Tags

alternative assets, asset managers, CLOs, hedge fund seeding, Leon Cooperman, leveraged loans, Paddy Dear, Polygon, Reade Griffith, residual equity tranches, Tetragon Financial Group, TFG

Continued from here.

The ultra-quick recap: Leveraged loans avoid most interest-rate price risk & enjoy better (default) recoveries than junk bonds, while CLOs offer diversification & loss mitigation, plus varying levels of tranche risk. These defensive attributes, coupled with current CLO yield spreads, may offer the best credit opportunity for 2013.

I like that risk/reward profile, but honestly, current yields & potential returns from leveraged loans/most CLO tranches don’t offer the level of return I’m seeking. Yes, you know where this is going… I want to take those defensive attributes & re-invest them into a more aggressive investment – residual equity tranches!

Time now for a proper introduction: Tetragon Financial Group (TFG:NA)

Tetragon IPO’d at $10 in 2007, as an Amsterdam listed closed-end investment company, primarily investing in US CLO residual equity tranches. Some funds & business development companies (BDCs) have recently added CLO equity exposure, but TFG’s one of the few pure plays out there. It’s managed by Tetragon Financial Management (TFM), which is controlled by the founders of Polygon Global Partners. Um, let’s just dive straight into the bad stuff…

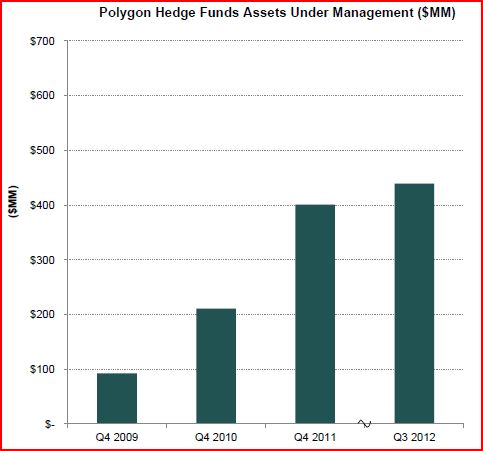

Polygon: Co-founded by the sharp-elbowed Reade Griffith (ex-Citadel), Paddy Dear (ex-UBS), and Alexander Jackson (ex-Highbridge – since ousted from Polygon & Tetragon as an active principal/director). Polygon was a high profile firm in the boom years, with a top reputation as an aggressive credit, convertible, event-driven & special situations investor. Couple this with strong risk-adjusted performance, and their AUM peaked at $8 billion plus. Then 2008 arrived, and things fell apart…awful investment returns, over-whelming redemptions, gating, incensed investors, lawsuits, etc.

But very few came up smelling of roses during/after the credit crisis… All we can really focus on is who actually survived & absorbed some real market wisdom. Polygon essentially re-invented itself in 2009, restarted most of its business from scratch, and has since returned to racking up good performance.

Corporate Governance: Griffith & Dear are both on Tetragon’s board! This is increasingly frowned upon, as it inevitably creates a potential conflict of interest. However, there are 4 independent directors…except I can’t help noticing two have a prior Polygon connection! But this pales into insignificance when we discover TFG’s only got 10 voting shares (the listed shares are non–voting), controlled by….c’mon, have a guess?!

Yep, the investment manager essentially exercises total control. Shall we assume they are perfectly happy with their appointment, now & forever!? What a f**king travesty… Only matched by the sheer idiocy of pre-crisis investors – who the hell bought into an IPO with this kind of governance?

Compensation Structure: Time to touch your toes… TFM charges 1.5 & 25 (a 1.5% management fee, plus 25% incentive fee of all NAV gains). OK, that’s not so extraordinary – Tetragon’s clearly an alternative assets investment fund, and many charge 2 & 20. And there’s a hurdle rate – though at 3 mth LIBOR + 2.65%, it’s now a measly 2.95%.

