Tags

activist investor, Irish shares, Irish value investing, mobile content, mobile marketing, mobile payment, Pageant Holdings, Ross Conlon, Zamano, ZMNO

Zamano plc (ZMNO:ID, ZMNO:LN) is a leading Irish/UK provider of games, videos, music, apps & other digital content to mobile users (D2C, Direct-To-Consumer), and mobile messaging/marketing solutions for businesses (B2B, Business-To-Business). It’s also terribly misunderstood & neglected – the share price is down 25% in the past six months (vs. the ISEQ up 4%). So, loath as I am, we should first tackle some:

Risks & Misconceptions

i) ‘They just sell ringtones?!’: No, they sell all kinds of digital content. Especially to Millennials, whose attention span’s as fleeting as Lee Evans between twitches – which means they’re a perfect target for the cheap impulse buys Zamano offers.

ii) ‘Oh, and porn!’: No. No. No, they bloody well don’t…

iii) ‘What about smartphones?’: Zamano primarily interacts with users via SMS (plus MMS, WAP, etc.), so smartphones must be killing them, right? Er no, as Portio Research points out: ‘SMS is not dead. SMS is still the king…’. For Zamano, smartphones represent more opportunity than threat:

– The SMS share of the pie may shrink, but the pie keeps growing. More & more people are forgetting their laptops & and are now living online 24/7 via phones (& tablets) – they’re all a potential target market for Zamano. And smartphones have allowed the company to upgrade & customize its D2C content, and to migrate its advertising online, thereby enabling more effective customer acquisition. Like so many tech companies, ZMNO’s really a sales & marketing company – so management’s ultimately agnostic, they’ll embrace whatever technology(s) deliver the best revenue/profit opportunities.

– If that’s via apps, that’s OK too… Because people have to get paid eventually, free/dollar apps won’t hack it, especially when it comes to regularly updated content. Maybe in-game/app purchases & advertising become the norm, but I suspect we’ll see an inevitable migration (back) to a subscription model – a far more stable/valuable revenue stream for companies. Just look at the evolution of online music: Downloading’s dead now, streaming’s where it’s at…maybe even Apple’s finally got the message!

– As for Zamano’s B2B business, SMS will be an attractive marketing tool for years to come. I mean, when did you last read your spam email? But we all still love that little dopamine fix when a new text message pings…we can’t help reading it! For companies, SMS is a simple, immediate & compelling medium for reaching out & marketing to customers. Combine it with geolocation and/or mobile payment technologies, and it offers intriguing new opportunities.

iv) ‘Don’t they have a crap reputation?’: Sure…if you want to believe the trolls. Yes, how dare they charge for that sub. you forgot about? Why don’t you complain about the skinny jeans you bought last week too, or the hangover you spent good money on last night? I blame the chattering classes – they tut-tut over the hoi polloi buying such chavtastic tat. Then we have nanny regulators like Comreg, who act like they’re waging a holy war to atone for the sins of the Irish banking regulator… Yes, Zamano has to compete with some dodgy rivals, but it also has a fiduciary duty to its investors. Shady practices might appear tempting, but when you consider the risks for a listed company…it’s never worth it. And because ZMNO’s listed (& highly visible), the regulator inevitably targets them first. I’m confident we can rely on management to maintain standards & compliance accordingly.

v) ‘Didn’t they nearly go bust?’: Er, no… ZMNO did announce its largest acquisition (Red Circle Technologies) in late-2007, just as sentiment & the global economy was heading off a cliff. Revenues subsequently collapsed 64% in 2009-11! Normally, that would have been a company-killer, but Zamano managed to retire most of its debt/deferred consideration by the end of 2011 (& now enjoys a net cash position).

vi) ‘What about the new CEO?’: Ross Conlon replaced Pat Landy as CEO in January. Investors noted he was a tech guy & still in his 30s…the stock dropped 20% the next day! Um, what do you think the average C-suite age is in Silicon Valley these days?! ZMNO’s in great financial shape, now it needs a CEO who’s suitably equipped for an ever-changing tech landscape. As the ex-CTO, Conlon has the tech stuff down cold, and he acquits himself well for a first interview as CEO. Plus his 1.4 million option grant over a year ago (vs. a million for Pat Landy) is revealing – the board was clearly grooming him for the top slot…

vii) ‘Or the recent results’: Reaction to ZMNO’s recent results was equally silly. The stock fell up to 35% in a couple of days, most likely on the back of a significant revenue decline. But investors ignored a crucial metric – EBITDA actually increased – clearly management knows what they’re doing!

