Tags

Alphabet, annual review, benchmarking, buy and hold, COVID, crypto, Donegal Investment Group, GARP investing, growth vs. value, KR1, multi-bagger, portfolio allocation, portfolio performance, track record, Universe Group, VinaCapital Vietnam Opportunity Fund

Looking back, I must admit I never imagined reaching this kind of anniversary…but yeah, the Wexboy blog turned 10 years-old earlier this month! A journey that kicked off with this Sirius Real Estate buy (at an astonishing 0.31 P/B!) in Nov-2011. Which was obviously a stock-picking tour de force – noting SRE‘s been a 7-BAGGER+ since. Well, except I somehow managed to distract/scare myself out of the position two years later…for a mere double-digit gain! And maybe that’s where this post should abruptly end, because:

The one BIG lesson most investors still need to learn is how to HODL!

But let me be clear up-front – this is not intended to be some lessons-learned victory-lap post. As investors, we never really know what’s coming down the road…next year could be a celebration, or a total humiliation. And we all make dumb mistakes, we repeat them, we live with them & we finally move on – great investors just make less mistakes. And we can’t afford to get disheartened, or to rest on our laurels – great investors (should) never stop learning & adapting ’til the day they finally exit this great game. To assume/pretend otherwise is to tempt the gods, which makes investing such a uniquely weird mix of confidence…and humility.

That said, this year & last year have been an accelerated learning experience for me – as is presumably true for all investors (& everyone we know). And yes, I know I’ve promised to write about this – and hopefully share some positive learnings & useful advice – particularly in light of my actual FY-2020 & YTD-2021 performance. But I gotta admit, I keep putting it off…because now I desperately want & need it to be a final epitaph for this (Zero-) COVID hell we’re still stuck in. [Despite most of the world getting vaxxed since!?] So yeah, that’s obviously something I gotta work on…

But meanwhile, I’m thrilled I’ve actually managed to deliver that unique & rarest of beasts…a public/auditable 10-year investment track record via the blog (& my Twitter account). I obviously don’t disclose the actual euros/cents of my portfolio, albeit my long-abandoned career & my family’s security/future clearly rely on it – which means return of principal is just as important to me as return on principal, in true family-office style – but readers & followers have always been able to assess my level of conviction/risk tolerance via my specific % allocation in (disclosed) stocks, and via (essentially real-time) tracking of my (rare) incremental buys/sells in those stocks.

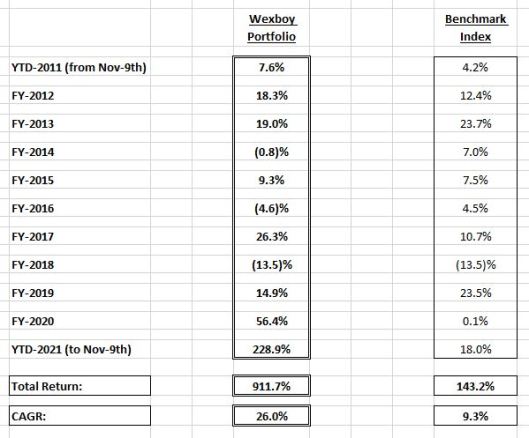

And in return, I’m far more interested right now in seeing readers draw (& even share) their own conclusions – privately, or publicly – from my stock-picking & investment track record to date. To facilitate that, here’s my annual returns…complete with links to my annual performance review & actual stock-picks/investment write-ups for each year.

[NB: I should highlight this 2015 post, where I went back & scrubbed my 2011-2014 performance for consistency…but since it actually lowered my portfolio returns & raised my benchmark returns, we don’t need to rehash those adjustments here.]

[And for reference, this was my 5 year track record back in 2016.]

YTD-2011 (from Nov-9th): +7.6% Return

[Reduced from a +16.4% average return to reflect an actual weighted average return.]

2011 Stock Recommendations & Performance

Sirius Real Estate (SRE:LN)

Cresud (CRESY:US), Part II

Total Produce (TOT:ID) – A Fruity Delight?

EIIB (EIIB:LN) – The Strongest Bank in the World? (Part II)

Trinity Biotech – Cheap Diagnostics

Duh, Duh, Dhir…

Learn to Love the Distress

Argo II – Time to Claim the Golden Fleece

Asta Funding – Buying Debt for Cents on the Dollar

Happy New Year! – A (Baker’s) Dozen for 2012

Avangardco – Eggsotic But Eggcellent!

Livermore Investments (I)

FBD Holdings – COR Blimey, Mate!

