Tags

Irish shares, Irish value investing, mobile content, mobile payment, Pageant Holdings, Ross Conlon, shareholder activism, takeover offer, Zamano, ZMNO

It’s 18 months since my original Zamano (ZMNO:ID, or ZMNO:LN) write-up:

Maybe I should kick off with an update…but if you’re a current (or potential) shareholder, how can we avoid the elephant in the room? Yeah, I’m talking about the early-Aug announcement of a possible EUR 0.20 per share offer for Zamano. The one where investors were subsequently left in the dark for nearly three months, only to learn in late-Oct bid discussions had actually been terminated (no further details were provided). I’m sure plenty of shareholders have been experiencing the five stages of grief since, and who can blame ’em really…it must feel a lot like getting jilted at the altar!

So, What Now..?!

Well, less than a fortnight later, the company released news of the Chairman’s upcoming resignation, plus a 9 month trading update which (while excellent) consisted of a single sentence… This appears to draw a line under the failed bid, and signals it’s business as usual, which I really don’t find acceptable. Shareholders deserve better. Whatever the merits/likelihood of the bid, it’s a frustrating reminder of the obvious value gap between ZMNO’s share price & its intrinsic value. I’m quite sure a majority of the company’s shareholders (i.e. its bloody owners!) now feel like they’re owed at least a strategic review, laying out in detail how the board intends to close the current value gap & grow shareholder value. Let’s map out the available strategies (and forgive a more jaundiced view):

Organic Growth

My last post relied on FY-2013 figures – since then, the company’s enjoyed consistent revenue momentum of +24% in FY-2014, +19% yoy in H1-2015 & an accelerated +37% yoy in Q3-2015, while net cash increased over 150% to €5.4 million. The recent trading update now pegs the revenue run-rate at €23.3 million, a 45% increase in less than two years! Maybe ZMNO finally deserves a growth stock re-rating?! Let’s hope so… Here’s updated financials to end-June 2015, focusing (again) on cash flow:

It’s encouraging to note recent (& historical) growth clearly doesn’t require increased cash investment. But let’s not fool ourselves, management’s enjoyed some attractive tail winds here. With 80% of the business now coming from the UK, sterling strength is a significant top-line contributor. The EUR/GBP rate averaged 0.8491 in 2013, and now it’s 0.7046 – that probably accounts for 25-30% of the post FY-2013 revenue increase. And with the UK & Ireland being two of the best economies in Europe (in terms of GDP growth/recovery & declining unemployment), increased consumer spending is another substantial tailwind. Plus, there’s a renewed emphasis on B2B – and while that delivers a more stable/durable revenue stream, it also means lower margins & a lagging EBITDA (which increased 19%, to €3.1 million) over the same period.

Now, this is not to denigrate management in any way – in terms of execution, they’ve done a bang-up job in the last few years. But we have to understand the impact & risk of losing favourable growth tailwinds. And with no obvious brand or customer loyalty, it’s a never-ending battle to replace revenue. [Sounds terrifying, but thousands of listed companies face the same challenge globally]. So, despite management’s best efforts & excellent headline growth, I’m not convinced we’ve seen a step-change in Zamano’s growth trajectory. After all, there’s little real difference in today’s financials vs. long term average revenue of €21.0 million & EBITDA of €2.7 million. And after years of effort, the company’s overseas business now amounts to a measly 4% of revenue, so geographic expansion isn’t the answer. Sustained growth will obviously require a larger B2B business, plus the launch/exploitation of new business opportunities.

Notably, Zamano has recently reported it’s developing/completing the platform infrastructure & network operator connections for merchants to sell directly to Irish mobile subscribers via direct carrier billing. Sure, this could be a huge opportunity, but it would also pit the company against some giant players (& mobile payment alternatives). [And why on earth wasn’t there a direct carrier billing update in the interims!?] Then again, the last great white hope here was the late-2013 launch of Message Hero, an innovative SME messaging system – unfortunately, it saw modest 2014 sales & hasn’t been mentioned since! And let’s not forget the ramp-up & subsequent shutdown of Newsworthie in 2011 (costing a former CEO his job). So, we have to ask:

How many years exactly would a game-changing growth & diversification strategy take here? And how much of a transitional revenue/margin hit might be involved? Sure, I previously posited a Hell for Leather growth strategy – i.e. sacrifice margin to accelerate growth – but noting the collapse in sentiment & share prices among ZMNO’s growth-oriented (and cash-starved) peers, such a strategy doesn’t seem quite so palatable now…

Acquisitions

In early-2013, Zamano formed a new development opportunities team ‘to explore, identify and target new product licencing, joint venturing and acquisition opportunities’. The Chairman subsequently clarified the company was ‘looking for acquisition opportunities to enable it to strategically re-align the Group’. Management hasn’t been idle since, admitting it has ‘identified and examined a number of opportunities in mobile media, billing and messaging’ in 2014 & (separately) in 2015, but no investments have actually met the board’s strict acquisition criteria.

