Tags

activist investors, An Grianan, Camposol Holding, catalyst, dairy, DCP, Donegal Creameries, Glanbia, Ian Ireland, Irish shares, Irish value investing, Monaghan Middlebrook Mushrooms, Produce Investments, Ronnie Wilson, seed potatoes

Last week, I published a surprisingly popular post: I identified myself as an activist investor, rather than necessarily a value investor (or, heaven forbid, a growth investor!). I meant this in the broadest sense – an activist investor sees a v different company & valuation to the one which currently exists (in the minds of most investors). That obviously implies a corporate transformation – and catalysts are a great way to ensure it occurs. Hopefully, you’ve noticed this approach in a number of my previous investment write-ups, but I also promised a brand new example! So, without further ado, let me introduce:

Donegal Creameries plc (DCP:ID)

OK, let’s just dive right in – here’s a snapshot of their last 5 years:

Ugh, that’s enough to make any investor lactose intolerant..! Revenues have declined 38% over the last 5 years – not surprisingly, cumulative operating profit (OP) is a puny EUR 0.5 mio, while net income’s not much better at EUR 3.1 mio. In per share terms, it looks worse: Net asset value (NAV) declined 12% – even if we add-back dividends, shareholders only earned 1% for the entire period. At this point, we can safely assume the majority of investors (value, or growth) have already discarded Donegal, probably for years to come, as a potential investment…

But I confess, I cheated a little on the table above: All the figures are genuine, but I neglected to mention the sale of a major division in Oct-2011. And Donegal’s suffered significant investment property write-downs. Of course, a smaller minority of investors will have insisted on reading through the annual reports – here’s a (brief) revised snapshot of what they’d find:

Segmental reporting doesn’t allow me to go back further, but I’ve restated 2010 revenues to exclude discontinued operations. This shows a healthy 15% revenue growth for continuing ops. in 2011-12. However, there seems little overall change in adjusted OP (on a pre-exceptionals/write-downs & continuing ops. basis), despite the sale. In valuation terms, averages probably make more sense here – adj. OP averaged EUR 3.3 mio, while average adj. EPS was EUR 0.512.

So, what would our value investor make of this? Well, we could value this six ways from Sunday, assuming debt’s at a manageable level (which I think it is), but let’s keep it simple: I’d expect most investors would come out somewhere between an 8 P/E (on avg. EPS) & a 1.0 P/B. On average, that works out to a EUR 4.92 target price. That’s a 14% discount to NAV, and offers an upside potential of 36% – not so shabby, but certainly not a story/valuation that would really set a value investor’s heart aflutter…

And what about our growth investor? Oh Jesus – he’s fallen asleep at the wheel, spun off the road, and now his car’s ablaze. Not even a milk tanker full of water could save him. Rumour has it, he hated the stock from the minute he heard its bloody name…

But as for me, I can’t stop thinking about Donegal Creameries in the past year. Because I see a v different company hiding inside this wallflower…

I trace this back to the sale of its dairy & agri-stores business in late 2011. This was a seismic event – Donegal’s dairy roots go back a century. Don’t under-estimate the bravery of a board who overturns that much history… Or how smart they were: i) realizing up to EUR 21 mio in cash from a low/volatile margin business, and ii) dodging the looming abolition of EU milk quotas in 2015, which would require a large & probably uneconomic investment in processing capacity. [I wrote about this recently re Glanbia (GLB:ID). btw I’m thoroughly bemused by GLB’s current (adj cont) P/E ratio of 20.7, while DCP’s is only 8.2!?] This major sale is a catalyst that’s propelled Donegal down an (irreversible) path to eventual transformation. And I happen to think the story will end with another major sale also…

I guess you could also describe the sale as a crash diet for Donegal – a great decision & a great result. But as we know, crash diets don’t work – what’s really needed here is a long-term diet & exercise plan to cut the fat & tone the muscle. Pull up a chair & crack a beer, let’s see what that looks like:

[NB: Donegal’s 2012 final results were released, but their annual report isn’t out ’til June – I may rely on the 2011 report & notes for certain info. & assumptions. btw If you’d like a copy of the Excel file I’m using here, just email me].

Company Name: The name’s probably worth a 20% discount on the bloody share price! Not to mention it’s misleading – sure, they still have a yogurt business, but they couldn’t be remotely described as a creamery. Time to cut the fat & change it to something like Donegal Group. Or even Donegal (why not visit?!), which has an appealing simplicity.

