Tags

absolute return, benchmarking, Brexit, diversification, Donald Trump, portfolio allocation, portfolio performance, relative performance, track record, value investing, Zamano, ZMNO

Trump.

Trump..?

Donald Trump..?!?!

No, just no, it can’t be…

How did he…how could they?

This isn’t what anybody expected…

Who does he think he is trying to steal a place in history from…

ME?!?

Because Nov-9th was destined to be MY day…which, I’m assuming, faithful readers already knew? ‘Cos five years ago, to the day, I first clicked the Publish button & launched the Wexboy blog into the wild blue yonder of the internet! And at the time, who in their right mind would ever have imagined the Donald being announced as President-elect to celebrate the 5-year anniversary of this blog?!

Though I’m sure he’d approve of my first post – a real estate investment write-up on Nov-9th, 2011: Sirius Real Estate (SRE:LN). More recent readers will marvel this post was a trifling 1,300 words long (note the last para of the post!?). Not to mention my insane pace initially – I clocked an astonishing seventeen more posts for the rest of that month – I guess I was finally learning, like many writers, to channel the rage in a more creative & productive manner…

If you’d asked me to look five years ahead to this day, I’d have laughed. And if I’d actually envisioned publishing hundreds of thousands of words since, maybe I’d have mapped out a killer-trilogy of bondage, vampires & bad metaphors, and lived off the royalties instead! [Though I suspect I’d have then started a blog to document my investments…so perhaps this was my destiny all along!] Ask me last year, and I’d probably have promised a rash of posts – some serious, some frivolous – to mark such an anniversary. But now we’re here, the urge to celebrate seems to have dissipated – I have to wonder if the Brexit referendum vote, followed by a Trump election victory, has something to do with that? In their wake, the blog certainly feels more like an unfinished story…

But looking back, I have to admit I’m amazed at this body of work to date. The investing advice I’ve offered along the way still (pretty much) makes sense to me – in fact, there’s little I’d change at this point, let alone go back on. As for the macro perspectives & investment themes I’ve elaborated on over the years, I’ve always tried to focus on the longer-term horizon & filter out the current market noise – the fact that much some of it still appears to offer a useful macro framework, plus a road-map for some interesting secular investment opportunities, would hopefully suggest I’ve achieved that.

Of course, the heart of the blog’s in the investment write-ups. Investors can read everything they can lay their hands on, but most are chasing a holy grail they’ll never find in books: How to properly assess a stock in real-time – in all its original & imperfect glory, and as its story evolves – accompanied by the usual all-too-human blood, sweat, tears, fear & greed. And in that sense, investment blogs are the grail – they provide that very window on the soul of investing. They’re undoubtedly the best learning tool available today for investors (of all stripes)…well, except for the painful but very necessary process of learning from your losses!

For me, as I’d hoped, reader/investor scrutiny has provided its own selfish benefit in terms of the rigour/consistency/transparency of my investment theses & process – not to mention, I upped the stakes by committing to an auditable performance record! And I’m pleased with that decision: I suspect there’s few investment blogs out there offering a 5 year performance window into a real-world portfolio, where investors can track the real-time evolution of each stock/investment thesis, knowing the level of conviction/skin in the game (as reflected in my portfolio allocation) & all subsequent/incremental buys or sells.

So, let’s get down to brass tacks asap…

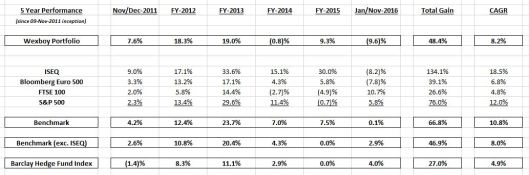

First, this prior performance post (which left me neck & neck with my benchmark) is worth reading – it lays out my entire performance rationale & methodology (NB: I specifically exclude dividends & FX gains/losses from my returns), my performance benchmark (a pretty arbitrary average of the ISEQ, Bloomberg European 500, FTSE 100 and S&P 500), plus an additional audit/scrubbing of my performance figures for consistency (which lowered my returns marginally). Updating for FY-2015 (here’s the related performance post), and performance YTD to Nov-9th, 2016, we have:

[NB: Barclay Hedge Fund Index performance is best estimate as of end-Oct.]