The discipline’s admirable…but we’ll be three years down the road soon, with no sign of a deal!? And the rest of the sector seems to be sinking into a morass of negative sentiment & distress (with a side helping of potential fraud), so picking up a business/division there looks problematic. While elsewhere, every second entrepreneur believes they’re raising a baby unicorn, so the price gap between buyer & seller keeps widening. And Zamano’s last acquisition (of Red Circle Technologies) proved near-fatal, not surprisingly for a debt-funded acquisition which closed in late–2007! Regardless of the crisis, it’s a reminder of the unforeseen financial/integration risks that can follow any acquisition.

More generally, I’m not convinced by the logic of Zamano’s acquisition strategy. Sure, it might look good on PowerPoint…but how does it stack up vs. share repurchases, an always sensible investment hurdle when evaluating potential acquisitions. I mean, what beats buying the business you know best (at the right price)?! Ignoring this hurdle’s an easy way to dilute shareholder value, esp. with an acquisition paid for in undervalued shares. And here the math’s even more daunting: ZMNO currently trades on a 0.6 P/S multiple, while its market cap is 36% cash & offers a compelling 18%+ RoE. Do you really think management can find & close on a (great) acquisition at such a cheap price..?

Share Repurchases

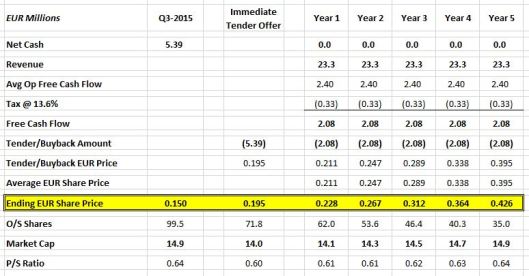

I may debate its growth trajectory, but a decade of financials offers persuasive evidence Zamano is a virtually indestructible cash machine. Operating cash flow only turned negative once (by €0.5 million in 2011, after a three year collapse in revenue), while free cash flow averaged €2.2 million pa (over €21 million since ’06). Zamano’s consistent cash generation, its cash pile, and its undervalued market cap, is a perfect recipe to enhance & realise shareholder value: Via Share Repurchases. But why argue the benefits, when a table can present a far more compelling story…

Here’s one potential 5 year share price trajectory: Assume an immediate tender offer (at say, a 30% premium), with all subsequent free cash flow utilised for ongoing share buybacks, and no change in the current 0.6 P/S multiple:

[NB: Scenario’s obviously from the perspective of an investor who sells zero shares – involuntary share repurchases would reduce their return (albeit, cash could be re-invested). It’s also debt free & intended to be flexible – a decline in revenue/profits (or FCF) would justify reducing (or even halting) buybacks].

OK, surely that’s a scenario investors would fall in love with…so here’s another share price trajectory: Now assume ZMNO’s valuation converges to a 1.2 P/S multiple (taken, arbitrarily, from my last write-up):

In both scenarios, note I assume zero change in revenue/free cash flow over the entire period…which makes a possible multi-bagger return in just 5 years from a EUR 0.43 (or even a EUR 0.67) share price all the more astonishing!

But that’s what the book ‘The Outsiders’ is all about… Extraordinary managers can actually produce extraordinary returns from what might otherwise be very ordinary companies. [And the success of the private equity industry’s obviously built on much the same premise]. Except investors tend to discover they’ve actually ended up in bed with management who are agents, not owners. Which is perhaps true of 90%+ of UK/Irish management (who can be decades behind their US counterparts in terms of shareholder value)…so unfortunately, we shouldn’t waste time discussing how reasonable such repurchase scenarios may (or may not) be. Instead, we can assume such value-enhancement will be automatically dismissed as pie in the sky by management, since they usually have no real skin in the game & zero desire to shrink their empire…

[NB: Zamano’s board currently owns just €59 K worth of ZMNO shares directly, a mere 18% of its aggregate annual compensation.]