viii) ‘ZMNO?! Huh, I lost a packet on ’em…’: Aah finally, the real problem! ZMNO IPOed at GBP 24p (on AIM in late-2006, the Irish listing followed in 2007), enjoyed a brief rally, then the perfect storm hit: The credit crisis, too much leverage & a cash-strapped Irish/UK consumer – here’s the chart:

Yep, most Zamano shareholders have lost money, so now they hate it… And new investors are few & far between, and easily scared off – who buys a stock doing this poorly, while the ISEQ’s doubled in two & a half years?! ZMNO’s a 3U stock – under-loved, under-owned & under-performing! All too often, investors wait for a big rally in a stock before they’ll even dream of buying it…

OK, still with me? Sorry, was that a touch of over-kill?! 😉 But we obviously have to worry about the risks & opportunities a company might face. Except that’s often a perfect excuse to presume earnings are about to surge, or fall off a cliff! In reality, with most companies, the future resembles the past far more often than investors might imagine… So, let’s dig up Zamano’s past:

The Numbers

Gulp, who wants more of this past?! In fact, I first looked at ZMNO in early-2012 & concluded it was potentially worthless (at least for minority shareholders). Noting its trajectory at the time, that wasn’t an absurd perspective. But if you’re a large shareholder, sometimes you can afford to take a different view. Let’s try again, this time with some key cash flow figures & the eyes of an activist investor:

The Real Numbers

Now, most companies aren’t flattered by this perspective, but Zamano stands revealed – this is a virtually indestructible business! I mean, how many companies do you know of which could survive 3 years of collapsing sales & still throw off (cumulative) free cash flow?! Sure, it finally turned negative in 2011, but the outflow was less than a million. Who needs scenario analysis, when ZMNO comes with a real-life case study?

The only obvious thing that might possibly kill this business is…management! [Or too much debt]. But with this kind of downward spiral, it’s often difficult to tell if management’s part of the solution…or the problem. Except in 2011, management attention was primarily focused on a new/loss-making division (Newsworthie), which required ‘further investment’. This was ridiculous, no management team gets to coddle a pet project when their regular business is collapsing ’round their ears. Things had to change, and quickly – fortunately, they did…

The Activist

Time to introduce Zamano’s largest shareholder, Pageant Holdings – who I first mentioned here. Most people probably don’t know the name, but I’m sure they know of Nick Furlong (& Peter O’Grady Walshe) because of Xtra-vision (Ireland’s largest video-rental chain). [Granted, it entered examinership in 2012…but Uncle Carl had a similar misstep with Blockbuster, so that’s forgivable]. And don’t forget, they were previously involved with Xtra-vision (back in the 90s), pulling off a successful turn-around & sale in 1996 to…Blockbuster! Anyway, Furlong’s wealth actually originates from Pilton Company, a distributor he started back in 1980 & eventually sold to DCC in 2005 for EUR 55 M in cash/deferred consideration.

Since the crisis, Pageant’s evolved into more of a family office, building stakes in a number of listed Irish companies. Noting his background, it’s obvious Peter Furlong (Nick’s son) has been a key contributor in this evolution. Pageant usually opts for a low profile, but this table (of their disclosed Irish holdings) confirms they’re clearly worth tracking as an investor:

[This table’s simply a guesstimate, based on the most up-to-date public disclosures. I expect the info’s reasonably accurate for the listed stocks, but probably far less accurate for the grey market stocks (One51 & NTR), so actual gains (& current unlisted shareholdings) may be quite a bit different. But you get the idea… NB: I haven’t included a new 3.0% holding Pageant reported for the first time in April – IFG Group (IFP:ID).]

