Tags

Alphabet, annual review, balance sheet, crypto, Donegal Investment Group, KR1, KR1 plc, multi-bagger, owner-operators, portfolio allocation, portfolio performance, Record plc, Saga Furs, Tetragon Financial Group, VinaCapital Vietnam Opportunity Fund

Seems like everyone on Twitter (if they didn’t just disappear already) scrambled to post their 2022 returns this year, either to bury a horrific result in the New Year’s rush, or because they’re one of the few who can boast a minor loss (or even a gain!) last year. As always, especially if you’re nursing your own portfolio (& pride) after an excruciating year, you should take all of this with a grain of salt…because, alas, it’s Twitter’s job to surface the outliers & the blowhards, so #FinTwit is definitely NOT a good (or even accurate) benchmark to reference as an investor in good years, let alone bad.

But as always, I’m here with a genuine/auditable portfolio, where all changes (if any) to my disclosed holdings have been tracked here & on Twitter on a real-time basis, for over a decade now. [Seriously, if you’re a new reader, take a peep: There’s countless posts on old & current portfolio holdings, plus my entire investing philosophy & approach…some of which may even be useful & interesting today!] And this year, my main (selfless) purpose is to make you feel better about your own performance. ‘Cos yeah, you probably did much better than me…and if you didn’t, maybe you should question your investing choices!? And I want to remind you: a) it could be worse, there’s plenty of bad ‘investors’ out there who’ve been trapped in a savage bear market for two years now (since Q1-2021), and b) once again that, esp. noting the past year, nobody knows anything…

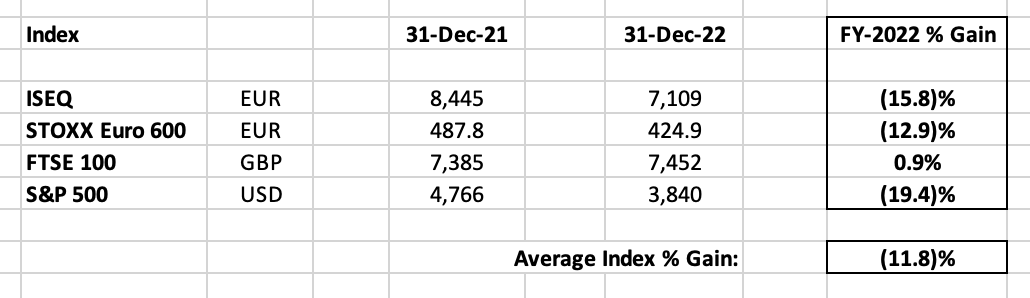

So let’s jump right in, here’s the damage in benchmark terms – my FY-2022 Benchmark Return is still* a simple average of the four main indices which best represent my portfolio, which produced a benchmark (11.8)% loss:

[*NB: As I flagged this time last year, I adopted the STOXX Euro 600 as my new European index in 2022.]