Sale

A sale may still be the quickest/simplest way to realise value here. But we’ve just seen a failed bid…should we be concerned something unexpected turn up during the due diligence process? A fair but probably unwarranted question: Small deals may take longer, as principals often have less M&A experience, but due diligence grunt work is still delegated to the professionals…who don’t need 11-12 weeks to find a deal-breaker. We should assume: a) the buyer failed to follow through on their bid, or b) the board simply couldn’t get comfortable with the actual bid (being too low, conditional, non-cash, who knows…).

But as things stand, a sale might be considered a mixed blessing anyway. The company remains significantly under-valued, its cash/financial strength is clearly unappreciated, and hopefully its value continues to compound – so a takeover would represent an exit, but the offer premium wouldn’t necessarily reflect Zamano’s underlying intrinsic value. As for management, a natural resistance to a sale is not unusual if it means an abrupt & unwelcome loss of control (and/or jobs)…this is particularly true of management who are agents, not owners.

To be cynical, we should recognise there may also be an over-riding strategy at play here…

Institutional Imperative

Yup, Buffett said it best – the Institutional Imperative is the ‘strategy’ which rules supreme in most companies. First, cash must be hoarded to protect the business (& shareholders) from all the scary (yet vague) threats lurking ’round every corner. But second, the Institutional Imperative’s really about empire building… [And God forbid, share repurchases would shrink that empire!] So a policy of growth at all costs is always far more appealing to management – the financial logic (of share repurchases) is conveniently ignored, and hoarded cash inevitably gets splurged on (overly) ambitious investment & acquisition plans instead. [And note the illogic: If cash represents a genuinely defensive asset, exchanging it for an illiquid asset (which generates a small fraction of that cash annually & comes with a bunch of related integration risks) would make little sense]. Unfortunately, management has more in common with politicians than we usually care to acknowledge – they may be far more handsomely rewarded, but all the same you should still brace yourself for disappointment…

[In Zamano’s case, the regulator(s) presumably stand ready to wipe out half their business & fine ’em into oblivion. But that’s always been the fear… In reality, public bodies often move slowly & neglect to offer any kind of specific guidance – which means fines are sometimes inevitable, but it also means long lead/lag times to work around new regulations. The financials confirm this – the regulator(s) may impact the top-line, but the bottom-line’s proven far more resilient. Yet investors still tend to over-estimate the risks, despite the fact: i) online complaints often relate to other companies ‘renting’ access to ZMNO’s systems/network relationships, ii) there’s zero reference to fines/penalties in recent annual reports (the largest fine I’ve found online was £50 K), and iii) management even highlighted to Comreg last year ‘complaints and queries have…[seen] almost an 80% reduction since the Code [of Practice in Jul-2012] has come into force’].

Now, So What..?!

Now, let’s man up, time for this pity party to end…’cos none of the above really matters. Seriously, it doesn’t matter a damn! Let’s repeat that:

IT.

DOESN’T.

MATTER!

So what if you feel like you missed out on a bid? You can be sure the board would have preferred to wait & only go public with a formal offer…except for the unexpected press leak!? [ZMNO’s press release came out over the August bank holiday, which tells you they were really scrambling!] And so what if you didn’t sell before the news of a failed bid? The share price was EUR 0.134 ahead of the bid, it’s unlikely you could have sold much better than EUR 0.16, and now it’s EUR 0.15 per share…so what’s the big deal? And so what if management hoards cash, instead of returning capital to its rightful owners? So what if they justify an acquisition, simply because the money’s burning a hole in their pockets? So what if they hope there isn’t another bidder lurking in the bushes? So what if they just sit on their hands & do nothing?

Because ZMNO is priced accordingly..!

Unless you expect management will do something extraordinarily stupid (& I certainly don’t), whatever they end up doing (or not) amounts to nothing more than a comparatively better or worse decision. If the Institutional Imperative does reign supreme, I’m confident Zamano offers significant upside potential regardless… And if management manages to shoot the lights out & actually deliver sustained organic growth, an exceptional acquisition (& integration), an aggressive share repurchase programme, and/or a superior bid, these are all free options on sale today. I also suspect investor sentiment offers the same asymmetric bias…i.e. good news may have far greater capacity to positively impact the share price.