FY-2012: +18.3% Return

[Reduced from a +20.2% return, primarily to reflect elimination of dividends.]

2012 – Aaah, How Was It For You..?

Feeling Blue? Try Some Richland Resources

From Russia With Love (Part II)

Asset Managers – OK, Time to Storm the Castle!

A Universe of Stocks…

German Residential Property V – A Buy!

An Investment To Die For..!

FY-2013: +19.0% Return

[Increased from a +18.4% return, to reflect corrected average stake sizes.]

2013 – A Game of Two Halves

Tetragon – Ready To Be A Star

Donegal Creameries – Low Fat Diet

Quite A Saga…

FY-2014: (0.8)% Return

[Increased from a (1.3)% return, to reflect a return of capital.]

Wexboy Portfolio – FY-2014 Performance

Zoom, Zoom…Zamano!

NTR plc…Wind of Change?

Newmark Security…A Real Steal!

FY-2015: +9.3% Return

Crushin’ It: FY-2015 Portfolio Performance

One Fifty One? No, It’s Worth Far More…

FY-2016: (4.6)% Return

2016 – Not Missing You Already…

FY-2017: +26.3% Return

FY-2017 Wexboy Portfolio Performance…Crackin’ The Code

So Why Not Google It..?

Love That Record…Give It A Spin!

Applegreen – Just Grab & Go!

Kryptonite Even Superman Could Love…

FY-2018: (13.5)% Return

FY-2018: What The Market Gods Giveth, They Also Taketh Away…

FY-2019: +14.9% Return

FY-2019…Hella Surprise Of A Year!?

Cpl Resources…A Most Talented Company!

FY-2020: +56.4% Return

Soooo, 2020…What A Crazy Year!?

YTD-2021 (to Nov-9th): +228.9% Return

For reference, here’s my H1-2021 performance post:

H1-2021 Wexboy Portfolio Performance…Yeah, It’s a Biggie!

Now let’s update it to arrive at a YTD-2021 (to Nov-9th) index benchmark return:

And here’s my Wexboy YTD-2021 (to Nov-9th) Portfolio Performance, in terms of individual winners & losers:

[All gains based on average stake size & 09-Nov-2021 vs. end-2020 share prices. All dividends & FX gains/losses are excluded.]

That’s 33 disclosed portfolio buys over the last decade. Which may look quite front-loaded (i.e. mostly bought back in 2011 & 2012), but that’s mostly a function of gradually introducing pre-existing holdings from my portfolio…not to mention, I’ve also bought other new (undisclosed) holdings in the past few years. So 33 buys over the course of a decade is fairly representative of my investing (& low turnover) approach – IRL, I often joke my ultimate ambition was always to stay home, veg out on my couch, read annual reports & hopefully discover a couple of great companies each year to buy. So yeah, life is perfect…and yeah, I really do mean that!

So here’s my Top 10 Winners:

[NB: *No longer quoted, or merged with another business/ticker. **Takeover, or liquidation.]

And my Next 13 Winners:

Which leaves, precisely…my Top 10 Losers:

KR1‘s the obvious #megamultibagger in the room. But that’s how markets & investing actually works…index/your net returns essentially come from a small fraction of stocks, as Bessembinder reported some years back (& all VCs intuitively know!). And if you’ve followed me for some years, you’ll know I’ve always considered KR1 a #YOLO investment – i.e. a once-in-a-lifetime multi-bagger growth opportunity (at an absurd value price) in an emerging foundational technology/asset class – but NOT some YOLO bet, noting it was only a 4.5% portfolio allocation for me at the start of last year. [Consistent with me recommending all investors should now consider a reasonable 3-5% allocation, via a diversified crypto investment company like KR1 (for example)].

Big picture though, I’m delighted I still own 4 of my Top 5 winners…I must be doing something right, and finally getting a little better at this whole buy & hold thing! And even my other winner – Universe Group – was finally recognized last week for its underlying M&A value (fortunately, despite the astonishing 129% offer premium, I’d already extracted most of UNG’s value back in 2015)! But this doesn’t change my underlying philosophy…while I’ve clearly focused on owner-operator high-quality growth companies more recently, paying a value price has consistently remained the key to my winners. This was even true of Google back in 2017 – just after it became Alphabet & just before it became a SOTP play for everyone – I estimated the core search business was on an underlying 15.5 P/E multiple (& is still cheap today)! And the same was true (for example) of Apple, which I bought (& posted about) ahead of Buffett, but alas never formally disclosed as a Wexboy portfolio holding – ‘cos who wanted to deal with the fan-boys, let alone the haters at the time – I bought it on an ex-cash 10 P/FCF multiple & it’s a 5-BAGGER since!