The Board: The company had 26 directors in 2005, and was still sporting 13 in their last annual report! This is an absurd Irish agricultural legacy. As any farmer knows, a healthy cull is needed now & again. The company’s forging ahead on a new path, so retiring all farmers & 10 yrs+ directors makes sense. That just leaves Ian Ireland (MD) & Michael Griffin, both ex-Kerry Group (KYG:ID) men, in situ. Considering Donegal’s size, 5 directors seems reasonable – so a new Chairman, FD (as promised) & 1 NED would be required. I estimate an annual EUR 102 K saving.

And the company’s now 40% smaller than mid-2011, in revenue terms. While some functions aren’t scaleable, a 20% HQ reduction seems appropriate. I can’t confirm this occurred in 2012…I shall assume not: The 2011 report appears to list 15 HQ employees (ex-MD & FD), so EUR 226 K of annual savings looks achievable. Other G&A savings may also be possible.

Speciality Value Added Dairy: Donegal continues to invest in its (primarily) premium yogurt business, consisting of The Different Dairy Company, Biogreen & Chef in a Box. Unfortunately, ‘invest‘ is often corporate-speak for ‘lose money‘… The 2011 segment result was EUR (1.4) mio & losses accelerated for the last 12 months (LTM) to EUR (1.9) mio (as of mid-2012). While some losses may be attributable to the Organic for Us brand (recently divested), the division’s abrupt absorption into a new/larger Food-Agri segment doesn’t bode well. Super-charged revenue growth might have compensated, but unfortunately mid-2012 LTM revenues were only 13% ahead of 2010.

Potentially this is an attractive business, but even if losses were reduced or eliminated, it seems obvious margins would always remain under threat & inferior to larger dairy/food companies. In fact, in the hands of a rival, I’m sure revenues could quickly double, on (say) a 10-20% margin – that’s a business easily worth a 1.33 Price/Sales (P/S) multiple. Of course, right now, it’s arguably worth nothing. Despite its key strategic status, it’s better off sold…

The Rumblers & Good Heavens brands may well be worth more, but let’s assume a rival shares only a fraction of the potential upside with Donegal. Say, 20% of mid-2012 LTM revenues (EUR 9.2 mio) – that’s a possible EUR 2.5 mio cash consideration received within the next year. Obviously, the real benefit here is the elimination of losses & the exposure of Donegal’s underlying profitability.

Stevedoring: Far less exotic than it sounds, and I’m sure there’s little need to make a disposal argument here! Donegal owns 75% of McCorkell Holdings, based in Derry, and 2011 revenues of EUR 1.3 mio are representative of the last few years. Operating profitability’s break-even, on average, but I suspect the book value of GBP 1.4 mio is understated. Obviously, the small size dictates an employee/local sale, so let’s assume 75% of book (EUR 1.3 mio) is harvested within 2 years.

Trade Receivables: Total receivables are EUR 38.6 mio at end-2012, and I estimate EUR 33.6 mio are trade receivables. This represents 5.0 months of revenues!? These are extraordinarily generous terms – they tie up surplus shareholder capital, and I’d argue longer terms actually increases the risk of non-payment. A company-wide programme (over two yrs) to gradually introduce average 3 mth terms is the obvious remedy. This would release EUR 13.5 mio of surplus cash, and I believe terms are still generous enough not to impact business or customer relationships in any significant way. We can also count the release of a EUR 2.5 mio contingent earn-out (from the dairy/agri-stores sale) which was received subsequent to yr-end 2012.

Other Investments: There are a number of legacy investments on the balance sheet. They include EUR 49 K of quoted shares, EUR 100 K of prize bonds, and EUR 518 K of unquoted shares (primarily in One 51). With the recent rally to EUR 0.38 in One 51 shares (vs. EUR 0.15 as of yr-end), these investments can be sold/redeemed for EUR 1.2 mio in the next year.