I’m actually reminded of my first Irish write-up: Four years ago, I highlighted Total Produce (TOT:ID) was severely under-valued at EUR 0.39 a share, but in a later post I strongly criticised management strategy. The shares had actually doubled at that point, and at EUR 1.40 a share, they’ve now almost quadrupled…funny thing is, we basically saw zero change in strategy! [OK, earnings accelerated marginally, if you call a high (vs. a mid) single digit growth an acceleration. And they started a buy back, but only (bizarrely) after the share price more than tripled!?] So, while management wasted multiple opportunities to enhance value, the lesson here first & foremost is that buying at a huge discount to intrinsic value delivers outstanding returns. Because:

Value will out…

I know, we’ve all tumbled into the sack with a few Ben Graham-type value traps, seduced by that logic. And sure, I can never disprove a negative – who knows, Zamano’s business could head off a cliff tomorrow, or simply wither away. But that’s what the doubters claimed 10 years ago, 5 years ago, 2 years ago…yet here we are, with a decade of cash flow under our belts & revenue up almost 50% in less than two years! And unlike your average value trap, you actually get paid to wait ’round here – ZMNO’s LTM €2.7 million free cash flow equates to an 18.2% RoE, based on its current market cap. [And if cash were returned to shareholders, that potentially equates to an astonishing 28.5% RoE!] And don’t forget, we still have a genuine catalyst (or two) lurking here…

Catalyst

Just three shareholders control 52% of Zamano: Ger Dowling (founder of Red Circle) owns 9.1%, via Grillon Holdings – he’s in the stock eight years, with almost a 60% loss to show for it. Ulster Bank Diageo Venture Fund owns 14.0%, with close to a 20% loss after six years. And Pageant Holdings (whose activist intervention was instrumental to Zamano’s post-2011 turn-around, as detailed in my last write-up) has also been involved for six years – it now owns 28.9%, and probably has a decent 50-60% gain to date, but that still only equates to a single digit IRR. [Plus we have a ‘new’ 6.3% stake declared recently by Cypriot-based Magizano Investments].

After all this time (& noting their losses/meagre returns to date), we have to wonder whether these shareholders remain happy with their investments in Zamano? Whether they support management’s current organic & acquisition-led growth strategy, bearing in mind the time required to execute? And whether they see substantial upside potential, or are now willing sellers? Again, it doesn’t really matter, because in the end a takeover represents their only likely/practical exit. So, if you feel bad…just take a moment & try picture how bad they must actually feel about missing out on a bid?!

But Pageant’s actually had a director in the boardroom for nearly 4 years now. What’s changed (if anything) since my last write-up? Well, quite a lot…in the past 18 months, we’ve actually seen Pageant emerge as a vocal & public activist, pushing NTR plc to realise assets & return capital to shareholders. [See also my write-ups, here & here]. So it’s only fair to wonder:

Why aren’t we seeing something similar happen at Zamano?

But who knows what’s happening in the boardroom? Notably, the Chairman John Rockett was actually appointed along with Pageant’s director – so will his departure potentially strengthen or weaken its influence? Again, it doesn’t matter… Because sooner or later, Pageant’s desire for an exit will surely mean Zamano ends up on the block anyway. [And who knows, if management recognises (& possibly fears) this eventuality, there’s a chance they just might propose an aggressive repurchase strategy as an alternative!?] Just to add some useful perspective, here’s Pageant’s Irish holdings (from my last write-up). The primary focus was presumably on its €10 million+ holdings, all multi-baggers. But we’ve seen big changes since: One51 was recently sold, NTR will be almost fully realised in the next fortnight, and Datalex (DLE:ID) keeps winning new contracts (while its shares more than doubled again). Zamano stands out more & more as the ginger step-child of the bunch…you have to wonder if Pageant’s now ready to do something about it?

[NB: Or a block buyer might appear – I’m sure the main shareholders would consider any exit opportunity, since they don’t necessarily have the luxury of timing here. I don’t think minority shareholders should be concerned by such a transaction – considering the circumstances, it’s likely a major new shareholder would bring their own activist/operating strategy to the table anyway].

Valuation

So now, what’s Zamano worth today? Let’s repeat a condensed version of the financials, showing the last few years & 2006-15 long term averages:

You’ll notice two LTM columns: The latter incorporates the recent Q3 trading update. I’m comfortable using Q3 LTM revenue of €23.3 million (notably similar to ZMNO’s long term average revenue of €21.0 million), but award no premium for current revenue momentum. Again, I’ll focus on operating free cash flow – cash generated from operations, less capex/intangibles – rather than EBITDA or operating profit. The latest Op FCF margin is 13.9%, but let’s be conservative & opt for the long term average of 11.4% – despite the haircut, this margin still deserves a 1.0 Price/Sales multiple.

