Tags

Donegal Investment Group, Fyffes, Irish shares, Irish Stock Exchange, Irish value investing, ISEQ, NTR, Petroneft Resources, Prime Active Capital, TGISVP, The Great Irish Share Valuation Project, Zamano

Unfortunately, after starting with such promise, the months of September & October now appear to be living up to their more usual fearsome reputation. At this point, we’re forced to commiserate over a 10% correction (in round numbers) for the ISEQ from its most recent (early-Sep) high, including a 6.3% fall last week. And the fact the index is down almost 14% from its (end-Feb) 2014 high just compounds the misery. But corrections also present a good opportunity to re-evaluate battle plans… Now, I’ll obviously be reviewing The Great Irish Valuation Project in greater detail at year-end, so I’m going to strictly limit my comments here.

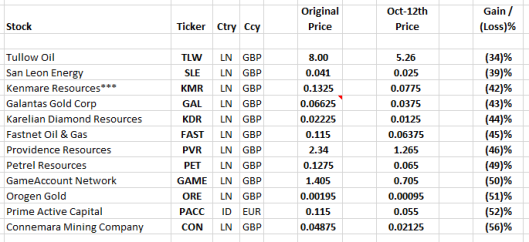

Updated snapshots of this year’s top winners & losers might prove instructive… [NB: Each stock’s gain/loss is simply measured from its TGISVP evaluation date (i.e. Feb-May, except for NTR), so actual YTD performance rankings of stocks might look a little different]. First we have the Sewer Shit:

Maybe it’s worth picking through the rubble for a couple of bargains? Hmm, perhaps not – with a couple of notable exceptions, all I see here really are bombs that may still explode in one’s face. As for ‘investors’ who already own some of these stocks, what can I say…if they’re stupid enough to buy ’em in the first place, I’m surely not the person who’s going to persuade them to finally cut their losses & run!

Switching horses might be the answer – perhaps riding the momentum of this year’s winners might be a wiser strategy? Here’s our Top Trumps:

As usual, a somewhat mixed bag: Investors are still enthusiastically bidding up the new Irish property REITs to significant premiums, a few junior resource stocks are enjoying some unexpected love (all too briefly, I suspect), while Petroceltic International (PCI:LN) has attracted a possible offer***. But we also see some unsurprising (and/or consistent) winners – fortunately including two stocks I own, NTR & Zamano (ZMNO:ID).

Maybe our best bet here is to simply re-rank all Irish stocks, in terms of their current share price vs. my target price. – i.e. their current Upside Potential. At this point, please note I’m going to resist updating my original target prices (once I start, where would I stop?!) – so if a stock interests you, be sure to pay close attention to any subsequent news & results (and any potential valuation implications). But let me (somewhat arbitrarily) tackle two exceptions:

Company: Prime Active Capital

Prior Post(s): 2012 & 2013 & 2014

Ticker: PACC:ID

Price: EUR 0.055

Well, the denouement here was as bad as the story itself…so much for my tagging PACC as a nicely under-valued stock. [Though in my defence, I did highlight we’d likely see a binary outcome here eventually – which can be a difficult situation to value]. I have to admit though, when I saw the headline of this press release – a EUR 7.5 million disposal (plus another 0.6 million for inventory) – I really thought the outcome was going to be (quite) positive. ‘Til I got to the line which said PACC would be left with just 1.6 million of cash, and no other assets or debt…

Frankly, despite reading the EGM circular & interim results, this still doesn’t compute. I’m astonished shareholders appear to have accepted & approved this deal (and turn of events) without a single peep of protest. PACC had net assets of EUR 6.1 million at end-Jun 2013, though this nearly halved to 3.3 million by year-end – since then, despite disposal proceeds of 8.0 million, net assets have declined to 1.5 million (similar to the indicated 1.6 million of post-deal cash) in the recent interims. It seems like the buyer of PACC’s cellphone stores business was able to cherry-pick all the good stores/business & reject any crap. Plus it also seems like much of the proceeds are being eaten up dealing with existing (and new?) liabilities & provisions related to this crap (and repaying the outstanding shareholder loan).