These investments demonstrate a keen eye for value, and a distinct preference for businesses which are low-risk, yet still offer attractive growth potential. While ZMNO isn’t their largest investment, it’s their largest % shareholding (by far) – which strongly hints at the substantial operating & valuation upside they see in the company. [But so far, in terms of gains, it’s still the stubborn stepchild of the portfolio]. Of course, this ownership stake also gave them excellent leverage as an activist…

The Turn-Around

And so, within the space of about 15 months: The Newsworthie venture was terminated in Sep-2011, with John O’Shea (CEO since 2005) departing shortly thereafter. His replacement, Pat Landy, had already been appointed to the board (early in 2011) – his background suggested he was an ideal candidate to lead an aggressive turnaround. By year-end, a (related-party) ad deal was also announced with Pageant, helping to stabilize & kick-start revenues. In Feb-2012, John Rockett & Peter Furlong were appointed Chairman & non-executive director, respectively. Finally, in Dec-2012, Pageant acquired Zamano’s existing loans of EUR 4.1 million from Bank of Scotland – the agreed terms reduced the debt outstanding to EUR 2.1 M, and deferred final repayment ‘til 2014.

OK, so that took care of ZMNO’s management & debt issues – what about the business itself? Let’s look at the numbers again (this time inc. 2012 & 2013):

Wow, this table speaks for itself! And the 2012 results should obviously dispel any doubts about Pageant’s activist intervention. The new CEO & board delivered a remarkable 28% jump in revenue & a near-EUR 4 million turn-around in operating free cash flow (Op FCF). [What would 2011 have looked like if the CEO was replaced early in the year?]. However, 2013 looks like an unexpected set-back, with revenue down 17% – but the decline actually reflects another run-in with the Irish regulator & was previously flagged by management (though none too clearly). But if they’d offered specific revenue guidance, plus an assurance profitability would be maintained, I doubt investors would have believed them… In fact, 2013 operating profit actually increased 9%, clearly demonstrating management had anticipated the revenue decline & steered the ship accordingly. With hands like that on the wheel, why worry..? 😉

So, what’s Zamano worth today?!

Let’s highlight my last ZMNO valuation as a taster – it definitely suggests there’s some attractive upside. But early last year the company was still recovering from (potential) distress, I hadn’t seen the 2012 results, and Pageant still owned its debt & had an outstanding related-party deal – all of which prompted a conservative valuation. Now Zamano enjoys a net cash position, the 2013 results are out, the Pageant debt & related-party deal have been eliminated, and it has a new CEO – which is a great position to occupy. Don’t forget, over the past few years, ZMNO was supported by Pageant Holdings’ activism & Pat Landy stepping in to lead a very successful turn-around – so management, understandably, wasn’t focused on pitching a ‘story’ to investors (though this presentation was a start, from late-2013). But now the mantle has passed to Ross Conlon. As a new CEO, a strategic review (formal, or informal) is the perfect opportunity for him to re-define Zamano’s strategy, really put his stamp on the company, and ultimately present a compelling story to investors. To come up with a new & appropriate intrinsic valuation – and a path to achieving/realizing such a valuation – it would be useful if we also pondered such a strategic review:

Looking ahead, what is Zamano’s operating strategy exactly? And perhaps more importantly, what is its capital allocation strategy?

Operating Strategy

I often find it useful to survey the spectrum of possibilities, and compare & contrast extremes with the current status quo. Which gives us three scenarios to consider here:

a) Liquidation: OK, let’s not talk risks again – been there, done that. But I can’t help myself – let’s suppose we concluded Zamano had no long-term future. Would it be such a disaster? Actually, no… ZMNO’s current market cap is EUR 8.2 million & a mere EUR 5.5 M if you strip out cash – that’s barely 2.4 times 2013 free cash flow (FCF)! And expenses could presumably be pared to the bone, so near-term FCF would likely increase. Sure, revenue would decline (over time), but the business could be managed accordingly. There’s some net payables & a sliver of debt to pay off, but Zamano’s direct access/relationships with the major carriers are valuable assets that could be sold off ultimately. Go ahead, play with the numbers, you’ll still get the same answer – ZMNO offers significant upside, even as a liquidation.

b) Steady As She Goes: Ignoring self-inflicted missteps, Zamano’s always been a bit of a stop-go business – that’s the status quo. Hard won revenue (gains) tend to melt away, in the face of fickle regulators & consumers. Whereas most companies are fortunate they can build a growth strategy off their core revenue/customer base, and enjoy limited regulatory interference. ZMNO management enjoys no such privileges… Much of their energy’s simply devoted to replacing lost revenue & accommodating the whims of the regulator.