My win-loss ratio’s helped too – 23 out of 33 stocks have been winners, a 70% win ratio, at the upper end of the range I’ve seen with most professional fund managers. Anything higher is rare & would impact returns (presumably, via an arbitrage/event-driven strategy), but I’d argue a lower win ratio wouldn’t necessarily limit returns in the same way…in fact, perversely, targeting & accepting a much lower win ratio could actually be the key to superior/best-in-class returns (again, as any VC would argue)!? And meanwhile…they weren’t necessarily multi-baggers, but I’ve also enjoyed & exited close to 3 in 10 stocks via takeovers (primarily) & liquidations (that’s 8 winners & 1 loser out of 33 stocks).

As for the wall of shame…we all have losers, but the reply guys will love it anyway (& ignore the big winners), so knock yourselves out! My only excuse (or lesson), is how difficult it can be to fight global sector/macro tides – emerging markets were a (relative) lost cause for the past decade, but that didn’t stop me seeking out emerging market losers. [Fortunately, my ‘New China’ bet via the VinaCapital Vietnam Opportunity Fund was a huge/winning exception – a reminder cherry-picking‘s long been the only viable alternative to increasingly absurd emerging/BRIC-type bucket investing]. For most of the last decade, the same was true of resource stocks…though clearly my quixotic (but small) tilt at micro-cap explorers/producers was remarkably stupid in its own right! And overall, my losers are a reminder how difficult investing in small/micro-cap companies with poor and/or intransigent management can be, regardless of price/value. The one saving grace is that I own just 2 of my losers today – which maybe turn money-good with an actual sale/takeover, albeit this is never a great thesis to rely on – and looking back at my exit prices (vs. the opportunity to invest elsewhere), I definitely don’t regret selling the rest of my losers!

OK, let’s move on to the grand finale – but first, here’s my benchmark index returns for the last decade. Note my benchmark’s a simple average of the ISEQ, Bloomberg Euro 500, FTSE 100 & S&P 500 – which best represents my overall portfolio – so I’ll break out these component indices too. No surprises there…the UK’s been dreadful, Europe was mediocre, whereas Ireland actually made an impressive attempt to keep up with the US (albeit, much of its gains came earlier in the decade):

And now, finally, it’s the most important table of them all…my Wexboy Portfolio returns over the last decade (vs. my benchmark index return):

And what an incredible journey & decade it’s been…ending up with a 10-BAGGER portfolio & a 26.0% pa investment track record!

And that’s not even counting dividends, that’s an additional couple of % pa. Of course, you can argue my recent/exceptional KR1 gains are diluted overall…i.e. a 13.8% KR1 stake in 2020 is obviously more impactful to my currently disclosed portfolio, than my overall portfolio. But hey, in terms of its real-world pound/dollar/euro impact, you can bet I’m not sweating that distinction! And fortunately, I’ve enjoyed other undisclosed multi-baggers in my portfolio – particularly in the last two years – in Apple (per above), in luxury & even in (crikey, a niche/alpha-generating) property stock!? Not to mention, mobile/e-commerce stocks – as referred to (obliquely) in my H1-2020 review – one of which turned out to be my third takeover stock in just 9 months & even (briefly) surpassed Alphabet in my portfolio!

So yes, overall, I think it’s fair to consider this public/auditable track record as pretty representative of my actual total (disclosed & undisclosed) portfolio returns over the last decade.

And here’s to a great Xmas season – despite the lingering COVID angst – and the decade ahead! May the road rise up to meet you…

Pingback: 2021…Wow, Another Crazy (Good) Year! | Wexboy

Congratulations on a great performance.

I’ve learned hugely following your blog and tweets. Thanks for both. You must have mixed feeling about faceless lurkers (eh, surely not me) making money of your IP😂

My biggest mistakes by far are not shares that turned out to be pos, but selling good companies way too early, esp. when they were in my wheelhouse (to extent I have one). Two of the biggest I use their products every day all day; microsoft and apple being. So learning from you and others to choose wisely and hodl. There’s often 50 reasons to sell when you only need a few to hodl, that can go against every natural instinct.

Thanks, Michael – much appreciated – if readers can learn & make some money along the way, that’s all good with me!