Investment Property: Donegal now has EUR 25.7 mio of investment property on the books, down from EUR 41.8 mio at end-2008 after 4 years of write-downs. Anybody acquainted with the Irish property collapse will find this a surprisingly mild decline… But Donegal’s investment property & valuations are mostly agricultural, and Irish land values in the west/north west fell by approx. 36% since 2008. We have enough detail, broadly speaking, to assemble our own valuation here:

– An Grianan Estate: An Grianan’s 3,000 acres makes it probably the largest farm in Ireland. Unlike much of the land in Donegal, it’s fertile & relatively flat. Checking ‘cross the web, I can’t determine if the 500 acre Inch Lake is within/additional to the total acreage. But lakes don’t necessarily come free anyway (just ask our economically exploited American cousins), so let’s split the difference & assume a 2,750 acre farm size. A valuation at least equal to Donegal’s latest average price of EUR 8,864 per acre is justified, and its 415,000 gallon milk quota might sell for 13 cts per litre – for a grand total of EUR 24.6 mio.

– Ballyraine Campus: Student residential property near LYIT. If I understand correctly, Ballyraine was initially valued at EUR 3.75 mio after its 2003-04 construction. It caters for up to 226 students, at a minimum rental per person of EUR 55 per week (higher rates are charged for summer rentals). No matter how I juggle figures & assumptions, based on a long-term 7.8% average residential yield, I can arrive at that same EUR 3.75 mio valuation at a bare minimum. [NB: Donegal’s valuation assumption is a conservative 9-10% yield. Taking a medium term view on highly reliable student accommodation, substituting a long-term 7.8% yield seems reasonable].

– Oatfield Building: The Oatfield building was retained & valued at EUR 3.25 mio in 2007, when Donegal sold Oatfield Confectionery. It’s difficult to determine if this asset’s now a (potential) commercial or development property. Irish commercial prices are down (say) 60%, while some development assets have declined up to 90%. Let’s assume a cumulative 75% loss in value, which leaves a residual value of EUR 0.8 mio.

– Agri-Stores/Other: In 2007, Donegal bought a property in Bridgend for EUR 0.8 mio. Let’s assume a 75% write-down to EUR 0.2 mio for this property. Also, while the agri-stores business was disposed of at end-2011, 9 agri-store freeholds were retained (at a EUR 1.5 mio valuation). Let’s now assume a 10% decline since to EUR 1.4 mio.

That’s a grand total of EUR 30.7 mio – wow, I never expected to be the one marking up Irish property..!? That’s EUR 5.1 mio in excess of Donegal’s own valuation. But I can live with that – when it comes to write-downs, companies are usually in denial long after the peak, and then throw the baby out with the bath-water… Anyway, I’m certainly not going to suggest all this property could be sold tomorrow at that kind of valuation! But I do think management can cherry-pick half the assets & slowly but surely sell them over the next 5 years (at book value, or better). That’s only EUR 3.1 mio in sales a year.

And should I remind you around 80% of this property’s agricultural, and Irish agricultural land’s actually in a (mild) bull market again (since 2010 & further gains are expected)?! Shocked? You shouldn’t be, UK & US farmland both acted like there was never a bloody financial crisis & have enjoyed v healthy bull markets for years now. Which Irish farmland would have happily joined, but first had to deal with the excesses of 2006-07, when developers chased up land prices to ludicrous levels.

All that’s really needed is a gradual carve-up of An Grianan – the time for sentimentality, or death threats (?!), is long gone now. Or the Donegal execs. could have a little fun. This summer, they should take a first-class trip, drinking their way across the US – all they need to do is find one US billionaire pining for his Irish roots. Considering the size of the land purchases some of these guys are making, buying An Grianan in its entirety would be a mere breakfast bagel with their pot of morning-after black coffee…

One final point – there was a EUR 3.3 mio deferred tax liability against investment property in 2011. I’ll add an additional EUR 1.7 mio, to reflect my incremental valuation, which increases the liability to EUR 5.0 mio.

Associate Loans/Investments: Donegal has a 22.4% stake in Northwestern Livestock Holdings, which owns development land that was worth a bloody fortune in the bubble years. Unfortunately, significant debt was also taken on, and as prices & prospects collapsed the company spiralled into negative equity. Let’s presume the equity’s worthless, and I suspect Donegal’s loan to NWH will ultimately prove irrecoverable. There’s also a 42.7% stake in Leapgrange, which owns forestry – net assets in 2009 were EUR 0.8 mio, so I think Donegal’s EUR 0.3 mio holding remains intact as a long-term asset. Then there’s a Monagahan Middlebrook Mushrooms EUR 0.5 mio loan (after a EUR 0.8 mio repayment in 2012), which will be repaid in the next year.

