Tags

Alphabet, annual review, crypto, Donegal Investment Group, KR1, KR1 plc, multi-bagger, owner-operators, portfolio allocation, portfolio performance, Record plc, Saga Furs, Tetragon Financial Group, VinaCapital Vietnam Opportunity Fund

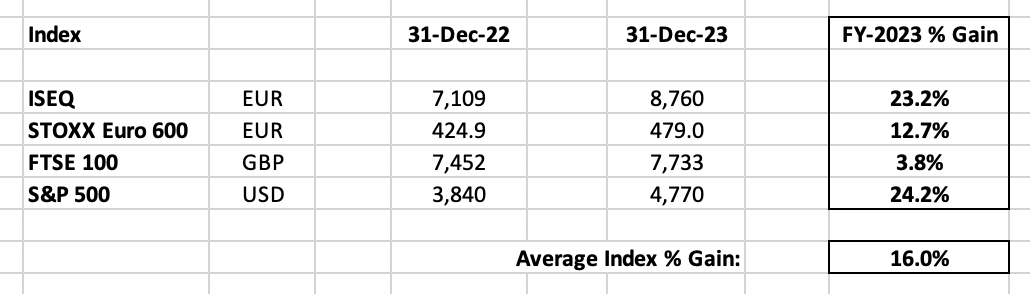

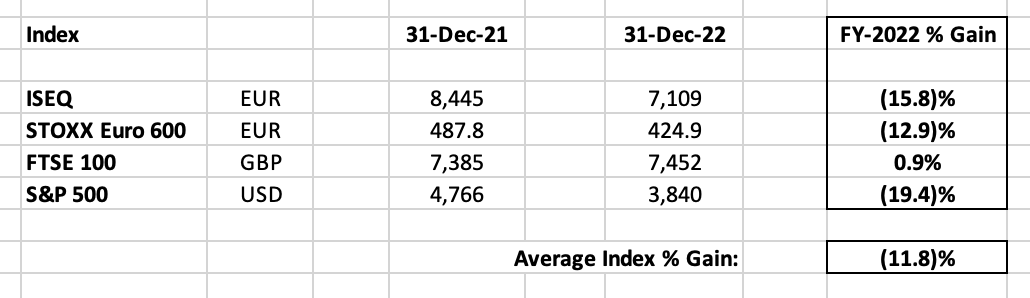

Well, 2023 obviously proved (once again) that nobody knows anything, so let’s skip the waffle & jump right in – my FY-2023 Benchmark Return is still a simple average of the four main indices that best represent my portfolio, which produced a benchmark +16.0% gain:

The respective index rankings for the year were actually pretty typical. The S&P 500 was the clear winner, obviously driven by the Magnificent Seven & a general recovery in technology stocks (from a bear market that stretched as far back as early-2021), as confirmed by a spectacular +44% gain in the Nasdaq. Both the ISEQ & the STOXX Euro 600 were led by the US, with the former enjoying a particularly excellent return, actually benefiting (perversely) from large-cap revaluations as they prepared to delist from the Irish market. Of course, the FTSE 100 was the perennial under-performer, while UK smaller companies didn’t look any better on average, with the FTSE 250 scraping out a +4.4% gain while the AIM All-Share somehow managed a further (8.2)% decline. [The Russell 2000 also under-performed, but still posted a very nice +15% gain in absolute terms]. Otherwise, going out the risk curve, the MSCI Emerging Markets USD Index enjoyed a +9.8% return, the MSCI Frontier Markets USD Index was up +11.6%, while crypto blew the lights with a +108% gain in total market cap (driven primarily by a +156% gain in Bitcoin).

Of course, the backdrop to all of this was the unexpected revival of a Goldilocks scenario for the US economy/market. The inevitable recession (for generally undefined reasons?!), as predicted by 9 out of 10 economists, never arrived…first they delayed it, and now even the economists seem to be giving up on it (it’s an election year, after all). Instead, we have robust US growth & full employment, while inflation spiked right down again to a reasonable 3.4%, and the market eagerly started anticipating Fed cuts in 2024. Which can all be summed up by the 10 Year UST round-tripping to end the year down a single basis point at 3.87%! Regardless, Biden continues to spend like a drunken sailor, still running $2-$3 trillion budget deficits, with the US national debt now surpassing $34 trillion. [Just to be non-partisan, both parties are fiscally incompetent today & both share the blame for the debt with only two Presidents running an actual (rounding error) budget surplus in the last century!]

But like I said, nobody knows anything…you really are better off ignoring macro 99% of the time, and devoting 99% of your time instead to your portfolio. The only macro ‘conspiracy theory’ I want to share is to again debunk the recent/ridiculous notion that Powell is somehow an inflation-busting incarnation of Volcker. I don’t think that’s true at all, I think he’s Biden’s whipping boy. Yes, the aggressive Fed hikes were obviously necessary to suppress the increasingly unpopular inflation spike, and to try offset some of Biden’s continued fiscal incontinence – the quid pro quo was that Biden wouldn’t question/fight higher rates – but this was also just a typical mid-cycle tactic of Presidents & politicians, and they bet on the inflation spike being a temporary post-COVID supply chain & welfare boondoggle/minimum wage hike phenomenon (& actually won the bet!).