Too many private investors never even get past their errors of commission – they never truly learn from their mistakes – so you’ve definitely grown as an investor when you recognize your errors of ommission are ultimately the MUCH BIGGER errors. But yeah, buying & esp. holding the best companies long-term doesn’t demand anything more than an average IQ…it’s your EQ level that’s the real challenge!

Cheers,

Wexboy

Pingback: This Week’s Best Value Investing News (12/03/2021) | The Acquirer's Multiple®

Congrats, very well done. The funny thing is that if you had bought only Sirius real estate and held onto it you would have had more or less the same result.

Thanks, George – guess that’s (almost) true, though a single-stock #SRE portfolio would have felt a wee bit hairy! In reality, Sirius’ leverage was drifting in the wrong direction – and the catalysts weren’t ‘catalyzing’ as I’d expected – when I exited:

Looking back, it’s fair to say that Andrew Coombs being appointed CEO was the real making of the multi-bagger Sirius Real Estate has become today…so hats off to him! Here he is in action a year ago on Proactive:

Congrats Wexboy, astonishing track record and thanks for the suggestivism 😉

Thanks, Foxy – much appreciated – plenty more suggestivism happening (& to come)!

Well deserved success. I’m in awe.

Blindly followed you in FIG, was before you in REC, also GOOG (but heavily topped up after your write-up).

Toyed with VINA but decided against it.

Explain the AAPL disclosure in more detail, pls. I don’t understand.

Keep writing, and as always, big THX 🙏

Thanks – appreciated, thanks for taking the time to comment – alwasy nice to see a non-lurker!

Well, we’re definitely overlapping on investments, so that’s a good sign – I still encourage you to consider VOF – even though it’s near all-time-highs, I suspect the VNI’s embarked on a new multi-year bull run, and VOF’s more diversified portfolio (inc. PE inv’ts) makes it an easier long-term hold for me.

Apple is NOT included in my disclosed Wexboy portfolio (BUT is a large holding in my IRL portfolio), as unfortunately I never posted a formal inv’t thesis/disclosed portfolio buy…you have to rem how hated/controversial $AAPL was 5 yrs ago (ahead of Buffett annointing it), so I really didn’t want to face dealing/defending a buy with the fan-boys, let alone the haters!

BUT to (discreetly) mark it publicly, I did question why on earth value investors weren’t buying Apple at such a cheap price…and the post also served as a bit of an intro to my Alphabet post/inv’t thesis/disclosed portfolio buy a month later!

Well done Wexboy, a solid 10 years of grafting with great results and fair play for sharing all this with everyone. I’ve the Kr1 bags packed and will buy you a pint in Rosslare once I get the mobile home setup circa 2025;)

Wishing you and yours a great Xmas.

Thanks Trig for posting – much appreciated.

And appreciate the offer – a Rosslare mobile home was actually close to the pinnacle of luxury when I was a kid – and hopefully there’s still enough bags in #KR1 today & STILL TO COME to make it all happen!

Merry Xmas

Congratulations – outstanding performance. I’ve been reading your blog for about 5 years now and have joined along for the ride with KR1 and Record Plc. Its been a profitable and entertaining read – so thank you.

Do you still intend to share new ideas on the blog or are you changing tack there?

Thanks MD – nice to hear!

Yes, I will still be sharing my (disclosed) portfolio & new inv’t theses/buys here – though the evolution in my buying (average in, average up not down, average out) & my holding (just #HODL!) has obviously meant less buys are making it onto the blog, but hopefully that’s offset by offering higher quality growth stocks, which hopefully prove to be excellent long-term compounders!

Fantastic returns and thanks for sharing your thoughts over the years. Wish you continued success.

Thanks isalahuddin – always tough facing into a ‘new’ decade, esp. after closing out this last (fantastic) decade – but investing has always been a marathon, not a sprint (punters who want to get rich-quick always end up being the biggest losers), so I continue to stick to the plan.

Great record! That goes for your investment returns and the Blog!

It appears to me, you ‘Dare to be different’! (also the name of two podcasts from Howard Marks)

Congrats💪

Thanks, searching4value – much appreciated – yes, I obviously want to be diversified, but I’m happy to do it in a different manner (i.e. not worry too much about indices/stocks du jour/etc.). And I don’t worry too much about what & how other investors are doing – I’m happy to learn from the best, of course, but it’s the inner scorecard that really matters to me.

Congratulations! Great work sir !

Thanks, Feidhlim – appreciated – and hopefully we’ll finally be able to sink a few drinks sometime to catch up!