In the end, there’s no real point in puzzling over this any further – ‘cos I never did buy into PACC! As I’ve stressed before, just because a stock offers decent/high upside potential doesn’t necessarily mean I’d ever dream of actually buying it… And seeing Peter Lynch jump ship this year (with nary a whisper of an apology) – certainly didn’t inspire confidence either. [I’m bemused to see him parachute into a nice little number with Mincon Group (MIO:ID) – to head up their M&A effort, no less!?] The only obvious way to value PACC now is based on its latest net assets of EUR 1.5 million (mostly tied up in escrow for the next year), less a corporate HQ expense run-rate of 0.6 million pa:

(EUR 1.5 M Net Assets – 0.6 M Ann. HQ Cost) / 22.7 M Shares = EUR 0.04

Maybe expenses get pared down a little – but who cares, obviously this is a completely ridiculous position for a company & its shareholders to be left in…

Price Target: EUR 0.04

Upside/(Downside): (26)%

_

Company: Fyffes

Prior Post(s): 2012 & 2013 & 2014

Ticker: FFY:ID

Price: EUR 1.03

The merger with Chiquita Brands International (CQB:US) was going so well – slowly maybe, but surely – ’til Cutrale/Safra showed up with a $13.00 cash bid for Chiquita (sorry, I should say unsolicited proposal!). [Plus Congress is now in a frenzy over tax-inversion deals…] And you have to presume this may be just their opening salvo – I’m sure they have plenty of additional fire-power, if they decide a higher bid’s necessary. The market certainly seems to agree, with CQB trading well in excess of the bid at USD 13.78. If one assumes a winning cash bid could end up somewhere between USD 15.00-15.50, for example, CQB’s current share price implies their chances of victory are around 35% right now. So the odds are clearly in favour of a merger still, though I wouldn’t necessarily bet on those odds myself…

We should note Fyffes management & shareholders are virtually irrelevant at this point, this is really a slugging match between Chiquita & Cutrale/Safra now. Even Chiquita’s shareholders may be irrelevant, unless they mount a serious legal challenge…we all know of management teams who put themselves ahead of shareholders, unless they’re forced to do the right thing. For the moment, Chiquita management still appears set on completing a merger with Fyffes – hopefully this isn’t simply a desire to protect jobs & expand their empire.

Frankly, I’m a little surprised FFY is so perky here. After collapsing to EUR 0.85 in August, on the Cutrale/Safra news, the share price has steadily recovered. But the revised merger agreement of 0.1113 ChiquitaFyffes shares for each Fyffes share suggests FFY should trade even higher. But that ultimately has little to do with the merger, and everything to do with a CQB share price that’s elevated by the current cash bid (and maybe the prospect of another)! I’m not quite sure what investors are anticipating here: i) The merger goes ahead – well, CQB’s pre-cash bid share price was USD 10.06, which would equate to FFY around EUR 0.89, or ii) Cutrale/Safra wins & Fyffes gets jilted at the altar – well, FFY’s pre-Chiquita share price was also (coincidentally) EUR 0.89?!

Maybe everybody’s clinging to the idea the merger will go ahead, and the new ChiquitaFyffes share price will magically home in on the curiously precise target of $21.20 per share, by end-2016. [Oh, you didn’t know? See page 20 of this presentation!]. Sure, companies love to tout the synergies of an M&A deal – despite how unreliable those forecasts invariably prove to be – but forecasting a very specific (& substantially higher) share price target, to be attained within a specific time period, is just plain ridiculous & irresponsible..!? But it highlights what management’s prepared to do/promise to see this merger completed. And it could hint at some type of potential scorched earth policy by Chiquita, if necessary, where raising their bid & winning may not be so attractive for Cutrale/Safra anymore.

However, a cash bid is always hard to beat (especially if the bidder has the fire-power, and the desire, to raise it), and CQB shareholders may soon realise even a $13.00 cash bid could be far superior to a ChiquitaFyffes share price that could trade anywhere… As for Fyffes shareholders, at this point referencing a stand-alone intrinsic value might be a good idea again: Adjusted EBITA’s notched a little higher to 3.8%, but again operating free cash flow (Op FCF) has only averaged about 55% of adjusted EBITA in the past few years. That’s effectively an operating margin of 2.1%, which deserves a 0.1875 Price/Sales multiple. If we fudge margins (by averaging them), I calculate the company could take on another EUR 76 million of debt & still limit interest expense to 15% of EBITA/Op FCF. Let’s haircut this debt figure by 50%, to be conservative (as usual). On the earnings front, Fyffes enjoyed a significant earnings jump in 2012, plus another this year (judging by forecasts, and the current 11.3 cts adj diluted EPS run-rate). However, its growth record is otherwise unimpressive – I think a 11.0 P/E is probably generous enough at this point:

(EUR 0.113 Adj Dil EPS * 11.0 P/E + (EUR 1.09 B Revenue * 0.1875 P/S + 76 M Debt Adjustment * 50%) / 298 M Shares) / 2 = EUR 1.03

Despite my misgivings about the near-term potential for the share price (regardless of the M&A outcome), it looks like Fyffes is trading bang in line with its underlying intrinsic value (which has been steadily increasing in the past couple of years). Of course, we’d have to factor in the underlying value of the Chiquita business if the merger goes ahead – but if the touted synergies are realised, it should obviously offer some decent upside potential…

Price Target: EUR 1.03

Upside/(Downside): 0%

_

OK, now let’s take a peek at the most under-valued & over-valued stocks, and see what’s currently on offer. Starting with the TGISVP Dozy Dozen:

Ugh…

Moving rapidly on, let’s look at the currently most under-valued stocks – these are obviously more interesting, so I’ll expand the table a little…here’s the TGISVP FAB Fifteen:

That’s more like it…no wonder I own four of these stocks! 😉 And now I look more closely, there’s still a fair amount of overlap in these tables with my previous TGISVP snapshot (in July) – see here for some commentary on many of these stocks, which you may find interesting/relevant. OK, that’s it – I did say I’d keep this relatively short & sweet! But let’s not forget, here’s my complete updated TGISVP file for your reference:

2014 – The Great Irish Share Valuation Project – Oct Update

If you have questions about any individual stocks & valuations, just post a comment here or email me. Cheers!

Pingback: Wexboy Portfolio – FY-2014 Performance | Wexboy

Pingback: The Great Irish Share Valuation Project – 2014 Portfolio Performance | Wexboy

Pingback: TGISVP – One Last Yr-End Snapshot | Wexboy

Pingback: Stock Picking…Art, or Science?! | Wexboy

Hi Wex I think you are wrong on Ffyfes.

There is a merger break fee of €17.8m coming – less expenses.

Even your own figures suggest FFY could comfortably pay a sizable dividend whilst remaining at the same valuation. Remember the MCAP is only circa €274m. – so your conservative debt of €35m is a potential payment of 12% of the market cap…

Also your statement

“CQB’s pre-cash bid share price was USD 10.06, which would equate to FFY around EUR 0.89”

Is a bit misleading FFY was about 0.89 pre-bid – suggesting the current circa 0.94 price is not taking into account any probability of this…

I get higher EBITDA cash conversion anyway close to 69% – but then I would rather use PE than price to sales.

Another way to look at FFY is to ask what sort of sustainable dividend / cash return could it pay.

Lets look at 2013 we have free cash flow (inc pension etc) of €28m.

We have maintenance capex of 7m – say 8m to be conservative – looking at prior years capex.

No real debt so FFY could pay a divi of about €20m each year – giving a 7% yield. This is too high given the current low interest rate world we live in.

Couple of points, FFY is very asset rich – so it could probably take on debt, secured against the assets then use the FCF to pay the debt and pay shareholders – LBO sort of model. I dont particularly like this way of doing business – I much prefer to buy lowly geared, asset rich companies and let nature take its course….

Hopefully this makes some sort of sense.

If you are interested more on my blog.

I would love to hear your thoughts on this.

rjmahan,

– That break fee is nice, but a lump sum of cash tends to get discounted unless they return it, or specifically invest it for a high return – for example, an acquisition.

– My additional debt capacity/adjustment may seem conservative, but reflects the cashflow shortfalls I’ve highlighted, and also existing debt & interest expense.

– Yes, cashflow has improved recently, but I wouldn’t be convinced yet. It’s also far more volatile than the P&L, so averaging this cash shortfall over the last few years & pricing/adjusting my valuation accordingly continues to make sense – albeit with room for improvement, if we see a sustained cashflow trend.

– Fyffes is Total Produce’s more exciting twin – it’s certainly far more capable of delivering an unexpected earnings growth. But it’s also a more volatile business (not to mention the cashflow aspect) – so I don’t disagree with your numbers, but your implied P/E of about 13.5 doesn’t necessarily look cheap (or expensive either).