Except for an important little footnote: Incentive fees crystallize quarterly, with no high water marks! Such rapacity is pretty unprecedented… Again I ask, what idiot investors signed up for this kind of shafting? To add insult, 12.5 mio options (to purchase TFG shares @ $10, exercisable ’til 2017) were awarded to the investment manager for arranging the IPO. Erm, surely the (semi-permanent) investment contract would have been more than ample reward..?

Related Party Transaction: In October, Tetragon announced the

acquisition of Polygon. No great surprise – for long-term shareholders, this deal seemed inevitable… TFG will issue 11.7 mio shares ($99 mio on a share price basis, $168 mio on an NAV basis) to purchase Polygon’s $450 mio in AUM, the remaining 25% of LCM (a CLO manager), another 13% of GreenOak (a real estate fund manager), and $25 mio of contracted fee income. [NB: I’ll return to this transaction]. The deal was independently blessed, but (no matter how generous my assumptions) this seems a pretty bloody steep price to me. Just like Tetragon’s fees…

Analysts seemed puzzled the deal didn’t include TFM (the investment management contract for TFG). I mean, really, that was never going to happen! Think about it, TFM currently earns $102 mio annually – slap on a hefty margin, and what would you consider a fair price for TFM? Arguably hundreds of millions…to internalize the management of a fund with a current $1.1 bio market cap?! Even Griffith & Dear don’t have the pig’s balls to attempt that deal.

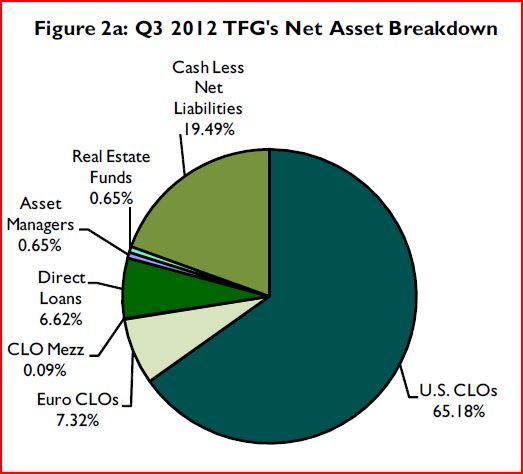

Leverage: Make no mistake, investing in Tetragon is a highly leveraged investment. Not because of borrowings – in fact, TFG had $353 mio of net cash at end-Q3 2012:

But investing in CLO residual equity tranches is inherently leveraged – they generally comprise only 5-10% of total CLO liabilities. This ties back to TFG’s end-Q3 exposure – the CLO portfolio was approx. $1.2 billion, but total indirect leveraged loan exposure was actually $18.7 bio.

Yeah, sounds kinda horrifying, but don’t forget the CLO risk mitigation & loss protections I’ve already highlighted. These are enhanced by TFG’s own macro/micro hedging. And the default assumptions embedded in TFG’s valuation models are relatively conservative vs. the current run rate for leveraged loan defaults. In addition, Tetragon usually acquires a majority stakes in its equity tranche investments, which will enhance their rights & negotiating power if things start turning sour.

ALR: State Street, as independent administrator, calculates Tetragon’s NAV. At end-2008, TFG set up an Authorized Larceny Accelerated Loss Reserve (ALR) – a balance sheet reserve that basically haircut State Street’s valuation(s) to reflect further potential unrealized losses. This reserve peaked at $349 mio by the end of 2009. I guess everybody’s infected by rampant pessimism during a market dive – nobody seemed to notice TFG’s NAV had already bottomed out in mid-09! Ever since, the board has had to eat humble pie as they’ve steadily reduced this ALR…a reserve established for losses that never came! But hey, it’s not all bad…

With just over two thirds of the ALR now reversed, and no high water marks, Dear Griffith & Co must be gobsmacked to have earned the best part of $61 mio in additional incentive fees from this round-trip. That’s real money, even for hedge fund guys…warms your heart to hear such a good luck story, eh?

