Tags

Alphabet, annual review, benchmarking, buy and hold, COVID, crypto, Donegal Investment Group, GARP investing, growth vs. value, KR1, multi-bagger, portfolio allocation, portfolio performance, track record, Universe Group, VinaCapital Vietnam Opportunity Fund

Looking back, I must admit I never imagined reaching this kind of anniversary…but yeah, the Wexboy blog turned 10 years-old earlier this month! A journey that kicked off with this Sirius Real Estate buy (at an astonishing 0.31 P/B!) in Nov-2011. Which was obviously a stock-picking tour de force – noting SRE‘s been a 7-BAGGER+ since. Well, except I somehow managed to distract/scare myself out of the position two years later…for a mere double-digit gain! And maybe that’s where this post should abruptly end, because:

The one BIG lesson most investors still need to learn is how to HODL!

But let me be clear up-front – this is not intended to be some lessons-learned victory-lap post. As investors, we never really know what’s coming down the road…next year could be a celebration, or a total humiliation. And we all make dumb mistakes, we repeat them, we live with them & we finally move on – great investors just make less mistakes. And we can’t afford to get disheartened, or to rest on our laurels – great investors (should) never stop learning & adapting ’til the day they finally exit this great game. To assume/pretend otherwise is to tempt the gods, which makes investing such a uniquely weird mix of confidence…and humility.

That said, this year & last year have been an accelerated learning experience for me – as is presumably true for all investors (& everyone we know). And yes, I know I’ve promised to write about this – and hopefully share some positive learnings & useful advice – particularly in light of my actual FY-2020 & YTD-2021 performance. But I gotta admit, I keep putting it off…because now I desperately want & need it to be a final epitaph for this (Zero-) COVID hell we’re still stuck in. [Despite most of the world getting vaxxed since!?] So yeah, that’s obviously something I gotta work on…

But meanwhile, I’m thrilled I’ve actually managed to deliver that unique & rarest of beasts…a public/auditable 10-year investment track record via the blog (& my Twitter account). I obviously don’t disclose the actual euros/cents of my portfolio, albeit my long-abandoned career & my family’s security/future clearly rely on it – which means return of principal is just as important to me as return on principal, in true family-office style – but readers & followers have always been able to assess my level of conviction/risk tolerance via my specific % allocation in (disclosed) stocks, and via (essentially real-time) tracking of my (rare) incremental buys/sells in those stocks.

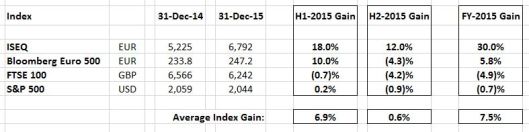

And in return, I’m far more interested right now in seeing readers draw (& even share) their own conclusions – privately, or publicly – from my stock-picking & investment track record to date. To facilitate that, here’s my annual returns…complete with links to my annual performance review & actual stock-picks/investment write-ups for each year.