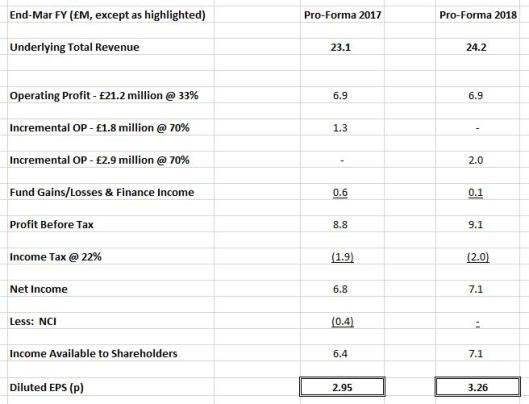

Now let’s change gears & make a dash for the finish line. Based on the step-up in FY-2017/2018 revenue (per my estimates, see tables above), I propose Record’s capable of earning a incremental 70% operating profit margin – consistent with a relatively fixed cost base each year & an incentive scheme which awards employees 30% of operating profits. This can also be confirmed historically via the incremental impact of +/- revenue changes on Record’s earnings over the years:

[NB: Record did flag an increased £0.2 million commitment in HQ lease costs – hopefully we see this offset by some potential performance fees.]

[FY-2018 Sanity Check: So that’s $57 billion AUME / 1.2903 GBP/USD * 5.4 bps fee = approx. £24 million revenue. Based on that revenue run-rate, we can interpolate Record’s historic EPS was actually v similar (at 3.1p) back in FY-2011/12.]

So that’s EPS of 2.95p & 3.26p EPS for FY-2017/2018 – quite impressive – Record’s even cheaper than we thought, particularly as I argue we should give full credit for net cash & investments in any valuation. However, there’s a fly in the ointment… And yes, it’s the same affliction Record’s experienced for the last five years. How do we know dynamic hedging & currency for return fee rates/AUME declines won’t continue to offset the impact of passive hedging AUME growth, thereby implying a static revenue & earnings trajectory?

Well, we don’t…

So while I’m confident of a step-up here, based on the revenue/earnings drivers I’ve fully confirmed already (vs. those still to be confirmed), I’m also conscious that changes in fee rates/AUME, sterling, possible new business investment, etc. could eat into this earnings step-up, and/or a new revenue & earnings equilibrium might simply re-emerge (albeit, at higher levels). Noting LTM EPS of 2.52p per share & a potential FY-2018 3.26p EPS run-rate, I’m going to (roughly) split the difference & assume my FY-2017 2.95p EPS estimate is now the underlying consensus for Record’s current earnings run-rate & multiple. At 43p per share, that puts it trading on a 14.6 P/E & an ex-cash 9.6 P/E. But evaluating Record’s revenue/earnings stability over the last 5 years, the stickiness of its AUME, the 30% pa long-term growth trajectory in its passive hedging revenue, the leadership of its owner-operators, and its technical positioning, I believe a fair value 15.0 P/E multiple, adjusted for its net cash & investments, is entirely reasonable:

(2.95p Run-Rate EPS * 15.0 P/E + (£36 Million Cash & Investments less £4 M Non-Controlling Interests) / 217 M Shares = 59.0p per share

A 59.0p Fair Value per Share estimate implies an Upside Potential of 37%.

As always, it isn’t necessarily about the closing of a possible value gap, what really matters is potential growth in intrinsic value itself (based on Record’s actual revenue & earnings over the next five years). Which brings us right back to the same questions: i) Will Record’s dynamic hedging & currency for return business stabilise, or continue to decline, and ii) will continued growth in its passive hedging AUME/revenue finally allow Record to establish a decisive new revenue/earnings growth trajectory?

Call me foolish, but I don’t actually have a base bear case here – at worst, over the next 5 years (noting the company’s stable record over the last five), I’m highly confident Record can declare & maintain total dividends (inc. special dividends) of at least 2.25-2.50p pa. [Almost 100% of Record’s LTM EPS, but only about 73-80% (on average) of my current FY-2017/2018 EPS estimates. NB: Edison has a 2.75p estimate. Not to mention, net cash & investments on hand could fund 6 years of dividends anyway!] Presuming a static share price, I could live with an annual 5.2-5.8% return in what I consider a realistic downside scenario.