But so what? Time & again, PE firms wring extraordinary returns out of low/zero growth companies…because they manage them accordingly! In the past 8 years, Zamano’s revenue averaged just over EUR 21 million, while FCF averaged EUR 2.3 M. If you singularly focused on punching out those numbers each year, with an 8 M market cap, that’s a bloody attractive proposition. Marry it with a smart capital allocation strategy & returns could be extraordinary too.

Diversification is also attractive, even if it doesn’t produce significant revenue growth. The new CEO has prioritized B2B, particularly on the back of the recent Message Hero launch. Peak B2B margins are lower (than D2C) & cash conversion’s slower, but revenue/customers are far more stable & regulatory risk’s mostly eliminated. And it leverages off the company’s existing infrastructure & only requires a small/incentivized sales team – so incremental business wins are a compelling low-risk proposition. [Plus it returns ZMNO to its roots – historically, 33%-50% of revenue was B2B. But this share was down to 16% by 2011 – annoyingly, this segment breakout’s no longer provided].

Geographic diversification’s compelling too. Margins may be lower (expansion usually involves local partners), but it dilutes & diversifies the company’s current regulatory risk. It’s also low(er)-risk – relying on existing infrastructure/content, plus local partners, often requires little up-front investment. [And D2C offers the possibility of an unexpected/viral success in a new market]. Conversely, a market exit can be relatively quick & painless if revenues don’t take off. The company entered Eastern Europe, Australia & Norway in 2013, and will explore a number of new markets in 2014.

In fact, I only see one major issue: Zamano’s clearly under-valued, but without a significant change in strategy, market sentiment/valuation may not change any time soon… But this offers additional opportunity, which I’ll get to shortly.

c) Hell For Leather: Let’s consider the other extreme… Zamano’s carved out an attractive niche, but it’s a small company operating in a very large market. A situation which often requires additional investment to fully capitalize on available opportunities. But when management says investment, it’s often code for losses…all for an uncertain future pay-off. That might tempt the dreamers, but it’s a tough proposition for seasoned investors. But ZMNO’s in a different category – based on its turn-around & subsequent results, the current board & management team deserve investors’ trust & confidence.

Look at the sector, revenue growth (& a sexy story) is the likely key to a premium valuation. So turning a profit may be the least attractive strategy right now for ZMNO shareholders. [Yes, an unusual statement from a value-minded investor! But I’ve said it before – see Universe Group (UNG:LN), or Argo Group (ARGO:LN)]. High growth opportunities shouldn’t be out of reach for the sake of a few million. Of course, I’m certainly not advocating pissing money away here… But if ZMNO presented a new hell for leather growth plan – premised on a break-even P&L, and a firm conviction the incremental spend will truly move the needle – I definitely think shareholders should enthusiastically support such a strategy.

Don’t forget, Zamano has a genuinely gigantic opportunity, in terms of potential customers, geographies & products. Ideally, it’s a case of right place, right time. People now live 24/7 via their phones (does a meal exist if nobody Instagrammed it?), and ZMNO’s operated in that ‘cloud’ from day one. There are present & future multi-billion opportunities in proximity marketing, gambling, mobile payments, gamification, etc. Ross Conlon, in his first interview, actually highlighted the company’s now looking into direct carrier billing – the ability to make purchases with a mobile phone, rather than a credit card, has massive potential in terms of greater choice, convenience & security. Now, I’m not suggesting they end up owning IP worth billions, that isn’t the investment proposition here…but could they partner up & earn a nice little slice of the action on tens of millions of transactions? Absolutely! Conlon even name-checked Stripe – a reminder even a tiny sprinkle of Web 2.0 pixie dust would have a tremendous impact on Zamano’s business and/or valuation.

Nobody really knows how things will shake out, even over the next five years – but as a D2C/B2B sales & marketing company, ZMNO may offer a free/low-risk option on that future. While customer & geographic diversification offers an obvious win, utilizing almost EUR 2.5 million (of annual Op FCF) to accelerate growth is a compelling proposition. Plus it offers a chance to experiment. Clearly, Zamano shouldn’t be all things to all customers, but the internet = interaction = iteration. It allows you to fail, quickly & cheaply, and to quickly scale up & enhance anything that works. Mash all this together, and it isn’t hard to believe sacrificing Zamano’s current margins might produce a far bigger pay-off. And maybe the pay-off hurdle’s not so daunting: If that much additional investment delivered (say) 2.5 M+ of incremental revenue, I’d hope to see investors more than compensated by the overall increase in ZMNO’s valuation.