[Again, please note regular dividends are excluded from my returns – which hopefully provides a good indication of likely net performance, e.g. after fees (& bid-ask spreads) (& noting a low turnover ratio). Investors also tend to compare investment performance with price indices, rather than total return indices – another reason for this approach.]

Compared to my H1-2016 performance post, my benchmark clawed back a (5.1)% loss – but still only managed to break-even as of Nov-9th, with the Irish & European indices offsetting nice UK & US index gains, a reminder how tough it’s been for diversified investors to actually make money this year. [Even the much vaunted Trump rally since then is nothing more than a good month’s return for the US market – in reality, significant price rallies have been limited to specific sectors]. As for my own portfolio performance, a relatively good H1 mutated into a rather unfortunate 9.6% loss YTD (which I’ll talk about more below). Let’s recap:

Since inception, the Wexboy Portfolio has chalked up a 48.4% Total Gain & an 8.2% CAGR.

Which I think is pretty respectable for a reasonably well-diversified portfolio, especially in a low rate/low growth environment where double-digit returns year-in year-out have been consigned to the dustbin of history. Unfortunately, this falls well short of my benchmark, which boasts a 10.8% CAGR…but I’m optimistic this shortfall can be reversed in due course. In fact, the picture’s much less grim than it might appear:

- As highlighted before, basing 25% of my benchmark on the ISEQ is tough, because of: i) its subsequent/massive out-performance vs. other indices, and ii) Ireland’s fractional share of world GDP, which would demand a grotesquely over-weight allocation in a diversified portfolio (if I hugged the benchmark). I guess that’s what I signed up for, I have myself to blame…but regardless, I’m heartened to see I remain (marginally) ahead of my benchmark (ex-ISEQ) which sports an 8.0% CAGR.

- Noting this, it’s somewhat ironic to reveal my current under-performance has nothing to do with the last five years, or even my overall portfolio…in fact, it’s solely due to a single Irish stock & its performance over the last three months!? Seriously… And if I actually exclude this one stock, my (adjusted) performance would be positive YTD, plus I’d boast a 10.7% CAGR since inception…right in line with the benchmark!

- And yes, I’m talking ’bout Zamano (ZMNO:ID) – for reference, here’s my most recent commentary (scroll down). The company still hasn’t appointed a new CEO or Chairman, their years-old acquisition strategy remains a total bust, plus they now face new regulatory uncertainty in the UK. Unfortunately, this highlights a key risk whenever you have an activist perspective/involvement – it might take a significant business reversal, and/or share price decline, before management’s finally forced to adopt a new strategy & (hopefully) a smarter approach to capital allocation. At this point, the remaining management team certainly appears to have burnt its bridges with all shareholders, both large & small – nor can I envision an acquisition which would still make sense here, in relation to ZMNO’s current enterprise value. But while management may have squandered time/upside potential here, I still believe intrinsic value & net cash remain well north of the current market cap. If Zamano & its management is now as unpopular with its major shareholders (who control a 52% stake, in aggregate), as it is in the Wexboy household, we should finally expect a more urgent focus on supporting the share price & enhancing/realising shareholder value.

- Obviously, I measure performance on the blog purely in terms of disclosed holdings – unfortunately, that math’s now working against me. So while I began the year with ZMNO as my largest portfolio holding, at 11.3% (due to price appreciation, plus some incremental buys), it’s more like 20% of my disclosed portfolio – which means the share price collapse hits my blog performance about twice as hard as my real-world portfolio. Plus my undisclosed holdings, which are far more biased now towards US & luxury stocks, have racked up an average 4-5% return YTD – obviously, that’s not relevant here, but it still helps pay the bills!