OK, wow, you’re still with me..?! This stock’s certainly not for everybody – investors may be a lot more comfortable buying in at a later date & incarnation, albeit at a much higher price. But it’s not all bad – let me walk you through TFG’s compelling attractions:

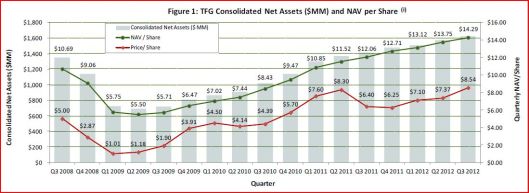

Historic Performance: TFG’s latest NAV chart misses its first post-IPO year – when investment income still exceeded valuation losses & produced a $10.69 NAV by Q3-08 (vs. a $10 IPO in 2007). NAV was subsequently sliced in half, to $5.50 – when you consider AAA mark-to-markets at the time, let alone equity performance, that’s actually an extraordinary performance for a portfolio of (leveraged) residual equity tranches. Since then, in just over 3 yrs, we’ve seen a +160% NAV rally:

This chart actually understates performance. Let’s include dividends:

TFG’s dividend-adjusted NAV has actually rallied +180% since its mid-2009 low. But this ignores the infamous ALR ($254 mio in mid-2009 & $107 mio in the latest quarter). Strip this out at both ends, and you’re actually looking at a 118% rally in underlying div-adjusted NAV. Still nothing to complain about…

And an excellent reminder TFG’s mid-09 ex-ALR NAV was actually $7.52. In my opinion, to see a credit-fund IPO at the peak of the bubble & only suffer a max. NAV drawdown of 25%, provides investors with a reassuring worst-case scenario. [But don’t forget market risk – despite the limited NAV decline, TFG’s share price was completely hammered during the crisis].

Current Performance: This chart should prove useful:

The portfolio‘s currently throwing off an annual $445 mio in CLO cashflows. This corresponds to total P&L income (inc. LCM fees) of $256 mio, a 16.9% gross return on average net assets & a 20.2% return on avg. (ex-cash) investment assets. Management/incentive fees eat up an absurd 6.7% of avg. net assets, while custody/admin/etc. fees eats up another 1.5% (but remember, this includes LCM’s expense base). Investment gains are well in excess of fees, though, while taxes are minimal. This produced EPS of $2.46 & a 20.4% return on equity (RoE). I’m astonished to see TFG trades on a 4.4 P/E!

I don’t want to see any debt issuance here (due to TFG’s inherent leverage), but the investment of surplus cash into share buyback & portfolio investment would significantly enhance RoE. That strategy is only logical anyway, in light of the sheer volume of cash the portfolio’s currently throwing off.

Valuation: Residual equity tranches are very much mark-to-model, not mark-to-market. Let’s focus on US CLOs – they comprise over 80% of the investment portfolio. [TFG hasn’t been increasing their European CLO & US leveraged loan holdings. Since these suffer higher WARFs/default rates and lower yields/IRRs, ideally we’ll see them gradually divested]. The lagging 12-mth loan default rate for TFG’s US CLO & leveraged loans is only 0.6%, vs. a US institutional default rate of 1.0%. The weighted-average WARF is now at 2,528 – a 300 pt improvement in the last 3 yrs. In addition, 100% of their US CLOs are currently passing their junior-most O/C test.

TFG’s valuation model actually assumes an average 2.6% default rate (and a recovery rate of 73%). The weighted-average IRR on US CLO equity’s now at 20.0%. The ALR further increases discount rates within the portfolio. The average carrying value for US CLO equity is now at $0.75 on the dollar, while European CLO equity’s at EUR 0.43.