Otherwise, let’s map out 4 Scenarios, referencing actual 5 year CAGRs for the growth (or decline) in AUME/fee rates within each of Record’s three business segments (from FY-2012/2016, to avoid the Multi-Product AUME re-classification). Here’s the table itself, then a brief explanation:

Scenario I maps out respective AUME/management fee rates in 5 years time, using prospective CAGRs which are 50% (except for passive hedging AUME, at 33%) of Record’s actual FY-2012/2016 growth/decline rates – resulting in future revenue of £24.6 million & a 3.38p EPS.

While Scenario II only uses prospective CAGRs which are 50% of Record’s actual FY-2012/2016 growth/decline rates, except no change in dynamic hedging & currency for return fee rates is assumed – resulting in future revenue of £29.9 million & a 4.71p EPS.

And Scenario III & IV obviously map out more aggressive scenarios – notably, dynamic hedging & currency for return AUME growth is assumed – you may (or may not) deem these unlikely scenarios.

Now, while I believe there’s a low probability of negative 5 year returns, these scenarios shouldn’t necessarily imply highly asymmetric upside potential’s on offer either… Of course, that will depend on the specific odds you attach to the likelihood of each scenario actually occurring – Scenarios III & IV may require an improved macro/FX environment, a stabilisation/turn-around in dynamic hedging & currency for return, and/or a possibly more aggressive new business approach. [Then again, no scenario maps out passive hedging CAGRs for the next 5 years which actually exceed historic CAGRs]. Of course, you may want to model a whole different scenario range, but simply eyeballing the above table should yield reasonable EPS estimates.

But if you agree Scenarios I & II, for example, look quite achievable over the next five years, the resulting EPS mightn’t seem all that exciting (vs. our assumed 2.95p EPS run-rate consensus today). But in reality, we can reasonably expect to enjoy an EPS-related valuation uplift, plus 5 years of cumulative EPS earned (via dividend payouts, and a continued accumulation of net cash & investments) – which looks like this:

In the upper half of this table, I assume Record’s current ex-cash 9.6 P/E multiple, which implies (see line A.) a Potential Total Return of 46% to 84% in Scenarios I & II (and as high as 255% in Scenario IV). While lower down, I assume its shares actually converge to my fair value 15.0 P/E multiple, which implies (see line B.) a Potential Total Return of 89% to 144% in Scenarios I & II (and possibly as high as 392% in Scenario IV).

I currently have a 6.5% portfolio holding in Record plc (REC:LN).

- Record plc: 43.0p per Share

- Market Cap: £93 Million

- P/E Ratio: 14.6 (based on a 2.95p EPS consensus)

- Ex-Cash P/E Ratio: 9.6

- Target Fair Value: 59.0p per Share

- Target Mkt Cap: £128 Million

- Target Ex-Cash Ratio: 15.0

- Upside Potential: 37%

Morning,

Any idea what’s causing the recent sell off?

Thanks,

Josh

Wexboy:

Sorry, Josh, I missed this question: Not sure what caused the actual REC:LN sell-off there – I guess some (clumsy) selling from a larger shareholder or two, taking profits? Unfortunately, I was hoping 50p+ levels would finally dissipate the long-term negative investor sentiment that continues to linger around the stock (presumably resulting from its post-IPO/2008 collapse). So I guess we’ll have to be a little more patient here…I still see investors/message boarders who perversely continue to cherry-pick small negatives in new Record trading updates, while ignoring the positives & Record’s underlying long-term passive hedging AUME/revenue trajectory. And unfortunately Record’s 6.7% dividend yield today isn’t on most investors’ radar, as the (sustainable) special dividend component is actually excluded on most financial/share websites. But I remain confident Record’s current fundamentals (& subsequent technicals) will still propel the share price significantly higher from here (with a potential significant long-term AUME growth kicker if/when volatility elevates & global macro/FX policies diverge more radically).

26-Oct-2017:

Tweet: Another spin of this beauty…I’ve now increased my Record plc holding from 6.2% to 6.8% of my portfolio. REC:LN

24-Aug-2017:

REC:LN up +3.4% today – here’s valueandopportunity’s take on Record plc:

Nice write up.

Why would their business model not be ‘broken’ by a typical prime broker/ib?

Are their current mandates exposed to key man risk, i.e. they only have them because of the 2 key long term employees?

Thanks Hades.