Debt: Total debt now stands at EUR 22.0 mio – I believe only a slight reduction in debt’s required, to EUR 16.2 mio (I’ll explain below). Therefore, EUR 5.9 mio of the cash proceeds detailed above will be earmarked for debt reduction, at some point. And while we’re mentioning debt, it’s worth highlighting: i) fortunately, Donegal has no legacy pension deficit issues, and ii) all other/remaining balance sheet assets/liabilities (i.e. those not carved out above) are assumed to be part & parcel of any valuation/sale of the operating businesses.

Other Operating Divisions:

– Agri-Inputs: After the sale of the agri-stores, this division now consists solely of the Smyths Daleside animal feed business. I actually like this business – it’s a steady earner & has little correlation with the economy. In fact, it’s negatively correlated with the weather – v handy when you have other companies complaining about said weather (and I don’t even buy retailers!). Unfortunately, it’s a pretty low-margin business: With Donegal’s annoying habit of chopping & changing segments, we’ve only 2 years (2010-11) of stand-alone financial data to rely on here. 2010 revenues were EUR 25.1 mio & OP was EUR 1.0 mio, and 2011 improved to EUR 27.7 mio & EUR 1.2 mio, for an average OP margin of 4.2%.

This is actually head & shoulders above the industry – look at Ridley (RCL:CN), Carr’s Milling Industries (CRM:LN) & Wynnstay Group (WYN:LN). In the past few years, their animal feed segment margins have only averaged 2.2% (2.6%, exc. WYN). Good news, but it also suggests little scope for Donegal to improve margins, whether organic or acquisition-led. This probably explains why they’ve tagged it as non-strategic.

Which may be marvelous timing, as the weather turned 2012 into a banner year. The animal feed business isn’t broken out for last year, but I suspect revenues jumped 30%+ & OP perhaps doubled! Those figures may well get discounted, but this offers the perfect set-up to sell the business in 2013. But I think a sale makes most sense coupled with a specific plan to bulk up the produce business.

– Produce: The produce business is solely focused on their proprietary seed potato business which exports to over 40 countries world-wide. The company sums it up far better than I could: ‘The Board remains confident in the strong growth potential of the Group’s core seed potato business underpinned by increased demand for food from global population growth, the westernisation of diets in emerging markets and issues around water availability [potatoes produce more carbohydrate per unit of water than most global carbohydrate staples]. All of these will enable the Group to become a leading global player in its core seed potato business. Overall, our seed potato business, is a high growth business generating strong operating profit margins, has low capital expenditure requirements and yields consistently strong returns on capital. It will be the key strategic focus for the Group going forward.‘ Here’s the business over the past 5 years:

2012 was an obvious bad weather outlier – I think we can be confident of continued revenue growth, and a return to/improvement on their peak 10.6% OP margin. There’s v little in the way of listed-peer companies globally – I think KWS Saat (KWS:GR) is the best example, and nicely illustrates (see p. 3 of their latest annual report) the possible growth & margin expansion opportunities ahead for Donegal.

– Valuation: For Agri-Inputs, I’ll assume last year was a total outlier, and use 2011 revenues & an average 4.2% OP margin. [This is a place-holder valuation – ideally the business is sold to fund a Produce acquisition]. For Produce, I’ll take 2012 revenues & presume the former peak OP margin of 10.6% is quickly restored. We then include EUR 0.3 mio of identified board & HQ savings, plus some v minor unallocated expenses. Here’s a pro-forma P&L:

You’ll note EUR 16.2 mio of Donegal’s current debt would enjoy 10.0 times interest coverage. That level of debt’s sustainable, and I believe a company with an 8.2% OP margin is fairly valued (and could be sold, complete with debt transfer) at a 0.7 P/S multiple. That’s a EUR 43.2 mio fair value – which equates (assuming a 12.5% tax rate) to a reasonable 10.9 P/E.

Monaghan Middlebrook Mushrooms (MMM): I thought I’d save the best ’til last..! Donegal has a 35% stake in MMM, which is now the second largest mushroom producer in the world. MMM’s founder & CEO, Ronnie Wilson, started the company in 1981 & has expanded into the UK, Europe & N America. In 2011, with GIMV (GIMB:BB), MMM acquired Walkro International, the largest producer of substrate for the mushroom industry in Europe. Just last month, they also acquired Prime Champ Group out of bankruptcy.