Capital Allocation Strategy

OK, before passing judgement, let’s consider the company’s capital allocation strategy. Zamano’s now in excellent financial health, so we can focus on:

i) Acquisitions: Zamano has some (limited) firepower for acquisitions. Issuing shares would be horribly dilutive, so management’s essentially restricted to paying cash. Structuring a deal with a large element of deferred consideration would reduce integration risk & help pay for itself. Unfortunately, small companies & entrepreneurs often believe they deserve an ambitious multiple, or they simply want to cash out & have a (non-negotiable) consideration in mind. And paying cash could be problematic too: How much revenue was purchased & what multiple do investors place on that revenue? How does that compare with handing cash back to investors? There’s nothing more value-destroying than a low multiple company executing a high multiple acquisition…

But I’d also acknowledge Zamano may have the scope to quickly double/triple margins – if it finds the right target! Of course, this would require a fairly aggressive rationalization & integration plan… But noting current sentiment towards ZMNO, it would be incumbent upon management to lay out the financial rationale & benefits of any acquisition for investors. Fortunately, shareholders have an obvious alternative against which they can benchmark any deal…

ii) Share Repurchases: Why buy other companies, when management can buy a well-known company for a far better price? Of course, I mean…ZMNO itself! The company’s so under-valued, cash is worth far more in shareholders’ pockets. Zamano could actually distribute most of its current market cap – funded by cash & debt draw-down – without impairing the company’s business, or financial stability. Even with a generous premium, a tender offer (and/or share buybacks) could be executed at a substantial discount to ZMNO’s intrinsic value. Capturing this discount, and boosting the company’s operating metrics per share (like EPS), would significantly enhance intrinsic value for all remaining shares outstanding.

ZMNO’s small & thinly-traded, so I suspect buybacks would drive the price sky-high. A tender’s probably far more effective in terms of buying shares & returning cash. And Pageant Holdings might be supportive, as they could participate on an equal footing without affecting their % stake in the company. [Buybacks are more problematic: If Pageant abstained, they might end up over 30% – forcing them to seek a waiver, or make an offer for ZMNO. Which I suspect they’d prefer to avoid. And if they participated, it might well raise corporate governance questions/issues for management & other shareholders]. However, Zamano could certainly follow up with (opportunistic) share buybacks, if necessary – future cash flow could be earmarked for this, as required.

iii) Sale: Why not let somebody else worry about capital allocation…just sell Zamano! The sector loves consistent & aggressive revenue growth. And most investors don’t seem to care if it’s organic, or acquisition-led, which explains the relentless pace of industry consolidation. Right now, an acquirer could obviously pay a very generous premium for ZMNO. In fact, an acquirer could probably still pay a decent premium, even if the stock traded much higher – as margins could be quickly boosted post-acquisition. Which is particularly true of Zamano, as its direct access to the major Irish/UK carriers provides an attractive margin/cost advantage (vs. many of its competitors). [Imagine the potential value to be extracted from this direct access by a porn company..!] Quite honestly, some of these acquirers don’t seem to care much for deal metrics anyway, as long as they deliver revenue growth.

Acquirers also prefer paying in shares, which means they can be a little more generous – I mean, it’s just paper, innit?! I prefer cash myself… But Zamano’s size may be a blessing: i) a cash deal, even at a decent premium, wouldn’t break the bank, or ii) an all-share deal mightn’t present much difficulty either – for ZMNO shareholders who prefer a cash exit, the impact of their selling might be quite limited in relation to an acquirer’s market cap/trading volumes.

Re-Set & Re-Start

OK, we’ve covered the bases. On the operating front, I certainly wouldn’t insist there’s one definitive strategy – management’s in the best position to determine & present the company’s best path forward. But it’s crucial they pair it with the right capital allocation strategy. One might presume, for example, a liquidation strategy offers limited upside – but combined with share repurchases, it becomes a compelling proposition. Same for steady as she goes – if this strategy’s a key reason (as I suspect) for Zamano’s current under-valuation, long may it actually continue…if it allows the company to slowly & surely cannibalize itself!