NAV Discount: The latest (end-Nov) NAV is $14.91, putting TFG on a 28% discount to NAV. If we exclude cash ($298 mio), TFG actually trades on a 34% discount! Ah, you say – Tetragon owns a bunch of potentially risky assets, of course it trades on a wide discount! But that’s a pretty common misconception…

As long as you believe assets are fairly/conservatively valued, a fund discount based on risk makes no sense. The risk’s already reflected in the pricing (riskier assets are generally valued at far higher discount rates). Of course, there are other reasons for a discount – investor sentiment, for example. But over time, that works both ways – my favourite investment strategy is to buy at a discount & harvest at a premium. And sentiment’s often backward looking – it can fail to notice a new/evolving strategy, or set of circumstances, and relative valuations are frequently ignored.

Relative Valuation: Absolute valuations are all that matter in the end, but relative valuations often provide excellent context & a more immediate indicator of value. If you’re still convinced TFG & its portfolio deserve a wide discount, peer valuations are going to prove a challenge:

I keep an eye on half a dozen leveraged loan (& senior CLO tranche) funds (mostly London-listed) – they currently trade at a 3% premium, on average. There’s a bunch more listed in the US and, as usual, the vast majority trade at a (sometimes significant) premium. But let’s focus on the (relatively) pure plays – they’re pretty limited, and all (oddly enough) are listed outside the US:

i) Greenwich Loan Income Fund (GLIF:LN) – 11% premium.

ii) Carador Income Fund (CIFU:LN) – 6% premium.

iii) European Residual Income Investments (ERII:LN) – 33% discount. ERII’s invested in the residual equity tranches of mortgage vehicles, but still offers a useful comparison. Discount’s wide, but shares are playing catch-up – NAV jumped by approx. 44% just in Q4, while the share price nearly tripled in the past year:

iv) Volta Finance (VTA:NA) – 11% discount. VTA’s a bit of a hybrid: It has almost two thirds of its portfolio invested in CLOs, but only about a third allocated to residual equity tranches.

Peer valuations definitely flag up the potential for Tetragon shareholders to benefit substantially from discount compression.

IR (& Share Repurchase): Aside from the obvious…I’ve generally found TFG’s investor relations to be otherwise quite exemplary. A wealth of information is provided in their reports, presentations and website. Residual equity is pretty exotic, and its inherent leverage isn’t immediately apparent – they do a pretty good job of laying out the portfolio & highlighting the risks involved. [I look at certain funds, and shudder – I have to wonder how many of their investors think they’ve bought into some kind of low-risk loan fund].

TFG has paid a cumulative $2.12 in dividends since inception. The current annualized dividend is $0.46, a 4.3% dividend yield. They’ve also maintained an aggressive & opportunistic share buyback programme. Up ’til end-Q3, they’ve purchased a cumulative 19.4 mio shares, at a total cost of $106 mio. This equates to $5.44 per share – a v substantial discount to the current share price & NAV! Since then, they’ve executed a fresh $150 mio dutch auction buyback at $9.75. And just last week, news came they plan to continue with a significant level of market buybacks in the next few months.

[Of course, there was another v obvious motivation for the dutch auction..! Perhaps to distract attention from the price & related-party nature of the Polygon purchase?! Actually, it kinda worked… I say to shareholders: Accept that gift horse with thanks & then renew efforts to hold their feet to the fire!]

Activist Investors: Shareholders are in good company here. One investor, Daniel Silverstein, launched a derivative shareholder lawsuit in 2011, stating: ‘…defendants have engaged…in the looting of TFG. The investment manager, with the active complicity of the TFG board, has expropriated almost $205 million in unjust fees.’ Unfortunately, that case has since been dismissed.

Leon Cooperman, a 10% shareholder, has been equally vocal – read his letter! Even if they ignore him directly, I suspect we should thank his efforts & vigilance for the ongoing IR improvements, the recent dutch auction buyback, and a tentative commitment to a US listing. Despite his distaste, the size of Omega’s stake speaks volumes about his opinion of TFG’s value (in fact, he’s nominated it as a top pick for 2013).

