Tags

benchmarking, Bloomberg Euro 500, FTSE 100, hedge funds, investment blogs, ISEQ, portfolio allocation, portfolio performance, S&P 500, track record, value investing

Crikey, the blog’s 4 years old soon! So this post’s been on my to-do list for quite some time now…as they say in the hedge fund world, you’re nothing ’til you’ve racked up a 3 year track record! And maybe it’s the perfect time for it, anyway – with an hysterical media insisting the market (& the global economy) are on the verge of collapse again, a reminder of the opportunity & rewards of medium/long term equity investment may offer some welcome relief.

First, I should remind readers of my approach since day one. When I started out here, there were some great investment blogs (some which I read to this day) that served as inspiration. Except many didn’t have any kind of portfolio tracking, or performance, which frustrated me… Now, don’t get me wrong, performance certainly isn’t the be-all & end-all of any blog. Quite obviously, the quality of the investment ideas & analysis is far more important.

Or is it..?

I mean, how on earth do you evaluate an investor’s conviction regarding a specific stock…when you don’t know whether he’s really putting his money where his mouth is (or even if he owns the stock at all)?! I’m not talking dollar/euros & cents here, disclosing the relative size of a position is more than enough. Call me crass & materialistic, but I tend to pay a hell of a lot more attention to someone telling me about their new 10% portfolio holding, rather than some 2% place-holder – how about you?! And then there’s the sad fact that investing isn’t just about investment ideas. As any hedge fund honcho will tell you, a great analyst doesn’t necessarily make a great fund manager…

‘Cos play money ain’t the same thing as real money!

[NB: And nope, I’m not (& have never been) a frustrated hedge fund analyst!]

So, when it comes to investment blogs, it’s natural to want a more holistic view of what an investor really brings to the table. Are they prepared to expose their portfolio to real-time public scrutiny? And if they are, can they actually live with that decision? For example: How do they perform under pressure, and how do they deal with the pernicious impact(s) of fear & greed? Do they insist on defending a failed investment thesis & going down with the ship, or can they bring themselves to admit they’re wrong…even when they secretly believe they’re still right? Or as any good trader might ask:

Do you wanna be right, or do you wanna make money..?!

Bearing all this in mind, I devised a few rules of conduct…which I must admit, added to the daunting task of starting the blog. [But even then, I knew raising the bar was its own selfish reward]. Nothing too complicated:

- Disclose the size/importance of each new investment holding, as a specific percentage of my portfolio.

- Disclose any significant changes (normally, 0.5%+) in investment holdings in a timely manner.

- Entry & exits for investment holdings to be based on market prices at the time of disclosure (not my personal entry/exit prices).

- Report the performance of individual investment holdings & my portfolio on a regular, consistent & transparent basis.

This would place my entire investment process under the spotlight, permit anybody to readily/independently audit my investment performance, and allow readers to duplicate some/all of my portfolio & performance (if they were so inclined!?). [OK, not quite…there’s been some very notable post–investment write-up share price surges along the way. My apologies! 😉 ]

To keep things simple, I calculate gains/losses based on the average size of each investment holding (obviously, exc. price appreciation) over the course of the year – plus/minus, any rounding tends to wash out, noting in particular my low turnover ratio. I also choose to exclude dividend income (I’ll comment on this again below). And I ignore any FX impact: Yes, I do think FX strategy & diversification’s important to any portfolio, but I want to primarily highlight my investment process & performance here. [I’m also conscious readers live/work with a wide variety of base currencies – so my FX gains/losses are irrelevant, or even misleading, for many of them].

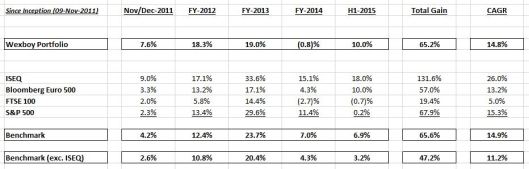

As for a benchmark, I ended up picking one on an almost entirely arbitrary basis: A simple average of the ISEQ, Bloomberg European 500, FTSE 100 and the S&P 500. The only logic here really was the fact these four markets would generally tend to account for a majority of my portfolio, and probably my readers’ portfolios too…

OK, for reference, here are my portfolio performance posts: Nov/Dec-2011, FY-2012, FY-2013, FY-2014, and H1-2015. [NB: The 2011 post only covers performance from the blog’s inception date, i.e. 09-Nov-2011]. Which is an ideal opportunity for me to actually go back & audit my returns…fortunately, there’s no glaring issues/errors to address, but some adjustments are required to ensure consistency across the entire period:

- My Nov/Dec-2011 performance should be on a weighted average (vs. a simple average) basis, reducing my reported return from 16.4% to 7.6%.