Do you mean: Could a prime broker steal their business – i.e. aggressively compete with them by offering currency overlay management? Presuming that…

Yes, prime brokers certainly could offer currency overlay (they obviously do lots of spot FX biz with clients already), but it’s not a meaningful part of their business. First, their main target client market (hedge funds) really don’t outsource currency hedging – though obviously there’s no reason they couldn’t. [Potential target market for Record? But Masters of the Universe probably prefer not to be seen delegating/outsourcing anything trading-related!] More importantly, prime brokers are inevitably part of a larger bank/broker/financial institution, which inevitably has an FX trading & sales desk (or client risk/strategy unit) with long-standing dibs on any client FX hedging business. These are, in fact, already long-term competitors…and obviously Record’s successfully held its own against them for many years now. And as I highlighted above, after all the bank/FX scandals, potential clients are presumably & understandably far more wary of non-independent currency overlay providers – Record, as the oldest/largest/owner-operated/independent currency manager, is likely a far more compelling choice now.

As for key-man risk, see my Owner-Operators paragraph above: Neil Record’s already in a Chairman role (i.e. he’s already stepped back from day-to-day management), senior execs have a very long average tenure, there are no star traders, the company specifically hires young & trains up its employees in the business/culture, and frankly they’d never win a pension mandate in the first place based solely on a single employee or two. Overall, I think Neil Record’s done an excellent job of institutionalising the firm, and I see no reason to anticipate any key-man risk (or major strategy/client changes) if/when he or any other long-term senior execs finally depart.

Regards,

Wexboy

hi Wexboy,

any view on the tender offer and managment tendering shares ? Not only Neil Record but most of the other top dogs tendered as well.

MMI

Hi MMI,

Yes, I’m actually delighted with how the tender offer turned out!

Obviously, most tenders are priced at a significant premium to current share prices – but management clearly viewed this as an opportunity to exit part of their holdings, and quite impressively, decided accordingly to peg the tender offer to the current share price. And since I obviously believe REC:LN continues to trade at a significant value-discount, I’m happy the company ended up buying in shares so cheaply (regardless of who owned them), and welcome the resulting (increased) enhancement in intrinsic value per share.

I also don’t perceive this as any kind of negative management signal. In light of the board’s substantial stake in Record, (occasional) share sales are no surprise – in this instance, the board’s aggregate holding will only fall from 46% to 45% of (gross) outstanding shares. That stake’s still worth about 15 times the board’s total annual compensation – a far higher multiple than you’ll find at virtually any other UK-listed company – so they still have a huge amount of skin in the game.

[And that’s not just driven by Neil Record’s holding – the rest of the board will still own 14% of the company (17% inc. options), which is pretty impressive too].

Cheers,

Wexboy

Pingback: New Portfolio Snapshot & Allocation | Wexboy

Pingback: H1-2017 Wexboy Portfolio Performance | Wexboy

14-Jun-2017:

Silly to see REC:LN re-test 40-41p support in lst mth, esp w/ gd results/likely 5.6-6.2%+ div yield coming Friday am http://www.londonstockexchange.com/exchange/prices-and-markets/stocks/summary/company-summary/GB00B28ZPS36GBGBXSET3.html …

Here’s my Record plc investment thesis again: https://wexboy.wordpress.com/2017/04/28/love-that-record-give-it-a-spin/ … REC:LN

Record plc FY16 EPS was 2.54p…my FY-17 estimate’s 2.95p (to be conf’d Fri & a likely 2.25-2.5p total ann div), and 3.26p fr FY-18. REC:LN

Let’s not forget, Record has 14.7p net cash on hand…and I’d expect FY-17 net cash at 15.5p & prob something like 16.2p of net cash today.

So at Record’s 40.375p close, it’s now trading on a likely 8.2 ex-cash P/E & a 7.4 ex-cash prospective P/E: http://www.londonstockexchange.com/exchange/prices-and-markets/stocks/summary/company-summary/GB00B28ZPS36GBGBXSET3.html … REC:LN

Even more absurd, my inv’t thesis highlighted a huge gap gap btwn Alpha FX Group’s 9.9 EV/Sales multiple vs. Record’s 2.8 EV/Sales multiple

Bt AFX:LN rallied +50% since on zero news (almst +150% since its IPO 2 mths ago) while REC:LN fell 6%…a far more ludicrous val’n gap now!?

If REC:LN broke 40p support, 36.5p wd present more support & buying opportunity…bt I suspect Friday’s results will forestall tht happening

And lack of REC:LN volume/interest (2 blog comments vs 34 Applegreen comments/replies!) remains encouraging…upside cd be lumpy, not smooth

My REC:LN FV est. of 59p per shr still stands (+46% upside pot’l vs today’s 40.375p)…bt shd improve w/ evolving FY-18 & increasing cash.