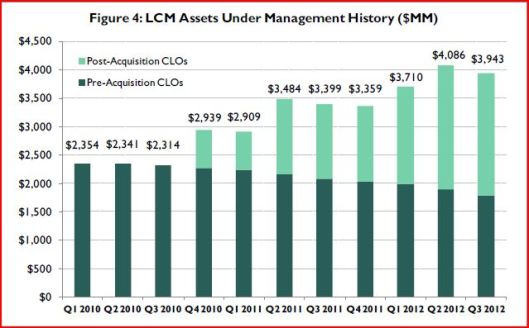

Evolving Strategy: I have to confess, what really excites me about Tetragon is its evolving asset management strategy. This may prompt TFG to trade at a substantial premium in due course, as book value fails miserably in capturing the value/success of such a strategy. Tetragon acquired a 75% stake in LCM, a CLO manager, for a negligible consideration in 2010 (from Calyon). The recent purchase of the remaining 25% offers further synergies & cost-savings, and AUM history since acquisition bodes well for the future:

LCM’s AUM has subsequently increased another 13%, to $4.5 bio!

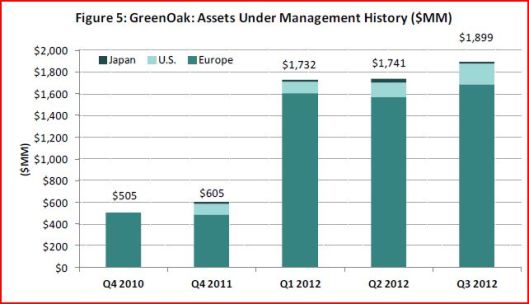

Tetragon also increased its stake in GreenOak (a real-estate fund founded by senior ex-Morgan Stanley employees) from 10% to 23%, and made a $100 mio co-investment commitment. The growth in AUM, since acquisition, is even more impressive here:

Finally, we have the recent purchase of 100% of Polygon’s $450 mio in hedge fund AUM (spread across 3 convertible, European event-driven & mining equities strategies), plus $25 mio of contracted fee income from a fund in run-off. Recent fund-raising history’s been equally rapid, and this acquisition is likely to prove the most exciting, despite the smaller AUM:

This signals an acceleration in Tetragon’s new strategy, and brings Polygon’s expertise & asset management platform in-house. This infrastructure is capable of supporting multiple alternative asset managers, and of handling multiple securities/ & geographies. The intention is to now transform TFG into a ‘world-class financial services company‘. This comes at a time when banks are reducing/de-risking their lending capacity & forcing out their proprietary trading talent, when institutional investors are desperately seeking genuine alpha, and increased regulation & due diligence are consolidating resources and capital into larger asset managers.

Seeding is the ideal expression of this strategy: Backing new alternative managers, ideally in-house, with capital, administration & marketing/fund-raising resources – in exchange for partial/total ownership of the resulting fund management revenues. This would also diversify Tetragon away from CLOs ultimately, into a much wider range of uncorrelated/alternative investment strategies.

The deal also aligns management far more closely with investors. Obviously, ongoing TFM revenues & profit will remain substantial, but Polygon principals will now own 11.7 mio TFG shares, which vest over 5 years. They also own 12.5 mio share options, which have only recently come in-the-money. This offers them a huge new incentive to increase NAV & (more importantly) the share price. They also now operate under a non-compete/exclusivity clause – all new Polygon fund-raising & growth is within TFG.

Shareholders may dislike the piggish rapacity of Griffith & Dear, but it will now be (mostly) working in their favour! I can’t help thinking of John Hempton’s recent pithy words in a different, but v topical, context:

‘They’re scumbags, but they’re [your] scumbags..!‘

Current NAV: TFG’s end-Nov NAV doesn’t include the impact of the dutch auction, or the current EPS run-rate. I calculate subsequent share buyback adds a full $0.81 in NAV-accretion, plus an additional $0.34 in subsequent net earnings (based on a $2.46 EPS run-rate). [Obviously, investment gains/losses could exert a significant impact, but v recent market/peer indications are positive]. This pegs the current NAV 8% higher, at $16.06 – which puts TFG on a current 33% discount, or an (ex-cash) discount of 37%.