With capital allocation, I think the choice is more obvious. A sale isn’t the most feasible option at the current market cap. Management needs to be open to all potential offers, of course, especially if somebody wants to offer funny money – but any likely deal premium probably won’t match ZMNO’s intrinsic value. [But a sale may offer an eventual exit for Pageant. Because selling a EUR 2.4 million shareholding’s obviously no big deal, but willing buyers of a 29% stake in ZMNO are probably more interested in acquiring the entire company].

Acquisitions don’t appear all that feasible either – share repurchases are a low risk/high reward alternative, so that’s a tough hurdle to beat if management wants to justify an acquisition. Timing doesn’t favour them either – six months out, the terms & price of a possible acquisition are probably much the same (as today), whereas ZMNO’s bargain price today might just be a fleeting memory at that point. People forget acquisitions are strategic, while share repurchases are inevitably opportunistic…they should be prioritized accordingly.

But a Re-Set & Re-Start strategy may offer the best of all worlds – and why shouldn’t shareholders have their cake & eat it? First, re-set the company’s capital structure with share repurchases: Use available cash & a conservative level of debt to make a substantial return of capital to shareholders via a tender offer. Then re-start revenue growth: A hell for leather strategy would sacrifice near-term margins, ideally in return for significant revenue growth, diversification, and greater economies of scale – all of which I’m sure would be amply rewarded by the market.

An unusual strategy combination perhaps… But picture a Zamano shareholder meeting. [It’s worth remembering just three investors – Pageant Holdings, Ulster Bank Diageo Venture Fund & Grillon Holdings (owned by Ger Dowling, Red Circle’s founder) – own almost 53% of ZMNO’s shares]. Now, picture management presenting such a strategy. And confirming a highly attractive tender price, the expected intrinsic value enhancement & the likely impact on the share price…while shareholders hang on every word! Yeah, that’s me, the handsome guy in the back – popping the first champagne cork & breaking the stunned silence. I’m confident shareholders would quickly conclude the reward of the Re-Set more than pays for the (perceived) risk of the Re-Start. And I’m sure the voting would be a formality…

Current Valuation

Right, we’re closing in on Zamano’s intrinsic valuation. But it may be entertaining to have a quick look at its absolute & relative valuation first:

Absolute Valuation: Let’s play find the smallest number… At the current EUR 0.084 share price, Zamano trades on a 0.5 P/S multiple (despite a 13.9% operating margin), 4.8 times net income, 4.1 times adjusted net income, 3.6 times free cash flow & just 3.2 times EBITDA. But these ratios ignore the company’s EUR 2.7 million cash pile! Strip that out, and (ex-cash) ZMNO trades on a 0.34 P/S multiple, 3.2 times net income, 2.7 times adjusted net income, 2.4 times free cash flow & just 2.1 times EBITDA. And dare I say it, Zamano trades on a 2.3 EV/EBITDA multiple!

Wow, the numbers roll off the tongue like gold coins! 🙂 An over-leveraged & dying company might deserve those kind of metrics…certainly not a company like Zamano, which enjoys a robust business & a bullet-proof balance sheet.

Relative Valuation:

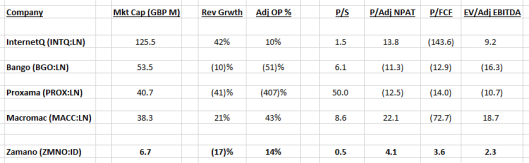

I’m usually not fond of analysts’ peer comparisons – too many outlier companies & figures for my liking – but let’s give it a go (UK-listed peers only):

Bango & Proxama nicely illustrate investors’ enthusiasm for companies involved with mobile payment – valuations may seem crazy, but reflect even higher multiples investors (& venture capitalists) are placing on some of the companies in the (broader) online payment sector. Clearly, if Zamano made any kind of progress in this direction, it could prompt a substantial uplift in valuation & investor sentiment. For the moment, Macromac & InternetQ (the sector benchmark) are more direct peers. [I didn’t bother to include Mobile Streams (MOS:LN) – most of its business is in Argentina, so I consider its financials to be fairly meaningless now]. But calculating peer averages, or a peer-based valuation, would be fairly pointless here – just a glance at the chart tells you, for example, investors don’t give a damn about (negative) cash flow! Plus, of course, it’s glaringly obviously Zamano should be trading on a multiple of its current valuation… 😉