- My 2012 performance actually included dividends. Excluding this income reduces my return by almost 2%.

- Disposing of 3 holdings in 2012 & 2013, inadvertently I included my final sale in my average stake calculation (thereby understating my average holding). Correcting for this increases my return by 0.5%, in aggregate.

- My 2014 performance omitted a 2p return of capital from Alternative Asset Opportunities (TLI:LN). Including this increases my return by 0.5%.

- For 2011-2013, I originally included a different (or no) European index in my benchmark. Including/substituting the Bloomberg Euro 500 for these years increases the overall benchmark return by 1.2%, in aggregate.

Unfortunately, these adjustments serve to reduce my overall return (vs. my original performance, as reported on the blog) in both absolute & relative terms, but deservedly so…

OK, now let’s put this altogether in a single portfolio performance table:

The Wexboy Portfolio actually chalked up a 65.2% Total Gain & a 14.8% CAGR since inception.

Which excludes dividends…so hopefully, it provides a good indication of what my performance would have been on a net basis, i.e. after fees (& bid-ask spreads) (again, noting my rather low turnover ratio). I’m also conscious people inevitably tend to (mentally) compare investment performance to price indices, rather than total return indices – which is another good reason for this approach.

As you’ll note, there’s no real pattern to my yearly under/over-performance vs. my benchmark – in fact, it’s extraordinary to see my portfolio & benchmark CAGRs within 0.1% of each other! [Though admittedly, after just 3.6 years, there’s little statistical significance to this comparison]. Of course, the ISEQ‘s amazing 26.0% CAGR is a reminder the Irish market’s a blessing & a curse… My actual Irish portfolio exposure has proved hugely rewarding, but as a benchmark the index has been a veritable stick to beat me with…as well as a nagging reminder I could/maybe should have gone all-in on a market I’ve been enthusiastically & consistently bullish on here, ever since starting the blog!

But chasing after a specific index is ultimately a fool’s game, in terms of home bias… Especially when it’s a market like Ireland, whose total market cap is a mere rounding error in terms of the major equity markets. And it’s worth remembering, during the financial crisis, the Irish market actually fell over 80% from May-2007 & still remains 40% adrift of its peak today. Anyone who’s lived through & suffered that kind of collapse – and fortunately, I didn’t – is someone who’s learned (& will hopefully never forget) the enduring benefits of portfolio diversification.

Let’s take another peek at my benchmark, excluding the ISEQ:

Arguably, this tells a very different story (and btw, I’m sure a total market cap weighted benchmark would tell the same story) – in reality, in terms of a (globally) diversified portfolio, I actually placed (& maintained) a massively overweight bet on the Irish market. And benefited accordingly…out-performing the major indices by an average of 3.6% annually.

But again, obsessing over relative performance is simply tilting at windmills… There will always be individual indices that whip your ass, that’s the nature of the beast when it comes to diversification. And the media & internet will always prefer to remind you of the investors & fund managers who left you for dust – that’s human nature, we like to otherwise forget about the hard luck stories & all the bets which never worked out… In the end, you have to remember each & every investor has a different objective. [As Ed Seykota once said: ‘Win or lose, everybody gets what they want out of the market.’] Maybe that sounds crazy, surely everybody out there is simply trying to notch up the highest gain possible? Actually, no…the guy who tripled his portfolio last year was also the guy who knew (or should have known) he risked losing 75% of it just as easily. Now, do you ever want to be the other guy? You know, the one who actually wiped out 75% of his wealth?!