- And speaking of bills, I can’t live on bloody relative performance alone… Sure, I may not feel a burning compulsion to dabble much in esoteric asset classes, and/or derivative hedging strategies, but I most definitely focus on absolute performance – in terms of preserving, as well as enhancing, my wealth. From that perspective, I’m more than delighted with my portfolio performance (both blog & real-world), esp. when I compare it to those Masters of the Universe! Despite the huge fees, salaries & bonuses, the average hedge fund’s only delivered a 4.9% CAGR in the last five years…a 3.3% annual shortfall vs. my own 8.2% CAGR (despite the ZMNO debacle).

- And who knows, I’m still hoping for a little bit of sanity re Zamano – and maybe even a storming Santa rally! So maybe my FY-2015 performance can still enjoy a nice bump by year-end. I’ve certainly been intent on running down my cash in fits & starts since a recent peak, with this scenario in mind – my only wish would have been for a little more (downside) Trump volatility along the way, but fortunately (I think!?) I remain focused on stocks which are not actually #TrumpPicks.

And as always, for many this blog isn’t necessarily about performance – or cherry-picking winners & losers – based on the feedback I get regularly, it’s the rigour & consistency I strive to apply in my analysis & valuation of new stocks/investment theses which seems to inspire readers most. I thank you for that, and certainly hope it’s something you can use and/or adapt in your own investing & portfolio…while luck may often seem responsible for your biggest winners/losers, I firmly believe it’s the rigour & consistency of your investment process which will ultimately determine your longer-term returns.

And finally, I must observe…for many, writing an investment blog for five years, especially when it anonymously separates this public life from my private life, might seem like the work of an austere & unsociable individual. But no… There’s some out there who’ve talked with me, met me, knocked back a few with me, collaborated with me, and/or actually know me, and I think it’s safe to presume they’d confirm I’m not that kind of individual!? As somebody said recently: You can definitely sing for your supper! So, my thanks to each of them…you know who you are.

But equally so, I want to thank each & every reader here for their interaction – whether it’s reading the blog, following/interacting with me on Twitter, commenting on individual posts, emailing me to discuss old/new stocks (both mine & theirs), offering their support for some activist effort(s) along the way, etc. As I sometimes joke: I’m far too young to consider myself retired…but also far too cynical to consider a regular job! So needless to say, each of you, along with the blog (not to mention my portfolio!), help keep me off those mean streets! Not forgetting this is also a great milestone to start planning for some new things I’d hope to achieve here & in the real-world – I’m looking forward to the next five years just as much as the last five…. 🙂

ps And yes, I know, I pretty much avoided writing about Trump this entire post – but aren’t you kinda glad?! Not to worry…there’ll be plenty of time & posts to come where I’ll tackle El Presidente!

Pingback: 2016 – Not Missing You Already… | Wexboy

Zamano, is it worth sticking with the stock or should I take it as a learning opportunity and move on?

Hi Trig,

Sorry, still on my to-do list…

Did take a (deliberately negative) look back at Zamano here in 2016:

Will be taking another look v shortly though, and plan to give a realistic (pros & cons) assessment based on its current situation, prospects & share price.

Good luck,

Wexboy

Well done Wexboy, thanks for the posts.

Zamano!! yep, can`t believe you have been championing that stock. Did alarm bells not ring?

Yes they could be considered a tech co. but only just. I just don`t get it, are they not just a glorified spin the wheel maker? Nothing really technical or innovative about them. And what about all those court cases against them?…

Ah well hindsight is 20 20 vision isn’t it.

Shauny,

Thanks.

Well, nope…I never described Zamano as a tech company (but it did inspire me to research/invest in Mobile, my largest portfolio allocation), it’s simply a marketing company (but then again, aren’t most tech co’s?). See here:

And I certainly didn’t paint some glowing operational upside here, in terms of revenue/profits – the upside was actually premised on the market ultimately recognising Zamano’s intrinsic value at the time, and/or management actively seeking to enhance & realise shareholder value.