Turnover’s grown dramatically over the years – in 2011, I estimated revenues were about EUR 300 mio. But Donegal has now published a share of revenue for associates figure for the first time – which implies MMM’s turnover actually soared to EUR 429 mio in 2012 (benefiting from acquisitions & an improved UK market). Beyond that, we’ve little in the way of financial statements, though we can make some reasonable inferences about profitability over the years. But I’m not sure how helpful that would be – MMM’s clearly run for growth, and margins may well be compressed to ‘fund‘ that growth. But this is a familiar story – companies inevitably reach a point (often post-IPO) where a more measured growth strategy rapidly captures that underlying margin potential.

If we look to Produce Investments (PIL:LN) (which grows & sells potatoes), we see it’s having a bad year, but its OP margin normally averages around 4.4%. There’s really no listed mushroom producers (except some Japanese companies – probably not the best peer-comparison, but check out Hokuto (1379:JP) if you wish). But I think Camposol Holding (CSOL:NO) (the world’s largest producer of asparagus & avocados) & Webster (WBA:AU) are valuable read-throughs & suggest 10% operating margins are ultimately achievable. Consider the more complex mushroom production process, their superior weight:value ratio, and far shorter shelf life, plus MMM’s market dominance (in the UK & Ireland) – and a significantly higher operating margin than potatoes certainly seems justified. On the other hand, at this point, let’s not assume industry-leading margins either. Splitting the difference makes sense here, which would imply a 7.2% operating margin.

I’d suggest a 0.6 P/S multiple’s now appropriate for Monaghan Middlebrook. But note Donegal’s granted an option on 5% of MMM to the CEO & senior execs. – this was for 5 years ending in Dec-2011, but oddly enough doesn’t appear to be expired or exercised yet. Presuming their stake does end up to be 30%, Donegal’s holding is worth EUR 77.2 mio. I hardly need to highlight this is a multiple of its recorded book value, and Donegal’s own market cap…

Cash & Share Buyback/Tenders: Consider the scale of the potential cash generation implied above, and Donegal’s equally large discount to intrinsic value… A strategy of shrinking their outstanding share count is often the simplest & best way for companies to utilize cash, return capital & enhance shareholder value. In this instance, share buybacks & tenders clearly offer the most compelling & attractive utilization of all cash raised (except EUR 5.9 mio for debt reduction).

I shall assume the share price increases 60% in the next year & continues to increase at half that growth rate (30%) for the following 4 years. Disagree? Think the share price will increase at a slower pace? Wonderful – all the better for share buybacks! Expect a faster pace? Great, you’ve also made my day..! 😉

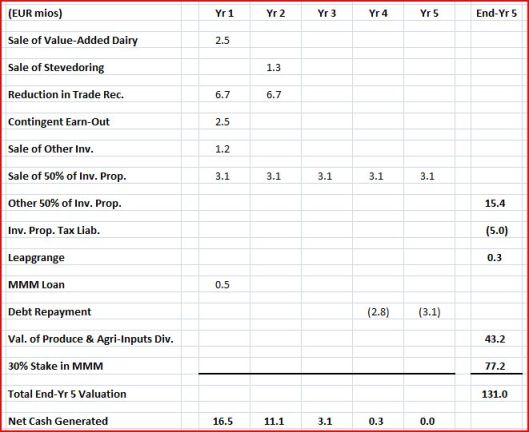

Now it’s time to piece this all together:

This shows the next 5 years of net cash generation, plus the valuation of all remaining net assets at the end of the period. Let’s see what happens to the share count:

We’ve a final valuation of EUR 131 mio for Donegal, while the vast majority of cash generation’s been utilized to reduce the outstanding share count by 55% to 4.6 mio. The only new addition to the analysis is 5 yrs of dividends, which I think is a reasonable assumption. We therefore arrive at a final valuation, in 5 years time, of EUR 29.39 per share. Did you just choke on your beer? Yeah, so did I! 😉 That price target might strike you as extraordinarily ambitious – it may take a minute…but hark, I think I hear some big ifs & buts coming?! Let me make a suggestion – we’re talking about a potential incremental value of EUR 25.76 vs. the current share price. How about we slice that in half & meet in the middle? That implies a EUR 16.51 Fair Value per share, which offers an Upside Potential of 355%. [You’ll note it also equals the projected share price above, using my assumed 60% & 30% growth rates].