My focus is just as much about preserving my wealth, as it is about actually increasing my wealth. As I’ve previously highlighted (like here & here), I personally benchmark myself to the hedge fund universe. I may not have exotic tail risk hedged out the wazoo, or try to necessarily bet against the idiotic & irrational, but my goal is to consistently seek out stocks, markets & asset classes which (ideally) offer the most attractive risk/reward equation, in terms of absolute value (not relative value). And if that includes dramatically over-weighting, under-weighting, and/or ignoring huge swathes of the available investment universe, and trading less risk for less reward, then so be it…

Let’s run that table again – this time, inc. the Barclay Hedge Fund Index:

The Barclay Index includes about 3,000 hedge funds, so you’re definitely up against the best & brightest of the investment industry. It feels pretty damn good to know I’ve actually out-performed the average hedge fund by 8.2% annually…though maybe not quite so good as looking at my actual broker statement! 🙂 Now, let’s recap:

We should never take things for granted, but here’s hoping (notwithstanding the latest bout of market hysteria!) I can keep striving to deliver on this performance record in the years ahead. Thanks again for your time & attention.

Now, it’s right about that time again…yep, it’s time to turn on your CNBC, and to dive right back into the fray!

Now that KWG was up over 50% in 2015, is it still in the value buy territory??

See my next post!

Hello!

Are you still following Saga Furs?

Do you have a revised opinion?

Thank you!

Regards

Yes, Saga’s share price development has been tough, but the numbers have been improving – still believe it’s an excellent/unique long term buy, but definitely the kind of stock that’s best to average into – and yes, I will try take another/closer look at Saga Furs again, as soon as I have a chance.

Great post – I’ve submitted it to the UKFinanceOver30 sub-reddit.

I plan to track your portfolio updates on there going forward – hope that’s OK.

https://www.reddit.com/r/UKFinanceOver30/

Thanks Mike,

Great sub-reddit, keep up the good work – feel free to include any of my blog posts there if they catch your fancy (but please inc. a blog post link).

Cheers,

Wexboy

Enjoyed reading this latest post and well done on your achievements to date!! I look forward to more of your detailed posts.

Many thanks Cris,

My H2-2015 performance is holding up well – but as usual, September (& probably October too) are proving to be fairly rough sailing. The Fed deserves much of the blame…

But I think we’ll see markets & sentiment turn positive again as we get closer to the end of the year – though near-term prospects for the US market (specifically) might be more constrained ‘til the Fed finally gets a hike or two out of the way.

Ta,

Wexboy

Thanks for the refreshing transparency. Performance, despite appearing black and white, is a lot trickier to measure than it seems like it should be – time periods, factor bets, portfolio structures, appropriate benchmarks, etc. I enjoyed your piece.

Simplysafedividends,

Appreciated. Definitely intend to be ultra-transparent…if I’m honest/transparent with readers, it forces me to be far more honest with myself as an investor! And also trying to strike a reasonable balance between simple & more complex/accurate tracking of my investment performance.

Regards,

Wexboy

Long only strategy. Should not be comparing to hf. Different volatility / sharpe ratio.

What would your performance have been without commodity stocks? I.e proper value situations

Nh,

Comparison is/was simply meant in terms of the original hedge fund spirit. The pioneers/greats broke away from the traditional asset management industry & its obsession with relative performance, and focused on absolute returns (which didn’t necessarily imply going short) & a go-anywhere investment philosophy.

I may not be able to emulate the breadth of their portfolios, or their impressive track records, but I can certainly aspire to the same philosophy – relative returns are no use to me (or my bank manager), and certainly don’t pay me extra, esp. if they’re negative…. I think any family office, for example, would appreciate this perspective – as I said above, the objective here is to preserve wealth, as much as to increase wealth.

There’s obviously some indirect commodity exposure scattered across my portfolio, but I made a deliberate (pre-blog) decision to avoid any commodity stock exposure. [Except for a minor detour into two ‘value’ junior resource stocks…but my portfolio allocation was tiny]. This wasn’t a judgement whether commodity stocks were value situations, or not – it was a specific macro call. which has worked out far better than I might ever have expected. So there’s been no meaningful commodity-related impact on my long term performance.

Cheers,

Wexboy