Meanwhile, I have re-upped my Record plc REC:LN holding from 5.8% to a 6.3% portfolio allocation…

I wonder whether the lack of comments is simply because the business is hard to understand, as opposed to Google and Applegreen ? I watched the video and don’t really get it. Having said that, I’m happy that the amount of cash, significant skin in the game and prospect of a dividend make the investment case compelling. Thanks for the write up and the idea.

Thanks Kippax,

The video was more to get a feel for Record itself…the people & the company/staff. In reality, Forward Rate Bias is far less important to Record today, because: i) a majority of its AUME is now Passive Hedging, so FRB’s irrelevant, and ii) they’ve also diversified into other currency for return strategies.

More generally, you’re probably not wrong…

I know Record & the FX industry for years/decades, but when I check the message boards & see the media writing about the FX market, it’s obviously opaque & frequently misunderstood territory for many people. And the parade of bank FX scandals & blow-ups over the years doesn’t help, even though they’re irrelevant to Record’s business. [In fact, I’d argue it presents opportunities which management should consider/exploit more aggressively]. I also suspect Record falls between two stools…for many (private) investors, it’s not quite a fund manager, but it’s not quite a business service provider either. [Whereas Alpha FX Group is – which investors seem entirely comfortable with it, judging by its valuation!?] But my own perspective is pretty basic & I recommend it to all investors:

Today, Record is essentially a passive fund manager & its core business is simply the automatic hedging of known client exposures (using forward FX hedges). Its currency for return business now is really just potential icing on the cake. And like most passive fund managers (of all stripes) over the last decade, and looking ahead, it has enjoyed extraordinary (underlying) growth in its passive AUME.

Of course, that’s the story management needs to get out there & pitch more effectively. But there’s a little bit of a wonky/nerdy collegiate environment at Record (which granted, is v reassuring for existing clients)…so an injection of new blood could really help/accelerate things here, both in terms of its Investor Relations & its Sales efforts.

Regards,

Wexboy

had any of the very wise brokers recommended to buy on the possible upward movement of the stock

I never worry too much about what the brokers are thinking…

i suspect Alpha FX is a short rather than Record is a buy. This establishes these are fickle businesses with low barriers to entry for competitors and low barriers to exit for customers. Without covering off their pricing model and pricing power as well as contractual relationship with customers it is difficult to get comfort on visibility of revenue.

Hi FX,

Apologies I didn’t reply at the time, but I wanted to see just how far the pre/post-IPO hype might actually take Alpha FX Group….

Obviously into ludicrous territory, judging by the AFX:LN share price today…up almost +50% (on no news) since this post!? And up almost +150% since its IPO, just over two months ago. It may be growing faster than Record right now (from a tiny base), but that really puts it on a funny money multiple – I won’t even bother to refresh my EV/Sales multiple comparison, it’s far too ridiculous at this point!?

[Oooh, go on then…alright, Alpha FX is now trading on a 15.7 EV/Sales multiple!]

We could debate Alpha’s growth trajectory all we want, but I strongly suspect its shareholders today will end up pretty disappointed regardless of how it turns out…since so much future growth’s already discounted in the price. And obviously there’s NO room for error here – in terms of a margin of safety – reading the prospectus at the time, I was astonished at some of the potential risk(s) here:

– Alpha FX is still a very young business – only founded in 2010.

– On average, it earns almost 0.50% (50 bps) on its corporate spot/forward trades – sure, a bank might try charge this & more as a commercial FX spread, but for any corporate treasury using a competitive FX bidding process this is a huge spread.

– Alpha FX only uses two active FX counterparty institutions (one bank & one broker) to offset its corporate trades – which doesn’t appear v competitive & poses significant relationship risk.

– Corporate FX is ultimately a commodity/price-driven business (you don’t spend a year or two winning some exclusive multi-year mandate!) – while Alpha does boast high client retention rates, a client & its FX business could easily be snatched away by a bank in the morning (and obviously, relationship banks can often exert huge pressure to win ALL of a client’s business).

None of these have proved a problem to date for Alpha, but each has the potential to inflict significant damage on its client roster/P&L…literally overnight. And if you’ve worked in the industry, there’s a well-known pattern to contend with here: Non-banks (who have about 15% compared to the banks’ dominant 85% share of the UK corporate FX market) & other competitor banks tend to grab clients & business by stealth from a bank for months ( or even years), but finally the bank & its personnel wake up one day to the threat/loss of business, and via both price & relationship they proceed to win it all back. Whereupon, in due course, the same cycle of client loss & then recovery starts all over again…

It will certainly be interesting to see how things develop from here for Alpha FX…

https://www.bloomberg.com/quote/AFX:LN

http://www.alphafx.co.uk/