But let’s return to the idea of the activist investor perspective – you’ll notice the great majority of my assumptions & valuation are firmly embedded in the present, even though I allow five years for this value to be realized. Nowhere do I rely on (or even include) future operating cash generation or revenue growth. In fact, the only real reason for the 5 year time horizon is: i) to allow a measured sale of investment property, which remains a difficult proposition, and ii) to cover my bloody ass – if I’m wildly off on (say) the valuation of MMM, I’ve five years of probable growth ahead to bail me out!

It’s also worth noting this isn’t about dismembering Donegal – the company still has all the available resources required for continued healthy growth of its core operating business. However, if I can see this inherent value as an investor, I’m sure there’s also a corporate or financial buyer out there who sees it too & might be tempted to come along & harvest it. But there may be a buyer far closer to home, anyway…

Ronnie Wilson is in his mid-60s now, he’s been building MMM into a global player for over three decades, and I’m sure he wants to secure his legacy & his family’s financial future. A public listing’s probably an increasingly logical & appealing option at this point. Of course, engineering a reverse-takeover of Donegal is a quick & easy way of achieving that… Followed by a placing to raise visibility with investors, to cash in part of his stake (but investors would obviously want to see him remain on-board – I’m sure he has no plans to retire anyway!), and perhaps to raise new cash for acquisitions & investment. [Ideally, Donegal’s focused its resources solely on Produce at that point – a possible take-out of Produce Investments (PIL:LN) could then be a great way for MMM to create a second vertical in potatoes]. And if not an IPO, a trade sale’s an increasingly likely alternative for MMM – clearly that would also be another value creation catalyst for Donegal.

Of course, you may just argue none of the above might happen… But let me return to my original catalyst – the sale of Donegal’s dairy & agri-stores business. As I’ve said, I believe this has set the company travelling down an irreversible path – and who’s to say management doesn’t already know exactly where this leads? They’ve already been buying back shares this year, albeit on a v tentative basis – but for a small Irish company, that’s actually quite extraordinary. They already have investment property for sale – here & here, for example. And here’s their latest commentary on strategy: ‘During 2013 the Group will continue to review options to release capital from its non-strategic businesses and assets with the objective of focusing financial and management resources on the strategic areas of seed potato, value added dairy and associate investments, and so deliver value for our shareholders.‘

And why on earth wouldn’t management want to capture the potential upside I’ve highlighted here?! As of the last annual report, directors own 6.7% of the company. This includes the CEO, Ian Ireland, who’s bought shares in the open market quite regularly (as have other board members) & now owns a EUR 0.5 mio or 1.3% stake. Then there’s all the current & prospective shareholders: Thanks to Google, many will find & read this article in due course – and even if they disagree with me significantly, I’m sure they’ll still be keen to chase up management by post, email, phone & in person to discuss how shareholder value can be maximized. In fact, probably the best thing shareholders could do is support a new option programme for the CEO & board – awards should be far more generous (but based on a strike price substantially higher than today’s share price), if they’re intended to incentivize management appropriately.

I now own a 5.33% portfolio stake in Donegal Creameries.

- Donegal Creameries (DCP:ID): EUR 3.63

- Market Cap: EUR 36.7 mio

- Dividend Yield: 4.4%

- P/E: 8.2 (adjusted EPS)

- Price/Sales: 0.46

- Price/Book: 0.63

- Tgt Mkt Cap: EUR 75.7 mio (based on a reduced share count)

- Tgt Fair Value: EUR 16.51

- Upside Potential: 355%

Did you note that yesterday Goodbody released a research note on Donegal.Target price EUR 6.70 with VERY conservative assumption (they used a 20% discount on the low-end valuation for the mushroom business, and used bear case valuations for a lot of other stuff).

Pepijn,

Yes – and I believe a couple of readers were quick to challenge whether the analysis was too conservative! If you piece together some of the less conservative assumptions, a price target of EUR 9-10 can easily be reached. I suspect if you excluded some/all of the value-creation measures in my scenario, my price target would be similar. This should give a lot of comfort to new/existing investors – DCP offers a relatively low-risk & high potential opportunity, simply based on current fundamentals.

But management’s responsibility isn’t only to close the current value-gap for shareholders, it’s also to increase & enhance the intrinsic value of the company. I believe current net debt poses no significant risk at this point – it should NOT be paid down, rather it should be maintained as prudent leverage to enhance returns. I also don’t believe capital needs to be particularly freed up for the produce division – it would appear to be a relatively asset-light business, so I think ongoing profits are probably sufficient to maintain a healthy organic growth rate (and I’d expect any acquisition(s) can support & be funded by new debt). Combine that with progressive sales of non-core assets, plus a significant & ongoing escalation of the company’s share repurchase programme, and you have all the makings of a long-term multi-bagger stock as I’ve detailed above.