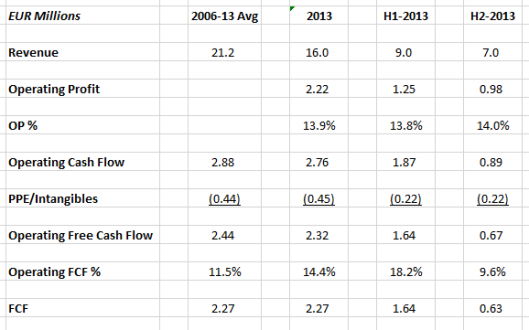

Intrinsic Valuation: OK, meat & gravy time… We should be conscious last year’s revenue decline was anticipated, but was also more pronounced in H2, so this final table will allow us to focus on long-term performance & isolate some key H2-2013 figures:

[This is a good time to remind you ZMNO’s not a suitable share for all investors – it’s a micro-cap, it can trade infrequently & mostly in small size in Dublin (& occasionally London), the bid-ask spread’s usually wide, and the last traded price can be ridiculously volatile. But if you have the fortitude & patience, those same attributes could rapidly jack the share price higher if/when sentiment changes (or in response to positive news, or a corporate action). Understandably, a lot of investors consciously (or unconsciously) haircut their intrinsic value estimate for stocks like this. I don’t agree – and acquirers don’t think that way either, in fact they can probably afford to be more generous buying small companies. If you find you’re applying such valuation haircuts, I suspect you’ll quickly lose track of proper relative values across your stock selection process. Demanding greater upside potential from certain stocks (like micro-caps) is a subtly different & far more useful approach to adopt.]

The long-term average for Zamano’s Op FCF margin is 11.5%, while the 2013 margin’s at 14.4%. The H2 margin dropped to 9.6%, but this looks like a timing issue (vs. H1) & six months isn’t long enough to draw any kind of sensible cash flow conclusion anyway. [But note the H2 operating profit margin increased to 14.0%, which is clearly reassuring]. Investors focus more on recent results, so an average of the recent & long-term Op FCF margins seems appropriate – the resulting 13.0% margin deserves a 1.2 Price/Sales multiple. [Particularly as it’s based on cold hard cash, i.e. Op FCF margins rather than reported operating profit margins. Plus I’m being a little unfair here – ZMNO’s FCF has averaged an astonishing 93% of Op FCF over the past 8 years, so a FCF-based analysis would probably produce a superior valuation.] To be conservative, let’s base this P/S multiple on H2-2013 annualized revenue (of EUR 14.0 million).

But incremental to this P/S valuation, the company’s significant cash & debt capacity can be immediately utilized for share repurchases. Assuming a 5% interest rate, Zamano could increase its total debt to EUR 6.9 M & still limit interest expense to 15% of Op FCF. It already has 0.6 M of debt outstanding – so let’s assume a draw-down of just 50% of the remaining debt capacity (i.e. 3.2 M), to be suitably conservative. The resulting 3.8 M of debt would amount to only 1.4 times annual operating cash flow, while interest would be covered 12.3 times by Op FCF – which presents no obvious risk to Zamano’s financial stability, or my P/S valuation. Of course, we’ll also add cash of 2.7 M to this (positive) debt adjustment. There’s also two other sources of cash:

– In-the-money options: I count 6.3 M staff options newly issued in 2013 (at EUR 0.0595), plus 1.5 M Pageant options (at EUR 0.03) issued in Dec-2012. Some options won’t vest (or get exercised) for a number of years, some may even end up lapsing – let’s be conservative & assume 100% dilution up-front. Therefore, to be fair, we’ll also include assumed option exercise cash (of 0.4 M) in our valuation.

– YTD cash generation: We’re already well into May – taking last year’s 2.3 M of FCF, we might expect another 0.9 M of cash generated YTD. Again, let’s be conservative & haircut this figure by a third (to 0.6 M). And if this estimate’s off, so what…just give it a month or two!