– I think TOT is more suited to such a strategy, and I’ve detailed it accordingly – but yes, there’s scope with FFY to do some kind of LBO-strategy: That is, to maximise debt (within prudent limits) & cashflow, and focus on returning cash to shareholder via share tenders/buybacks.

Regards,

Wexboy

Thanks Wexboy I agree TOT looks good – particularly after recent falls…

Hi Wexboy – first of all I am greateful for all the useful and detailed work you are doing on this blog. I have recently developed an interest in active investment and the amount of data and information out there to absorb is quite challenging. I have a question for you given my “new” background to this – what are your preferred methods for stock valuation and what benchmarks you use. So for example P/E – Shillers advocates a P/E of 16. Investopedia says 15/20. I would be interested to hear your take on this. Thanks in advance!

Thank you Chris,

Sorry, this comment slipped by me for a while…

I try to use as many valuation approaches & metrics as possible, really. The more they confirm each other, the better – and the more divergent they are, the greater the need to investigate further. [Which could turn out to be positive, or negative – divergent valuations can spell risk, or opportunity].

I’m not a huge fan of P/E ratios myself – at best, it’s a rather blunt valuation tool, and at worst, it can be downright dangerous. If I was using a P/E ratio, I’d normally use a 1.0 PEG ratio as a rough rule of thumb – i.e. the P/E ratio should perhaps equal the earnings growth rate.

I tend to find the Price/Sales ratio a far more useful & robust valuation approach – it’s less volatile, far less prone to manipulation, and it better approximates how corporate/PE acquirers value companies. See the comments below, and elsewhere, for more detailed P/S commentary.

Regards,

Wexboy

Thanks Wex, I’ve been back to that post many times in the past to read up on precisely that part but I think you’ve just cleared it up for me – higher margins deserve higher multiples so below a generalised 10-12% for 1.0, the inverse is true – and with that you used the more conservative Op. FCF for the already conservative P/S valuation.

I always enjoy reading your posts because they always show something new and your way of valuing things on here is always a great way to see our own blind spots and check against our own techniques – thanks again!

Thanks Alex,

Yes, good perspective – my P/S multiple tends to compress below a 10-12.5% operating margin, but expands with higher margins. You’ll note P/E ratios exhibit a similar pattern – a 1.0 PEG ratio’s a useful rule of thumb, but a 30% earnings growth rate will probably attract a much higher (expanded) P/E ratio. [Though obviously there’s a lower limit to this relationship – stable earnings (i.e. zero earnings growth) probably still deserve at least an 8-10 P/E].

Cheers,

Wexboy

Hi Wex, another interesting post as always, thanks. I’ve been following the valuation techniques explain here on the site for a while now – the one on Fyffes got me wondering though. You get to a P/S ratio of .1875 which I appreciate is penalising an adjusted margin for lack of cash conversion – since four decimal places is a bit much for anyone from a finger in the air and the fact it’s an adjustment of 12%, would you be able to talk us through your thinking of the cut from 2.1 to 1.875?

Cheers, Alex

Thanks Alex,

See the P/S note in my DCC write-up earlier this year: https://wexboy.wordpress.com/2014/02/03/2014-the-great-irish-share-valuation-project-part-i/

If I’d relied on solely a P/S-type valuation here, I might well have used an average of Fyffes’ 3.8% EBITA margin & its (average) 2.1% Op FCF margin. But I’m also using a P/E multiple here, which already reflects the higher EBITA margin – to compensate, I’ll stick with the more conservative 2.1% Op FCF margin for my P/S valuation. Assuming an 11% margin equates (on average – as per my note above) to a 1.0 P/S multiple, you’d therefore expect to see something like a 0.19 P/S multiple. But I often have an irrational** habit of expressing decimals in terms of the nearest sixteenth – so 3/16 equals 0.1875!

** But grounded in a certain logic: Most interbank interest rates & trading were originally expressed in sixteenths (for example, ‘I’m quoting 4 5/16-3/16 in the 3 mths’), and even in thirty-secondths as the amounts got larger. [These days, most quotes are totally decimalised]. Years later, I can still repeat every 32nd to five places of decimal with my eyes closed…so they’re inevitably the ‘patterns’ I see buried in every decimal I look at!

Cheers,

Wexboy