As for court cases, I recently tweeted abt a Zamano case that was dismissed…now who would you believe, a judge, or internet whingers with too much time on their hands? If you look back over the years, court/regulatory fines & penalties have actually posed a relatively immaterial risk/financial impact to the company – the main risk was, in fact, the regulator changing the rules of the game.

At the end of the day, all I can do is to try & help bring the horse to water…..

http://www.investegate.co.uk/zamano-plc–zmno-/rns/business-update—strategy-board-changes/201611251539472203Q/

Regards,

Wexboy

Pingback: How to invest under a Trump Presidency – One percent Money

Pingback: Some links | value and opportunity

Do you have any thoughts Providence Resources ( PVR). Costing me a fortune

Hi Brian,

Look back here on the blog, I’ve generally seen compelling value in Providence Resource’s resource potential, except when it was trading at 600p plus…and we all know what happened next! Of course, we’ve seen huge share dilution since, but my valuation approach (which focused primarily on Barryroe) would still suggest attractive upside potential from here. Unfortunately, when it comes to junior explorers, resource potential is essentially inaccessible (or even worthless) when there’s no cash and/or a catalyst(s)…

But arguably, PVR now has both: It’s debt (& litigation) free with ample cash on hand, it now has a rig-contract signed for a Druid (& likely a Drombeg) drill, and Tony O’Reilly is obviously hoping to sign at least one farm-out deal by 2017. Of course, it’s hard to handicap the odds here & as usual the outcome will be pretty binary, so this is still a stock you should exit if you’re not prepared for a possible 75-90% loss (from here)…otherwise, in terms of risk/reward, your upside potential’s probably better than it’s ever been for your entire holding period.

Regards,

Wexboy

Congrats from Germany !!

Thks, mmi!

Congrats 🙂

Thanks, Hielko – same to you, keep ’em coming!

What’s going on with the Finnish fur company you wrote about a year ago? Stock price is down…Any update?

Also is this only listed in Finland? My broker (IB) can’t find the ticker you used. Is there another listing?

Hi Banjomano,

Perfect storm hit the company in terms of Chinese over-production…which may be lower quality, but has hit auction prices hard & left a lot of auction furs unsold. Saga Furs is now restructuring what had become a progressively inflated cost base, but more aggressive cuts are obviously needed…otherwise, the company’s v dependent on the supply-demand situation correcting itself (there do appear to be signs of that, Chinese farms seem to have the ability to turn on & off production at will).

Meanwhile, Saga trades at a 0.6 P/B & 1.1 P/S multiples – certainly appropriate in light of current fundamentals, but could also be considered deep-value territory in terms of historic/peak results. In terms of investor sentiment, opinion also now appears to be finely balanced, with the share price having stabilised around the current EUR 14.00 level since early summer.

I wouldn’t disagree with that: i) one can argue Saga’s business has always been cyclical & the Chinese have merely amplified that cycle…which could see Saga’s results come back even stronger in the next up-cycle, but ii) if the market’s undergoing a major secular change, I’m not convinced management have the will/guts to radically chop the staff/cost-base to preserve shareholder value. But I’m encouraged by the continuing fashion/luxury/consumer demand growth we see (hopefully the ultimate driver of success for the company), and would also still consider Saga an interesting play on emerging market consumers. Not to mention, there’s always the possibility of a business combination with Kopenhagen Furs – which might suggest competition/anti-trust issues, but in this instance I’m not sure regulators would particularly care (or oppose a deal) – though I wouldn’t recommend holding a stock simply for a deal that might never happen.

I only see a Finnish listing: SAGCV:FH. No idea why your broker can’t find it…could just mean they don’t cover that market. Here’s the Bloomberg ticker:

https://www.bloomberg.com/quote/SAGCV:FH

And the actual Nasdaq OMX Nordic ticker:

http://www.nasdaqomxnordic.com/shares/microsite?Instrument=HEX24384

Regards,

Wexboy

Thank you very much for your reply.

I’ll have to revisit the thesis. Chinese over supply can take a while to work through