Intrinsic Value: I’m sure investors will continue to focus on Tetragon’s published NAV, but success with their asset management strategy should mean intrinsic value increasingly diverges from & out-paces NAV. Calculating intrinsic value is a far less simple approach – one needs to factor in the dilution from the Polygon acquisition shares & share options, assess the true value of the asset management businesses, and perhaps include an eventual unwind of the ALR. I actually calculate TFG’s intrinsic value is currently within 3% of its NAV, so I won’t bore you with the math right now. But intrinsic value will clearly become an increasingly important metric, so I expect I’ll revisit it in more detail at a later date. [Just email me if you wish to discuss further].

Summary: Looking ahead, there are 3 paths for the US economy: a) QE & fiscal stimulus finally produce a growth/inflation surge – v positive for corporate credit, and CLOs (unlike most fixed income) will benefit from the surge in rates, b) things continue to muddle along – low rates will be sustained, CLO models already price in higher defaults, and CLO yields/IRRs look v attractive on a relative basis, or c) things take a turn for the worse – well, CLOs performed pretty well during the last crisis, and we know the US government & the Fed will take (near) infinite measures to keep the party going…

Focusing on Tetragon, we have: Excellent relative performance during the crisis, substantial post-crisis NAV growth, a history of share repurchases, current 20% RoE & IRRs, far higher peer valuations, plus the growth potential offered by its evolving asset management strategy & platform. [An eventual US listing would potentially add far higher visibility & valuation. A higher dividend ultimately would also attract more investors, but at the moment I prefer to see cash being ploughed into NAV-enhancing share buybacks]. In my opinion, this certainly deserves a 1.0 Price/Book Fair Value – in fact, sustained success in their asset management business could usher in a significant premium to book eventually – which corresponds to a $16.06 Fair Value, and a 49% Upside Potential.

I now own a 2.8% portfolio stake in Tetragon. The inherent leverage/risk of their CLO residual equity tranche portfolio has somewhat limited my position. If TFG does, in fact, evolve into having a more diversified investment portfolio, and a much larger asset management & seeding business, I’d accordingly expect it to become a larger & more permanent portfolio holding.

- Tetragon Financial Group (TFG:NA): $10.75

- Market Cap: $1,061 mio

- Net Cash: $181 mio (estimate)

- Dividend Yield: 4.3%

- P/E: 4.4

- Current NAV: $16.06 (estimate)

- Price/Book: 0.67

- Tgt P/E: 6.5

- Tgt P/B: 1.00

- Tgt Mkt Cap: $1,585 mio

- Tgt Fair Value: $16.06

- Upside Potential: 49%

Pingback: Mid-Year 2013 – Performance Update | Wexboy

Pingback: Portfolio Allocation (XIII – Alternative Investments) | Wexboy

Pingback: EIIB…Ex-Bank – Love It! | Wexboy

Pingback: Hitting The Century (XI – Distressed) | Wexboy

Pingback: My Dirty Little Dividend Secret… | Wexboy

09-Feb-2014: Tetragon Fin Grp $TFG:NA nw trading on a 39% discnt to avg NAV – announces a $50 M tender. My portfolio holding increases frm 2.4% to 3.5%

–

–

For some bizarre reason, I accidentally flipped to a EUR instead of a $ NAV/target towards the end of my original post. In my mind, I suspect I was already spending (imaginary) profits in EUR in the coffee houses/flesh-pots of Amsterdam. 🙂

Can’t believe I didn’t notice & correct it ’til now! No reader mentioned it, but if you happened to notice it, I presume/hope you didn’t think I was suggesting a (EUR 16.06 NAV * 1.3190EUR/USD =) $21.18 price target. Well, at least not yet..! 😉