But shhhh… I’m OK with the current share price – it presents the company (and me) with attractive share (re)purchase opportunities! 🙂

Cheers,

Wexboy

Pingback: Titanium Asset Management…What A Deal?! | Wexboy

Pingback: Red or Green REIT?! | Wexboy

Pingback: TGISVP – Hot & Not, Mid-Year 2013 | Wexboy

Pingback: Portfolio Allocation (XIV – Emerging & Frontier Markets) | Wexboy

Exactly wht I was talking abt: http://www.businessweek.com/news/2013-05-20/billionaire-malone-buys-irish-green-banana-as-castle-prices-drop Donegal Creameries (DCP:ID) needs to flog An Grianan to one of these guys…

pg 23,24 of the latest preliminary announcement:

“total consideration 5,311”.

“The post acquisition impact of the Biogreen business combination on Group profit for the financial period was a loss of €0.25m”

“If the acquisition date of AJ Allan (Potato Merchants) Limited and AJ Allan (Brechin) Limited was at the beginning of the period, Group Revenue for the financial period would have been €141.5m. In addition, the loss of the Group for continuing operations would have been €3m.” (reported continuing ops. loss was -2,790)

I know they will tell you it didn’t rain this or that year, or the drought, or whatever, and all that will change. and I’m sure all segments will be up one odd year. but you extrapolate your numbers to EVERY year.

the point is they’re subpar businesses and they dropped 5m on them instead of buying back shares.

danone dairy margin is 12%. it’s the lowest margin division and i could have sworn it’s in mid single digits.

Right, looks like both businesses were marginally loss-making when they were acquired. I’ve no further comment on the Biogreen purchase – like I said, I think Donegal should get out of this business anyway. As regards AJ Allan, I’ve seen nothing to suggest this has turned out to be a bad acquisition. And it’s quite reasonable to assume a company can (fairly quickly) wring its normal margin out of a smaller complementary acquisition – through better management, and/or through redundancies, restructuring of the expense base & revenue synergies.

There’s no intention to extrapolate the Produce division’s peak 10.6% margin to every future year. Agribusiness tends to be volatile (but usually self-correcting), so we might actually see that peak margin turn up this year, or maybe we’ll see 12.5% after 3 years, or maybe the margin is only 7% in 5 yrs time but revenues have increased 40%+ at that point… In terms of margin history, and revenue growth potential, I’m v happy with my current valuation.

I think Danone’s overall/divisional margins are irrelevant here. As I’ve said, if a small but attractive dairy brand is plugged into another company’s much larger manufacturing & distribution network, there’s v little incremental cost/investment required – therefore, the incremental operating margin to be earned can be pretty substantial (not to talk of the increased revenue potential). Far larger than a small company, or Donegal, could earn – so perhaps my estimate of sale proceeds could actually prove conservative.

Pingback: 2013 – The Great Irish Share Valuation Project (Final – Part XII) | Wexboy

Pingback: Weekly Links | valueandopportunity

Nice find, even without he investments in associates, the operating business and property investments make this an interesting investment. At a PE of 8.5 we essentially seem to be getting the investment property thrown in for free.

With regards to MMM, I found something in the 2011 Annual Report p65.

“During 2011, the Group recognised an impairment of €379,000 to the carrying value of loans to associates following a review

of the recoverability of those assets”

It doesn’t say what this relates to but comes immediately after the MMM discussion. Could it be related to that?

The MMM loan went from €1.9m to €1.2m in 2011 which seems like our only estimate of free cash flow (assuming it wasn’t impaired). You would expect real free cash flow to be higher than 700k as it’s a growing business but your €77m value still seems a bit heroic from that and I prefer to be a pessimist when it comes to investing 🙂

Thks, Sidekick,

Yes, I think Donegal’s current market cap would make sense even if they just owned the Produce & Agri-Inputs businesses.