Putting all this together, we get:

(EUR 14.0 M Revenue * 1.2 P/S + 3.2 M Debt Adjustment + 2.7 M Cash + 0.4 M Option Cash + 0.6 M YTD Cash Generation) / (97.9 M Shares + 7.8 M Option Shares) = EUR 0.225 Fair Value per share

But wait, we’ve forgotten a crucial component – we’re presuming Zamano’s cash & debt capacity (of EUR 6.9 million) is utilized for a tender offer. Let’s assume management chooses to tender for 50 million shares. Which implies a EUR 0.138 tender offer price – a 64% premium to the current share price is pretty damn attractive! But the best is yet to come, we need to redo our valuation on a post-tender basis:

EUR 14.0 M Revenue * 1.2 P/S / (97.9 M Shares + 7.8 M Option Shares – 50 M Tender Shares) = EUR 0.302 Fair Value per share

But there’s many a slip ‘twixt cup & lip – it would be wise, at least for the moment, to average our two fair value estimates. And so, we arrive at a EUR 0.263 Fair Value per ZMNO share. [To add perspective: If I re-calculate a 2013 FCF of EUR 2.1 M (to reflect incremental debt expense), my Fair Value would equate to just 6.9 times adjusted FCF!]

This price target offers an Upside Potential of 213% – I currently have a 6.4% portfolio allocation to Zamano.

- Zamano (ZMNO:ID): EUR 0.084

- Market Cap: EUR 8.2 M

- Price/FCF: 3.6

- Price/Sales: 0.5

- Ex-Cash P/FCF: 2.4

- Ex-Cash P/S: 0.34

- EV/EBITDA: 2.3

- Tgt Fair Value: EUR 0.263

- Tgt Mkt Cap: EUR 14.7 M (based on a reduced share count)

- Tgt P/FCF: 6.9

- Tgt P/S: 0.9

- Tgt EV/EBITDA: 7.1

Pingback: TGISVP – An Updated Snapshot | Wexboy

Pingback: NTR plc…Wind of Change? | Wexboy

What’s happening here boss?! 🙂

Ultan – my comments from Twitter:

Zamano $ZMNO:ID dropped 41% intraday to 6.5 cts…basically bck to square one nw w/ a 10-11 ct bid-offer at the close http://ise.ie/Prices,-Indices-Stats/Equity-Market-Data/EquityDetails/?equity=47592

$ZMNO:ID Sequence of trades http://www.sharewatch.com/irish-share-prices.php shows wht a muppet investor w/ no limit order cn unintentionally do to a micro-cap shr…

$ZMNO:ID If a broker was involved w/ the trades, he shd be ashamed of himself…bt I presume this was an online/automatically directed order

Guess ISE doesn’t impose price limits/circuit brkers…4.5 million wiped off $ZMNO:ID mkt cap intra-day, mostly due to a EUR 894 trade!?!

Pingback: Wexboy Portfolio – H1-2014 Performance | Wexboy

Pingback: H1-2014 TGISVP, Portfolio Performance | Wexboy

Pingback: TGISVP – End-H1 2014 Snapshot | Wexboy

Pingback: 2014 – The Great Irish Share Valuation Project (Final – Part X) | Wexboy

Wex, do you track your picks/writeups even the one you don’t invest it. I’m impressed with your research and writing skills.

Thanks dph,

Any stock writeup you see on the blog is invariably a stock I own – I track their performance here, for example:

I also track a lot of potential buys, sometimes for many years – this post will give you an idea of the process:

Cheers,

Wexboy

Looks like someone is reading this blog: there’s a big volume on ZMNO on AIM today!

I see that. Irish price is usually more volatile than the UK price, so there’s a simple rule (for peace of mind): Check the Irish price on up days (+25% today!), but stick with the UK price on bad days…

Hi Wexboy the read more of this post option is not workin? Nothing on them if one does a search on your website also? Can you advise? Thanks! Ultan

I’m not sure what you mean, I haven’t seen/heard any other issues? Do you mean you can’t read the full Zamano post? Here’s a link specifically to the post:

Do you know the CEO? He’s following you on Twitter. Interesting idea.

Of course…he’s my favourite new CEO!

#1 Irish stock promotor 😉

I mean you, of course. Interesting idea nonetheless, thanks for the writeup.

Promoter? Sure – roll up roll up, stock on offer: Dead cheap! 😉 When I see plodding ‘blue chips’ on huge multiples, and story stocks (which can’t even generate a profit, let alone cash flow) on much crazier multiples, I just want to try & restore a little balance to the world… 🙂