Pingback: Catching Up On Some More Links | Value Investing Journey

Pingback: Hitting The Century (X – Distressed) « Wexboy

Pingback: Why I Write… « Wexboy

tetragoninv.com/~/media/Files/T/Tetragon-Financial-Group-Limited/news/pressreleases/2012/TFG-December-2012-Monthly.pdf …

My current TFG $16.06 NAV estimate wasn’t too bad at all – in fact, improved model assumptions ultimately boosted TFG Dec NAV to $16.41

tetragoninv.com/~/media/Files/T/Tetragon-Financial-Group-Limited/news/pressreleases/2012/TFG-December-2012-Monthly-additional-disclosure.pdf …

All credit to TFG for highlighting their diluted NAV – in fact, it’s frankly too conservative – as I pointed out above, if you fair value the asset mgmnt biz, a potential ALR reversal, etc. my proforma NAV/intrinsic value is actually v close to published NAV (and shd exceed it in due course, possibly substantially, presuming continued (rapid) growth in AUM).

Thanks for all the hard work.

I bought in some years ago (a very modest stake) when the cash in the balance sheet nearly exceeded the share price (buy price under $1.50) and I now love the running dividend return on my (small but 7+ bagged) original investment.

You are correct the governance and fees are a disgrace (not a great advert for Amsterdam listing requirements), but I have enjoyed the ride and will continue to hold. I agree that fund management will help enhance more common interests of management and shareholders.

I also took positions in GLIF, RECI & Carador as the market mis-priced the value.

Thks, Flying Pig – unfortunately, TFG wasn’t on my radar when the share price traded down in the $1 direction. Considering the colossal discount at the time, I hope I wd have least considered buying it – but a good buy on your part, that took balls at the time!

And, yes, RECI was a v obvious value not that long ago..!

Convincing stuff as usual Wex but do the potential positives and inherent value of Tetragons AUM really outweigh the glaring governance issues you’ve exposed?

Specifically, Cooperman’s letter would be more than enough to spook me. Granted many minority shareholders are forever complaining about this and that to keep management on their toes but the allegations Cooperman and Silverstein have raised are particularly serious, albeit the lawsuit dismissal.

I’m particularly gobsmacked by Cooperman’s dividend grievance:

“Why is it that from the date of the company’s IPO in March 2007, through the end of 2011, cumulative management and incentive fees paid by Tetragon to Polygon, at $300 million plus, exceeded cumulative dividends distributed to Tetragon shareholders by almost 50%”.

It’s blatantly clear to even a novice like me that Tetragon’s management view shareholders as a source of capital and nothing more. A “we win now, you win later…maybe” mindset is pervasive as you repeatedly acknowledge.

So I guess I’m just intrigued by this paradoxical purchase of Tetragon despite the fact you have clearly unearthed shocking revelations about its treatment of shareholders???

Best Regards,

Hi Michael,

All in all, I now reside in the same camp as Mr Cooperman – money talks, his stake tells you his real opinion here.

I sometimes joke: ‘When bad things happen to companies, good things happen…to new shareholders!’ Everything bad abt TFG is true, but the fee structure is already embedded in a highly attractive 20% RoE, and you get a whopping great discount as well (in absolute & relative terms).

You prob didn’t need to say ‘allegations’ above – it all happened…legitimately. In fact, from one perspective, shareholders even agreed with the ALR at the time ( because they drove the share price far lower!).

Ultimately, the size of my holding right now is my current compromise between pros & cons. I may be happy to increase my position in due course…

I will have to be proved right or wrong, but I think we may have seen an inflection point – asset management will become increasingly important, and also management’s shares & options create better alignment. I also think management wd like a US listing as much as shareholders would ( though I think that event is not so close right now), and that may demand a real governance/fee/etc. overhaul beforehand, on a voluntary & involuntary basis.