Donegal has both equity & loan interests in its associates – and associates also include North Western Livestock Holdings & Leapgrange (and there might be other small/undisclosed bits & pieces). It’s hard to tie down the figures precisely, but I’ve seen no suggestion there’s been any adjustments to the MMM loan in the past few years – MMM have stuck to a steady repayment schedule of EUR 780 K P&I per annum. It seems clear any adjustments have been in relation to other associates. Nothing in Donegal’s accounts indicate/confirm MMM’s actual free cashflow.

I think the logic of my MMM valuation is pretty sound, in terms of its peer group & other comps. And if you disagree, don’t forget I’ve factored in a pretty large cushion: i) five years of likely MMM revenue & profit growth, and ii) essentially, a 50% valuation haircut!

Very interesting to see the activist shareholder philosophy validated so publicly and so rapidly with regard to Donegal Creameries. Well done. Do you see any possibility of a similar resurrection at INM, given the changing of the guard, the sale of South African assets, fixing of pension deficit and write down of debts etc.? I know you have a poor opinion of O Reilly firms and have valued INM at zero but perhaps miracles do happen sometimes.

Regards,

Niall

Thanks, Niall – ah Jesus, don’t ruin a nice post by mentioning INM..!

Quite honestly if I was considering investing in a business suffering a double-digit decline in revenues, and cashflow that always seem to fall way short of operating profit, I’d look for zero debt & pension deficit (at the v least) to try create a decent margin of safety. Pension deficit may not necessarily get solved quickly or painlessly either…

Just to drill a bit further into the case for asset realisations, these obviously make sense from a shareholder value perspective. What evidence do we have that the company is run for the benefit of shareholders, and that the management aren’t empire builders. Obviously, the fact that they have assets on sale is good. But I’m greedy. Have there been any public statements? How did they get themselves into this pleasant mess?

See my second-last para above again: Believe me, dairy isn’t a normal business by any stretch of the imagination – there’s always ‘stakeholders’ knocking on your door telling you why they should come ahead of shareholders. If they were able to sell dairy, they could sell anything…

And they obviously stand ready to sell the agri-inputs business & property if they can. My only real disagreement is the value added dairy business. As for the seed potato business, I’m quite happy if they empire build – nothing above impedes that as a viable strategy.

I don’t see they’re in a mess at all – the poor results for past 5 years were due to dairy & property write-downs, neither of which will/should cause any problems in the future.

[And it’s worth mentioning: Yes, they fell for the Irish property bubble…just like everybody else. In fact, I can count on one hand the people who actively avoided/sold out of property at the peak – so realistically, the only way forward is to chalk it up to experience & grant the nation a free pass on that whole delusion. Fortunately for Donegal, it’s mostly about missed opportunity cost – i.e. they didn’t sell at the top – most of their properties were legacy assets even then, not bought in at ludicrous levels, and thank God they never crucified themselves with debt].

Chapeau

Thank you, sir!

Look at the price rise! You market mover, you…

Ya boyya…!

You cause a spike in the Donegal sp today wexboy 🙂

Nice to see 🙂 And which DCP justly deserves & more…

Thanks for the writeup. As mentioned in the post, it would be great if you could email me the excel files used for this analysis. Looks very interesting. Thanks – Imran

Thanks – done!

I’m not familiar with EU ag regulations, so maybe selling the milk biz was the right thing (I doubt it), but they used $5 mil to buy 2 money losing businesses instead of buying back shares. biogreen, really? the world doesnt need the 500th brand of biotic yogurt. and 10-20% margin? I think dannone does mid single digits.

CEO has been there since 2004. I doubt he’ll suddenly wake up and do smth about receivables.

There is some upside there but I think you’re being too optimistic looking at how much capex this thing needs.

What money losing businesses? Only acquisition after the dairy disposal was AJ Allan, certainly not a money loser – and the rest of the proceeds were applied to a prudent pay-down of debt. btw The dairy business was a money-losing business.

Danone actually has a 14.2% operating margin. If they bought & plugged Donegal’s value added dairy business (I believe Rumblers, for example, is a popular brand in France) into their existing production & distribution, they’d obviously (& quickly) earn a far higher incremental margin.

Similarly, in early 2011, I’m sure 9 out 10 Donegal shareholders would never have imagined the sale of dairy & agri-stores – yet one year later, they were gone.

I don’t understand your capex comment – as they state in their latest report:

‘Overall, our seed potato business, is a high growth business generating strong operating profit margins, has low capital expenditure requirements and yields consistently strong returns on capital. It will be the key strategic focus for the Group going forward.’