This time ’round, we’ll ignore any potential value-enhancement from share repurchases, but we must still acknowledge the strategic value of the company’s cash & debt capacity. While we can’t know if/when/how effectively management might tap this potential, it’s an integral & significant component of underlying intrinsic value…which should inevitably be recognised (and/or realised) in the fullness of time. Zamano currently has EUR 5.4 million of net cash on hand (& gross debt is de minimis). Noting current Op FCF of €3.0 million & assuming a 5% interest rate, I estimate Zamano could comfortably support €9.0 million of debt (interest expense would then equal 15% of Op FCF) without impacting its valuation multiple (or financial strength). Let’s apply our usual 50% haircut & assume €4.5 million of debt capacity instead (which equates to a reasonable 1.4 times EBITDA, or 1.3 times operating cash flow). Finally, we have 5.9 million dilutive share options outstanding, vesting soon with a 5.95 cent strike – it’s prudent to include them in our outstanding share count, while also inc. €0.4 million of exercise cash. Which gives us:

(€23.3 Million Revenue * 1.0 P/S + €5.4 M Cash + €4.5 M Debt Capacity Adjustment + €0.4 M Option Cash) / (99.5 M Shares + 5.9 M Options) = EUR 0.318 Fair Value per Share

Versus the current EUR 0.15 share price, this EUR 0.318 price target now offers an Upside Potential of 112%.

ZMNO trades at dirt-cheap 5.5 P/FCF & 3.1 EV/EBITDA multiples – while at the target price, it would trade on 11.6 P/FCF & 8.4 EV/EBITDA multiples, which looks entirely possible in terms of average market metrics/multiples. As for its ‘peers’, I don’t think a valid comparison’s even possible: Here’s some peers I previously highlighted (all were burning cash) – since then, they’ve collapsed on average almost 60% in the past 18 months. Judging by ZMNO’s vastly superior relative performance, I wouldn’t be at all surprised to discover investors are steadily gravitating towards it as a sector winner…

While Zamano might seem like a challenging holding to some, its steady technical & fundamental progress/momentum over the past 4 years is very encouraging. It continues to generate significant cash flow, strengthen its balance sheet, and compound intrinsic value…not to mention the fact (see here, here & here) there may be other bidders still lurking in the wings!? Of course, the market’s the best arbiter of any investment thesis: ZMNO’s actually delivered a 79% gain (in just 18 months) since my original write-up!

In fact, its cumulative appreciation means it has now become my largest holding – I continue to maintain an 11.7% portfolio holding in Zamano.

Dividend

And finally, I’m now lobbying Zamano’s management to declare a final dividend. Noting the current revenue momentum, profitability & cash generation, balance sheet strength, and the recent failed bid, the least shareholders expect & deserve at this point is a dividend. A 25-40% dividend payout ratio is normal for a healthy company. In Zamano’s case, its balance sheet strength & free cash flow (which has exceeded net earnings in the past couple of years) justify a ratio at the high end of this range. Noting a current 2.4 cent adjusted diluted EPS run-rate, I would propose a 1 cent per share dividend as prudent & sustainable. [ZMNO’s net cash would also cover the dividend for over 5 years]. And if you’d like to see a 6.7% dividend yield on your investment, as a shareholder, I would urge you to also contact & lobby Zamano management in the coming months. And/or please feel free to express/confirm your support to me at wexboymail@yahoo.com – thanks!

- Zamano: EUR 0.15 (ZMNO:ID) [or GBP 0.10 (ZMNO:LN)]

- Market Cap: EUR 14.9 Million

- Price/FCF: 5.5

- Price/Sales: 0.6

- EV/EBITDA: 3.1

- EV/Sales: 0.4

- Tgt Mkt Cap: EUR 31.6 Million

- Tgt P/FCF: 11.6

- Tgt P/S: 1.4

- Tgt EV/EBITDA: 8.4

- Tgt EV/Sales: 1.1

- Tgt Fair Value: EUR 0.318 per Share

- Upside Potential: 112%

Pingback: Zamano – Time For A Dividend & Your Support… | Wexboy

Pingback: Wexboy – Top 14 Tips for 2016! | Wexboy

I got pretty interested until I googled ‘Zamano complaints’. They are scum. For example:

http://www.telegraph.co.uk/finance/personalfinance/household-bills/11328500/Premium-rate-text-trap-retired-vicar-billed-200-for-gambling-texts-he-didnt-want.html

and https://en.wikipedia.org/wiki/Zamano#Controversy

Hi MrC,

I’ve already addressed most of the risks/misconceptions I see re Zamano, please see my previous post:

But I did highlight one other misconception in my new post: ‘online complaints often relate to other companies ‘renting’ access to ZMNO’s systems/network relationships’. The retired vicar story is an excellent example: Buried in the story you’ll note the line ‘The resulting investigation found that the service was “misleading” and led to PhonepayPlus fining Gresham Mobile’:

Click to access 18987-Tribunal-Minutes.pdf

PhonePayPlus actually brought a case against & fined Gresham Mobile, a UK company, for its TextPlayWin sub. service. Zamano merely provided network access, and the Tribunal actually highlighted a dozen actions it took to mitigate & respond to the related risks/issues. Regardless, the hack focused her entire story on Zamano…I’m surprised she didn’t also go after Vodafone, Vodafone’s billing provider, the mobile phone industry, and/or the inventors of the Internet itself!? The stats from this case are also a reminder complaints only come from a v tiny % of subscribers. Except these are the only people you actually hear from on the internet…nobody’s sitting up at 3 am in their miserable little garret ticking stars, banging out reviews or contacting journos about the great Zamano content they downloaded last week!

In the end, I have little desire to ‘defend’ ANY company…like most investors, I prefer to focus on the negative aspects (whether real, or imagined) of a company in terms of the potential financial/investment risks they might pose – and I think I’ve done that here, having a decade of Zamano’s financials & operating history to reference.

Kind regards,

Wexboy

The comprehensive report is impressive and logical. The only niggling question is if it is such good value why didn’t bidder think so, took about 3 mths and then walked away. Company did not elaborate much either so we are in the dark which is not the safest place to be. Hence, why caution is necessary.

Well, see my comment(s) above. Yes, a high % of (possible/actual) offers you hear about tend to ultimately result in a deal – but I don’t believe that’s the correct universe of offers against which you should judge Zamano’s failed bid… There’s actually a huge number of approaches & possible offers you never hear about, and a high % of those never result in a deal – so a possible offer that was outed as a press leak & subsequently failed is far less unusual than it appears.

More generally, you have a good point, if Zamano is so cheap why don’t investors (or bidders) snap it up? But that’s the eternal value question…trouble is, people see value but don’t know if it will be realised in a year, or maybe 5 years (& they prefer the comfort of the pack anyway). So they only jump in when there’s an actual event & sufficient share price momentum…ie they pay up for greater certainty (actual, or perceived). That isn’t necessarily a bad thing, but if you want to potentially earn much bigger gains, you have to accept much greater uncertainty. But sometimes a potential value catalyst can offer you a free option in such situations…

I agree they seem to have a lot of surplus cash, should certainly pay a dividend of at least 1c. And the logic of share repurchases which you set out seems compelling.

In your valuation section, you assign €4.5m debt carrying capacity. I realise this is hypothetical,. But for the avoidance of doubt, I don’t want them to actually take on debt, not even for a perceived “good” acquisition.

Thanks Guy,

Noted. As are your comments re debt – at this point, I’m sure the primary focus will be on the best use of cash here, rather than considering taking on any potential debt.

Regards,

Wexboy

Good post, at least the share price is reflecting progress over the past 3/4 years. A dividend would be very welcome, and would certainly get the attention of Irish/UK investors looking for yield. The stellar performance of the ISEQ over that past 3 years means that dividend yields are poor.

I’d prefer the scenario of buybacks, but management may have no incentive. At least it is comforting that they are very selective about spending that pile of cash.

Thanks John W – your comments here, and emails to me & ZMNO management are also appreciated. Cheers, Wexboy

Great Blog, very informative. Thanks

Thanks, Matt!

the irish stock exchange regularity body has failed to fullfill its duty to provide and protect investors for the past 30 years . it would appear like most institutions in ireland where a few good old boys with winks and nods look after the chosen few and doing an honest job properly for a large salary is not on the agenda . last year there was the company takeover by an individual and pal which was as close to any sharp tinker dealings i saw in ballinasloe horse fair .