Cheers, Wexboy

Hi Wexboy – does the NAV of tetragon take into account the horrible fee structure ?

I have done some analysis on these vehicles in the past and what has occurred to me me is that if you look purely at he FCF yield of say VTA, CIFU and TFG that they are all quite similar (i.e. 4 – 5 x)

My conclusion was that TFG trades at a discount because of it’s egregious fee structure a – i.e. if you have the same underlying risk on two bonds and someone “steals” 20% of your coupon then that bond should naturally trade at a discount… I chose to invest in CIFU as it consistently pays out 50% of all free cash as dividend and reinvests the other 50% in similar asset and its running at much lower cost base and REALLY is a pure play (i.e. no Asset Management assets) – adding to that ISA eligible and CIFU stands out from my perspective.

TFG seems to be hoarding cash and has argued against paying dividends – that makes me worried – rather pay dividend and let investors decide what to do with it ? Look at the dividend yield of CIFU / VTA and you will see the difference. Management hoarding cash and not significantly doing anything with it is not ideal (justification given on a conference call was: “if you look at the cost income ratio of a bank we have a better dividend yield”… – smart argument comparing yourself to a bank but does not do it for me). The buyback program is hampered by their listing apparently – where on A’dam stock exchange you can only buy back x% of daily volume – which is naturally low. They really should pay a big dividend with the cash – but would you if you had such an egregious overlaying fee structure ?

On VTA: difficult to build size in and it has some synthetic CDOs – which makes it less of a pure play compared to CIFU. Lastly, you should look at KFN as well – very similar.

Anyways this is my 2 cents… like your blog!

Thanks.

I will often haircut an NAV by one year of fees, if they’re over 2% of NAV ( I do something similar for regular cash-burn companies too). When NAV growth is steady – that is, there’s a run-rate – I generally see no need for that.

I am sometimes puzzled by the widespread focus on fund fees & discounts. If a company was similarly earning a 20% return on equity, and with a high cost base, people would price it generously and v few would ever comment on management salaries etc.

Not to excuse TFM at all though…

I actually approve of TFG’s cash policy to date. They eliminated debt ( a long time back now), and the IRRs available on share buybacks & US CLO equity investments have been far more attractive than dividends.

Dividends will make sense though eventually, and it wd be nice to see the arrival of the dividend droolers…

Yes, KFN is among the half-dozen funds I mentioned I keep an eye on.

Cheers

Wexie, are you running a fund? You must be, otherwise why would anyone in his right mind spend all his time researching a 2.8% position with a 50% upside? That’s like a potential 1.4% gain over the next x years? Given a 1M portfolio, 14K in money. Does the chicken cross the road to make 14K? 🙂

Hey Ruyiswick,

I know…er, strike that, there are plenty of young ladies who would cross the road for 14 dollars even..!

Erm, thks, I think there’s a compliment in there maybe?! You have a point, but:

a) I have to do the research first anyway before even thinking of buying/sizing a stake, b) research takes abt same time for big & small positions, getting it down on paper adequately is sometimes the longer/more difficult challenge, c) not v sensible to factor it into my target, but obviously NAV is a moving target, so that may offer plenty of additional upside potential, and d) TFG may become a v different beast in due course, so better research now will prove useful & may permit a quick increase in my holding size at some point.

Cheers,

Wexboy

i feel your pain: sometimes I read up on something and it is so BAD/useless that i have to write it up PRECISELY because it is so god awful– stuff like MVO – talk about ripping off the dumb individual investor’s face with grade 7 sandpaper! this case is a fascinating situation, the brazen-faced proctolo-analizing of investors by management blows the copulating mind of this little white mouse, i got to say.

keep it up — very exciting to read everything you write, luv a man who can think AND talk about it

ps. hey, if you happen to know any girls willing to cross this way for 14 bucks, give me a holler! 🙂

Thanks – so I guess I’d be earning, say $7, a pop..?! 😉